JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Cognizant (NASDAQ:CTSH) has a growing demand for its products and services, plus existing customers tend to be loyal due to high switching costs. CTSH can provide an excellent return from covered call premiums and dividends even if the stock does not move much.

Cognizant

Here is what I gathered about Cognizant from their corporate website.

Cognizant Technology Solutions Corporation is a professional services company. Its services include digital services and solutions, consulting, application development, systems integration, application testing, application maintenance, infrastructure, and business process services. It is focused on areas, namely the Internet of Things, digital engineering, data, and cloud. The Company operates through four segments: Financial Services, Healthcare, Products and Resources, Communications, Media, and Technology. The Healthcare segment comprises providers, payers, and life sciences companies, including pharmaceutical, biotech, and medical device companies. The Products and Resources segment includes manufacturers, retailers, travel and hospitality companies, and companies providing logistics, energy, and utility services. Its Communications, Media, and Technology include information, media, entertainment, communications, and technology companies.

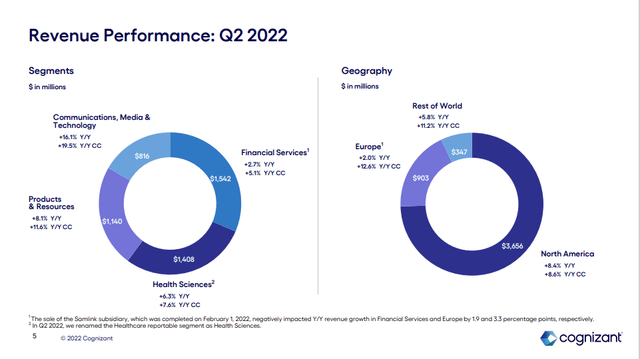

www.cognizant.q4cdn.com/123993165/files/doc_financials/2022/q2/Q222-Earnings-Supplement_vFinal.pdf

CTSH has annual sales above $19.2B with 341K employees. They are 92.9% owned by institutions with only 1.6% short interest. Their return on equity is 18.9%, and they have a 16.8% return on invested capital. Free cash flow yield per share is 7%, and their buyback yield per share is 3.1%. In 2021, Cognizant returned $1.3 billion to shareholders via share repurchases and dividends.

Good Technical Entry Point

I’ve added the green Fibonacci lines using the high and low of the past five years for CTSH. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. CTSH is currently above the 38.2% Fibonacci retracement level but could go lower. However, I believe that CTSH will trade near the 50% Fibonacci level of $66.20 by June for the reasons in this article.

The seven most accurate analysts have an average one-year price target of $71.29, indicating a 13% potential upside from the October 28th closing price of $63.02 if they are correct. Their ratings are mixed with three buys and four holds. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

Trend In Earnings Per Share, P/E Ratio, And Net Profit Margin

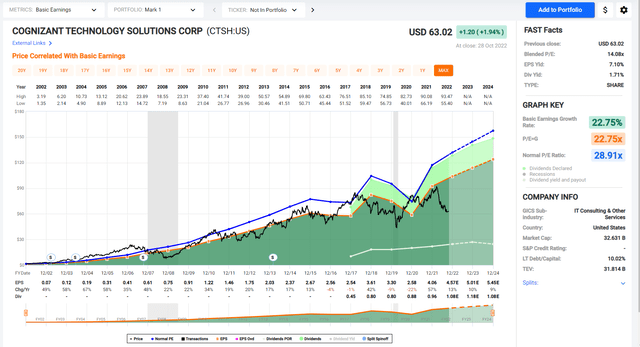

The black line shows CTSH’s stock price for the past twenty years. Look at the chart of numbers below the graph to see that CTSH had trough earnings in 2020 during the pandemic. They bounced from $2.58 in 2020 to $4.06 in 2021, and they are projected to earn $4.57 in 2022 and $5.01 in 2023.

The P/E ratio for CTSH is currently at 14, but the average ratio over the past ten years is 22. I don’t think the P/E will rally back to 22 anytime soon. If CTSH earns $5.01 in 2023, the stock could trade at $75.15 if the market assigns only a 15 P/E ratio.

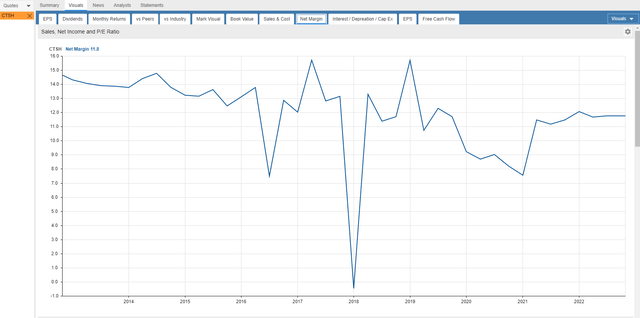

The net profit margin trend has declined since 2013, when it was above 14%. This metric is not at all-time highs, but it is off the lows and stabilizing near 11% or 12%.

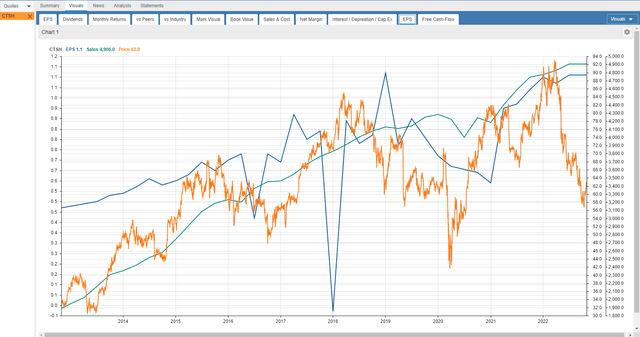

Sales (green line) have been growing consistently since 2013, while EPS (blue line) is also increasing, but not as consistently. Investors must patiently wait for the stock price (orange line) to catch up. The market may need one or two more post-pandemic earnings calls to value CTSH more.

Balance Sheet Flexibility

CTSH’s balance sheet is in good shape, with about $750M in net cash. They are projected to generate over $2.3B in free cash flow in 2022 and 2023. This provides flexibility for mergers, acquisitions, organic investment, dividends, and stock buybacks.

In 2020, CTSH announced ten acquisitions for approximately $1.6B; all focused on strategic priorities around digital engineering, data and AI, cloud, and IoT. Examples include New Signature, an independent Microsoft (MSFT) public cloud transformation company completed in August 2020, and Tin Roof, a custom software and services company that closed in September 2020. Together, all acquisitions contributed $222M in revenues.

Growing Demand For CTSH Products and Services

Below is what I have gathered from an article published by VentureBeat.

Conventional wisdom would call for reducing costs, not accelerating them in a turbulent economy. However, according to research and consulting company Gartner, worldwide IT spending will total a whopping $4.6 trillion in 2023.

Gartner claims that companies will use digital technology to reshape revenue streams, add new products and services, change the cash flow of existing products and services, and change value propositions for existing products and services.

Gartner’s latest research predicts that:

- Software spending will grow by 11.3%

- IT services spending will grow by 7.9%

- Data center systems will grow by 3.4%

- Communication services will grow by 2.4%

By contrast, device spending will decrease by .6%.

CTSH can help companies improve visibility, control, and compliance, save money, improve efficiencies, and manage risks. I think CTSH can grow the consulting portion of its business and automate some of its business process outsourcing, allowing for margin expansion.

High Switching Costs

Existing customers tend to be loyal to CTSH due to high switching costs. CTSH contracts often last several years since it takes significant time to design and implement what customers want and need. What CTSH installs becomes mission-critical, and a company could bear immense costs if it is not maintained correctly. Cognizant reports that more than 90% of overall revenue yearly is derived from existing customers.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on CTSH eight months out. CTSH closed at $63.02 on October 28th, and June’s $65.00 covered calls are at or near $5.70. One covered call requires 100 shares of stock to be purchased. Selling a June covered call will allow the investor to collect dividends in November, February, and May at $0.27 each. The stock will be called away if it trades above $65.00 on June 16th. It may even be called away sooner if the price is above $65.00, but that’s fine with me since I will have my capital returned sooner.

The investor can earn $570 from call premiums, $81 from dividends, and $198 from stock price appreciation. This totals $849 in estimated profit on a $6,302 investment, which is a 21.5% annualized return since the period is 228 days.

If the stock is below $65.00 on June 16th, investors will still make a profit on this trade down to the net stock price of $56.51. Selling covered calls and collecting dividends reduces your risk.

Takeaway

The CTSH trends in EPS, P/E Ratio, and Net Profit Margin provide good indications for stock price appreciation. Even if CTSH’s stock price moves from $63.02 to $65.00 by June 16th, a 21.5% potential annualized return is possible, including covered call premiums and dividends.

Be the first to comment