metamorworks/iStock via Getty Images

Many companies are going through a “Digital Transformation” in which they aim to transfer their onsite IT resources to the cloud. This is great for increased performance, flexibility, and cost savings. However, it also brings with it a whole host of new challenges. This includes monitoring data across various different Cloud-based applications.

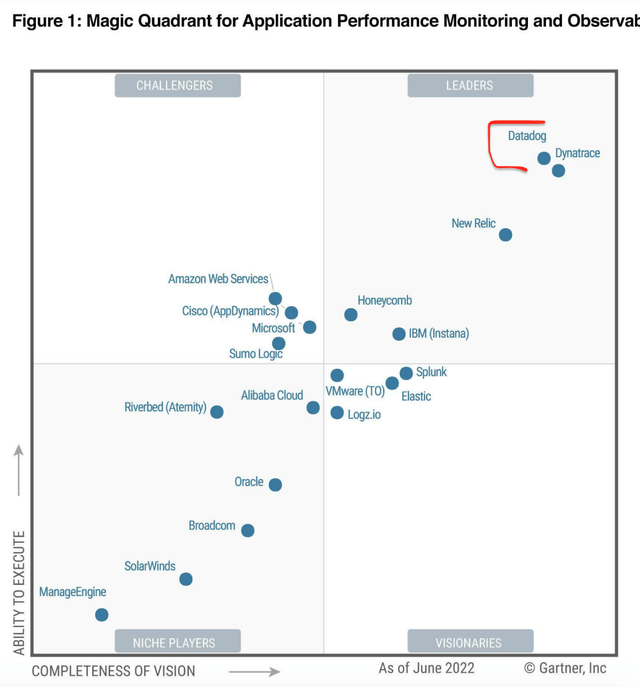

Datadog, Inc. (NASDAQ:DDOG) solves this problem as a leader in IT. Observability, its software platform, brings together data from multiple sources and enables observability, querying, control, and recently security. The company is a Gartner Magic Quadrant leader in Application Performance Monitoring [APM], as you can see from the chart below.

APM Datadog Leader (Magic Quadrant Gartner)

The cloud computing market was worth $450 million in 2021. It is forecasted to grow at a rapid 19.9% compounded annual growth rate [CAGR] and be worth over $1.7 trillion by 2029. Datadog is poised to benefit from this growth trend, and estimates the IT Observability industry to increase in value from $38 billion in 2021 to $53 billion by 2025. In this post, I’m going to break down the company’s financials and valuation, so let’s dive in.

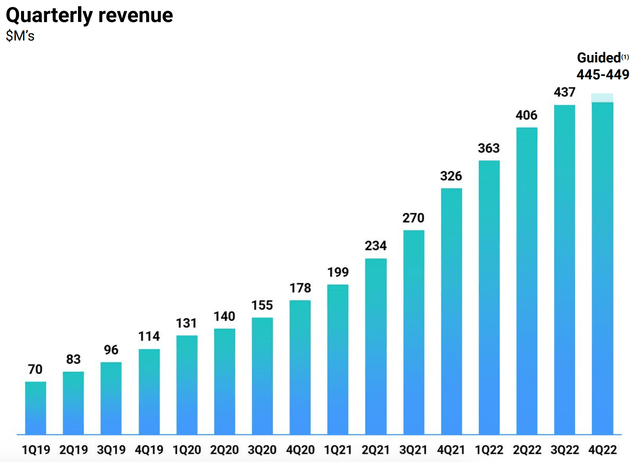

Strong Third Quarter Financials

Datadog reported strong financial results for the third quarter of 2022. Revenue was $437 million, which increased by a rapid 61% year-over-year and beat analyst expectations by $22.28 million. This was driven by solid customer growth, from 17,500 in Q3,21 to 22,200 by Q3,22. The company has continued to grow “upmarket,” and its high-ticket customers with an Annual Recurring Revenue of $100,000 or more increased from 1,800 to 2,600 year over year. Amazingly, these few enterprise customers generate 85% of the business’s annual recurring revenue, thus it is clear that catching whales is a solid strategy.

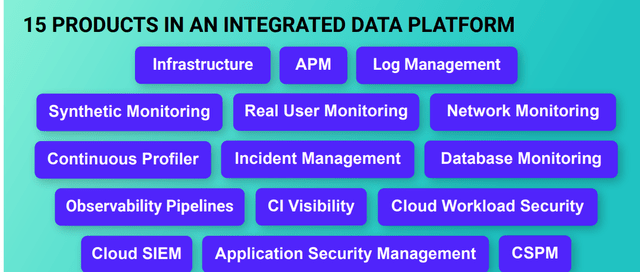

Datadog is a cloud monitoring platform that has continued to execute its “platform” strategy in an outstanding manner. The Datadog platform has 15 products, which include its legacy Application Performance Monitoring [APM], Log Management, Real User Monitoring, Cloud Workload Security, and more. Its new security platform is particularly interesting as application security has become a strategic priority for organizations. The global cyber security industry was worth $185 billion in 2021, and is forecasted to grow at a steady 12% compounded annual growth rate, to over half a trillion by 2030.

Platform Products (Q3,22 report)

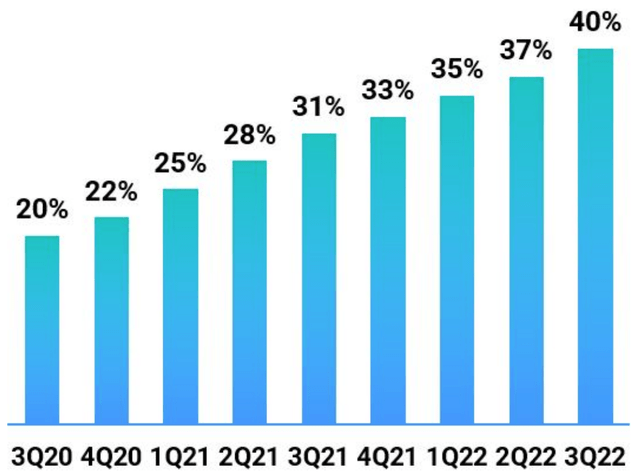

Datadog uses a “land and expand” approach to upselling and cross-selling its various products on its platform. For example, 80% of its customers are using at least two products. 40% of customers are using at least 4 products and 16% of customers are using over 6 products.

Percentage of customers using at least 4 products (Q3,22 report)

Due to the aforementioned strategies and value proposition of the product, it is no surprise that the company has a 130% dollar-based net retention rate. This means customers are staying with the company and spending more on upsells.

Profitability and Expenses

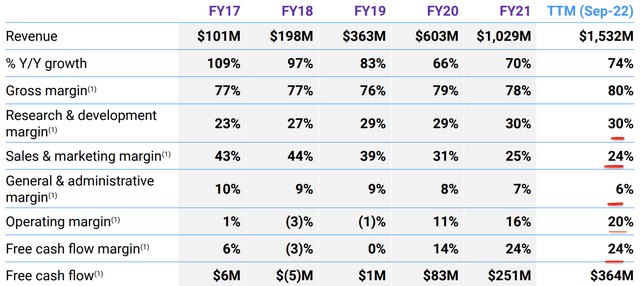

Datadog has a super high gross margin of 80%, which is characteristic of SaaS (software as a service) platforms. The company is operating at a loss on a GAAP basis, but is profitable on an adjusted basis with stock-based compensation (“SBC”) added back.

Datadog reported GAAP earnings per share of negative $0.08 in the quarter, which beat analyst expectations by $0.02. Its Non-GAAP EPS was negative $0.08, which beat analyst expectations by $0.02. This equates to a healthy 20% Operating Margin in the trailing 12 months on a Non-GAAP basis. The company is investing approximately 30% of its revenue into Research and Development, which isn’t really bad, as companies in the technology industry must continually innovate to stay ahead. In addition, companies that invest more in R&D tend to produce greater shareholder returns over time, for example, Alphabet/Google (GOOG, GOOGL) or Amazon (AMZN). Datadog is “doubling down” its investments into the business’s two new products, Data Stream Monitoring and Cloud Cost Management. Both of these products have high demand from customers. The idea of moving to the cloud is to offer greater flexibility, control, and ultimately cost savings long term. Therefore, during a recessionary environment, I imagine there will be strong demand for its Cloud Cost Management solution.

Financials Datadog (Q3,22 report)

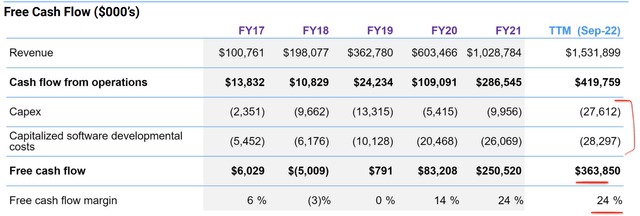

Datadog has gradually optimized its Sales and Marketing Expenses, which have declined from 43% of revenue in 2017 to just 24% in the trailing 12 months, which is a positive sign.

General and Administrative expenses have also demonstrated operating leverage as its percentage of revenue has reduced from 10% in 2017 to 6% in the trailing 12 months.

As Datadog’s investments have paid off, its Free Cash Flow Margin has increased from 6% in 2017 to 24% trailing 12 months or $364 million. This is a Non-GAAP measure that capitalizes software development costs and minuses Capex.

Datadog has a solid balance sheet, with $1.766 billion in cash and short-term investments. In addition to total debt of $836.7 million, of which the vast majority [$738 million] is long-term debt.

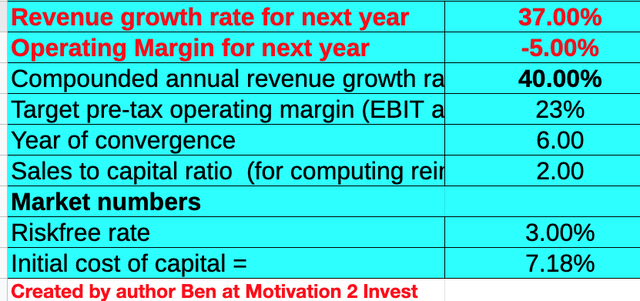

Advanced valuation

In order to value Datadog, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted a 37% revenue growth rate for next year and 40% over the next 2 to 5 years. This is aligned with the most recent growth rate figures and guidance, but I am predicting a slight improvement in years 2 to 5, as the economy is likely to recover.

Datadog stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted a 23% target pre-tax operating margin in 6 years, which is the average of the software industry. I expect this to be driven by the continued improvements in the operating efficiency of the business, as its scales.

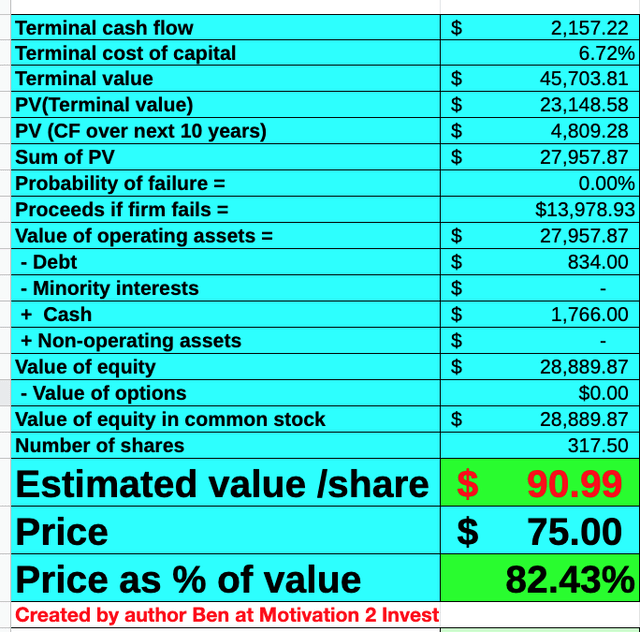

Datadog stock valuation 2 (created by author Ben at Motivation 2 Invest)

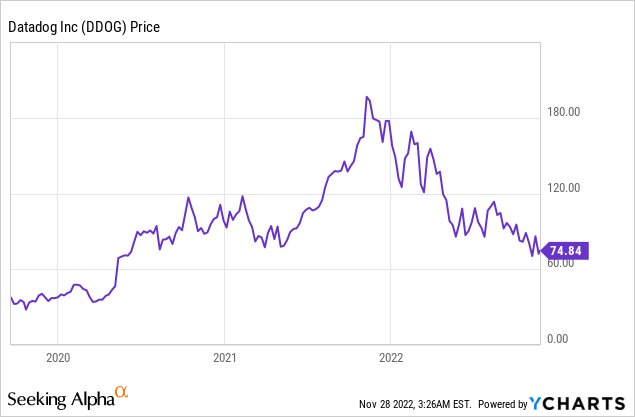

Given these financials, I get a fair value of $90 per share for Datadog, Inc. The stock is trading at $75 per share at the time of writing, and is thus 82% undervalued.

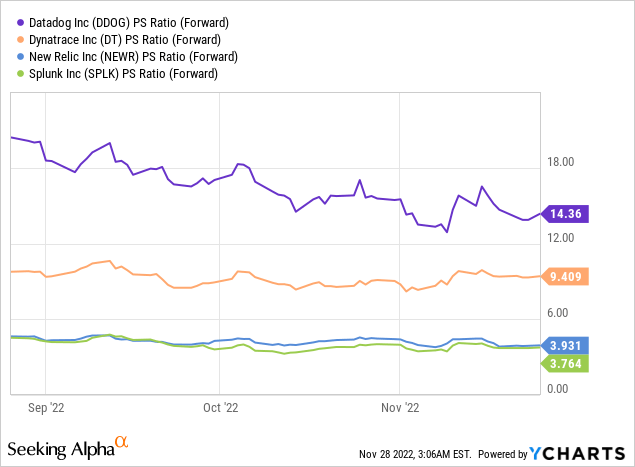

As an extra data point, Datadog trades at a Price to Sales ratio = 15, which is 58% cheaper than its 5-year average. As you can see from the chart below, Datadog is trading at a higher valuation than its competitors, but it is the market leader and growing faster than its peers.

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Companies are acting increasingly cost-conscious, and thus I expect longer sales cycles for any B2B business. The good news is Datadog’s focus on its new cost optimization products could be a key selling point for businesses.

Final Thoughts

Datadog, Inc. is a tremendous company and a true technology powerhouse. The company is continually innovating, executing strong and has a loyal growing customer base. Datadog, Inc. stock is undervalued intrinsically and relative to historic multiples, thus it could be a great long-term investment.

Be the first to comment