10’000 Hours/DigitalVision via Getty Images

In my relentless quest for solid long-term investment opportunities in my No Guts No Glory portfolio, I decided to evaluate some companies that operate in the communications industry. Back in November of 2021, I suggested buying shares of Rogers Communications (RCI) before the merger with Shaw was approved. Since that time, the merger has been approved and the stock is up 20% since I wrote the article.

With the recent two years of lockdowns, staying home, and working remotely, more people have been viewing streaming services along with existing cable and satellite TV stations. Imagine the bandwidth and provider services needed to support all those people sitting inside their homes and apartments, watching streaming videos on TikTok, YouTube, Apple TV, Netflix, and/or your local cable channels like Fox News and CNN.

Three Fingers Lakes near Las Vegas (author photo)

Although many of those using streaming services are “cord-cutters,” the cable TV industry is still alive and substantial with a strong customer base that is still paying for cable TV, especially in the US. I found these to be enlightening statistics regarding the current state of the cable TV industry, according to a blog post titled “27 of The Most Incredible Cable TV Subscribers Statistics for 2022” (all emphasis in original):

65% of Americans are still paying for cable TV

56% of Americans receive TV via cable or satellite in 2021

The US has 1,775 total television stations and about 5,200 cable systems run by 660 operators, reaching 90% of the entire population

In 2019, cable industry subscriptions in the US were worth $92.44 billion

63% of Americans over the age of 68 pay for cable TV

Over the past 10 years or so, the trend has been clearly towards more streaming services and cord-cutting (cancelling cable and satellite TV subscriptions), especially with the younger generations. However, the cable/satellite TV industry is still alive and well in the US, and even more so in China and India. And the communications industry is one that is rather recession-proof, which is a bonus in these uncertain times that we are facing in 2022.

Who is CSG Systems?

Living in the Denver metro area, I caught a story recently in a local publication that announced a contract award renewal for a local company called CSG Systems International (NASDAQ:CSGS). The announcement included a multi-year contract extension with DISH Network (DISH), another Colorado-based corporation that offers satellite TV services.

Curious, I decided to investigate further. In reading the press release I discovered that CSG Systems has been supporting DISH for over 25 years. Another major CSG customer is yet another Colorado-based company, Charter Communications (CHTR). And on November 3, 2021, CSGS announced a 6-year contract extension with Charter, with whom they have also had a nearly 25-year relationship. That deal makes CSGS the BSS (business support services) provider of choice for all 32 million Charter customers supporting residential and small-to-medium businesses for high-speed broadband video and voice.

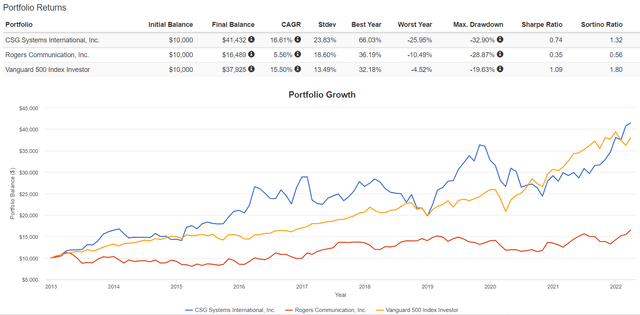

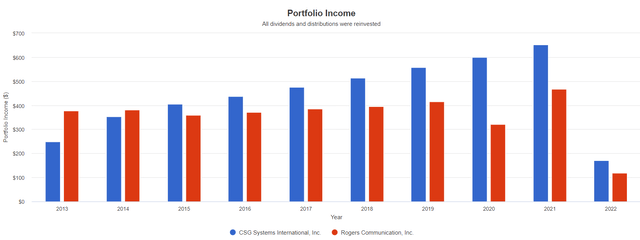

Those 2 announcements alone were reason enough to investigate further, and as I did, my interest in CSGS as an investment opportunity was piqued. I decided to compare RCI with CSGS over the past 10 years to see how the total returns compared against each other, and against a benchmark using the Vanguard 500 Index. With dividends reinvested, CSGS was the clear winner in terms of both total return and income generated over the past 10 years through March 2022, with a 16.6% CAGR.

Total Returns compared over the past 10 years (Portfolio Visualizer) Income generated RCI vs CSGS (Portfolio Visualizer)

Company Overview

Although CSG Systems started out developing business support systems for cable TV providers, they have now expanded their offerings substantially. According to the CSG investor Relations website, this is a summary of who they are now:

CSG is a leader in innovative customer engagement, revenue management and payments solutions that make ordinary customer experiences extraordinary. Our cloud-first architecture and customer-obsessed mindset help companies around the world launch new digital services, expand into new markets, and create dynamic experiences that capture new customers and build brand loyalty. For nearly 40 years, CSG’s technologies and people have helped some of the world’s most recognizable brands solve their toughest business challenges and evolve to meet the demands of today’s digital economy with future-ready solutions that drive exceptional customer experiences. With 5,000 employees in over 20 countries, CSG is the trusted technology provider for leading global brands in telecommunications, retail, financial services and healthcare. Our solutions deliver real world outcomes to more than 900 customers in over 120 countries.

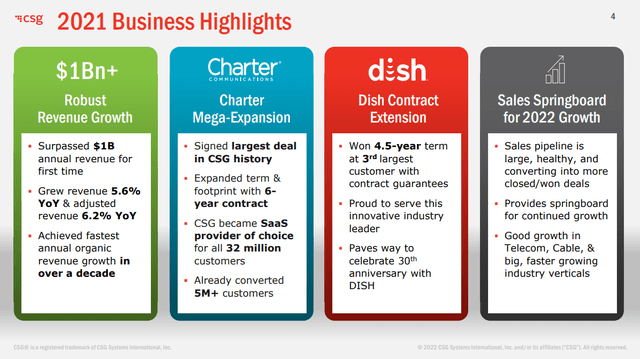

In 2021 CSG passed a major milestone with over $1 billion in revenues generated for the first time in the company’s history. In the company’s Q4 2021 earnings presentation, they summarized the 2021 highlights on the following slide.

2021 Business Highlights (CSG Q421 Earnings Presentation)

The list of company awards keeps growing too, including most recently, the Great Place to Work (in India) Award 2022. In 2021, they received the Gartner Magic Quadrant for Field Service Management award and the 2021 ColoradoBiz Top Company award for Technology and Software, among others.

Industry Diversification

Recognizing that cord-cutting is likely to continue to impact the telecom and pay TV service providers, CSG has actively been pursuing, and winning business with customers in other industries, including financial services, retail, government, logistics and transportation, utilities, healthcare, insurance, and other media and entertainment providers. In 2017, the revenue mix included 70% cable/pay TV, 23% telco, and 7% other. In 2021, those numbers consisted of 57% pay TV, 19% telco, and 24% other.

Another CSG avenue for expansion and a key strategic priority is to grow via value-added acquisitions. In 2021, 3 acquisitions were closed including Kitewheel, Tango Telecom, and DGIT Systems.

A recent win for the company that demonstrates additional market diversification is this announcement of a new strategic partnership with Velosimo to provide government technology solutions.

Shareholder Returns

As outlined in the Q4 2021 earnings press release, the following items were listed.

- Declared quarterly cash dividend of $0.25 per share in November 2021, bringing total dividends paid in 2021 to $33 million.

- January 2022 CSG’s Board of Directors approved a 6% increase in the cash dividend with quarterly payments of $0.265 per share to be paid in March 2022.

- Repurchased approximately 732,000 shares of common stock for $36 million during 2021.

The annual dividend yield based on the increased quarterly distribution works out to about 1.65% based on the $64.40 closing share price as of March 30, 2022. Although not a substantial payout, the dividend growth has continued for 8 consecutive years, and it is poised to continue growing over the next decade.

Future Outlook

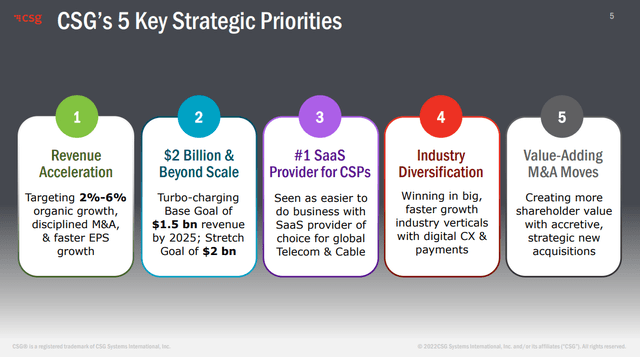

In 2021 the company realized YOY revenue growth of 5.6% and adjusted revenue growth of 6.2%. The sustained long-term organic revenue growth is practically assured for the next 5 to 6 years or more as a result of the 2 major contract renewals with Dish and Charter. Along with potential additional M&A activities, the company has set a base case goal of reaching $1.5B in revenues by 2025 with a stretch goal of $2B – in other words, they expect to realize 50 to 100% growth in revenues over the next 3 years.

CSG’s 5 Key Strategic Priorities (Q421 Earnings Presentation)

The future revenue and earnings growth is pegged somewhat to the future growth and success of its larger customers, including Comcast, Charter and DISH. However, that revenue base is solid and provides a foundation for future expansion and diversification into other industries and other customers.

In the Q4 earnings transcript, President and CEO Brian Shepherd had this to say about their existing CSP (communications service provider) customers:

“…we are committed to being the number one technology provider of choice for communication service providers globally. And our continued sales success with both North American and Global CSPs prove that we’re executing well against this strategic priority. In the cable market, we have long-term guaranteed contracts to be the BSS provider of choice for all 65 million combined Comcast and Charter subscribers two largest cable providers, with CSG having migrated tens of millions of subscribers, off of both Amdocs and NetCracker over the last 6 years, we plan to build on this market share success in the years ahead.”

In addition to the US and North American telecom markets, new wins in the global telecom markets are also fueling future growth. More details were provided by CEO Shepherd on the earnings call:

“In the global telecom market, we continue to grow with new wins and contract extensions with leading telecom operators all around the world. In early 2021, we signed an exciting new deal with Mobily, the second-largest wireless operator in Saudi Arabia with nearly 14 million customers.

Mobily was looking for a partner to future proof their business, accelerate innovation, and improve their customer experience. Demonstrating our strength as a technology leader in wireless, CSG was selected as the prime systems integrator to deploy our full revenue management platform for this digital leader. We expect big growth to continue in our Middle East and Africa telecom business.

Another exciting global telecom win is TalkTalk, the UK’s leading value for money connectivity provider. CSG’s cloud-based end-to-end SaaS platform enable TalkTalk to launch the country’s first ever Netflix subscription outside of a traditional TV bundle. With CSG’s marketplace solution at the heart of its entertainment operations, TalkTalk has the scalability to add new content providers and evolve its offering to keep pace with the ever-changing consumer demands. And finally in May, we announced a multi-year contract expansion with MTN South Africa, the largest mobile network operator in Africa with over 30 million consumers.”

Financial Position and Valuation

Revenues increased 5.6% from 2020 to 2021, growing from $260M at the end of Q420 to $275M at the end of Q421. The 2021 fiscal year ended with cash flow from operations before working capital increasing to $179M from $164M at the end of 2020. Year-end 2021 liquidity stands at $684M with $234M in cash and $450M available from their revolving credit facility. Net leverage grew slightly YOY from 0.5 to 0.6, but still quite manageable for a company with a market cap of about $2B.

The GAAP P/E for the trailing twelve-month period is 28.5, which is a bit on the high side, and the forward P/E according to SA is 18, which is also historically high but not unreasonable given the growth prospects.

Risk Factors

From the Q421 10-K some of the pertinent risk factors to consider include:

Loss of business from a significant customer – we generate over 40% of our revenue from our two largest customers, Charter and Comcast, which each individually accounted for over 10% or more of our total revenue

The Delivery of Our Solutions is Dependent on a Variety of Computing and Processing Environments, and Communications Networks Which May Not Be Available or May Be Subject to Security Attacks (emphasis in original)

We Rely on A Limited Number of Third-Party Vendor Relationships to Execute Our Business Which Exposes Us to Supply Chain Disruptions, Cost Increases, and Cyberattacks (emphasis in original)

We Face Significant Competition in Our Industry (emphasis in original)

These are just some of the risks mentioned and are the ones that should be considered most relevant to an investment decision, in my opinion. Some of those risks can be mitigated by management decisions. However, like many risks in business, some may be outside of the company’s control.

Summary and Recommendation

CSG Systems had a spectacular year in 2021, surpassing $1B in revenues for the first time in the company’s history and signing significant contract extensions with two of its biggest customers – Dish Network and Charter Communications. They completed three acquisitions to further extend their SaaS offerings, helping to diversify into new markets and extend their global reach. They have an ambitious goal of doubling revenues over the next 3 to 5 years and returning value to shareholders in the form of growing dividends and share repurchases. I am impressed with the management team and the key strategic priorities that they are focused on including additional organic growth along with value-added M&A using a disciplined capital allocation approach.

The stock is currently trading at a relatively high valuation historically speaking, so my current rating is a Hold. I would look to buy the stock on any substantial pullback in share price below $60, or if you are looking to add a dividend growth stock to your portfolio that is somewhat recession-resistant and that is likely to hold its value in the event of a significant market correction.

Be the first to comment