MF3d

Welcome to the August 2022 cobalt miners news.

The past month saw cobalt prices stabilize after heavy falls in July. Despite some slowing demand for cobalt in China, the IEA forecast we will need 17 new cobalt mines this decade as lithium-ion battery demand surges 10-fold.

Most of the cobalt producers have been reporting large profit increases from the past year, while the juniors continue to progress slowly.

Cobalt price news

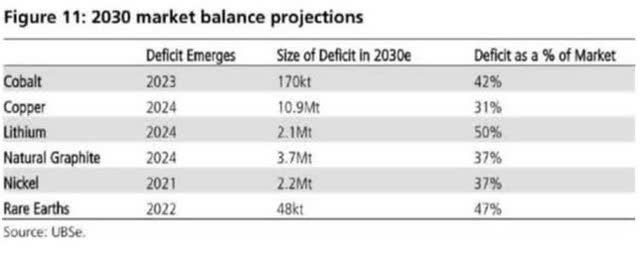

As of August 23, the cobalt spot price fell slightly to US$22.11/lb, from US$22.57/lb last month. The LME cobalt price is US$48,505/tonne. LME Cobalt inventory is 190 tonnes, lower than 196 last month. More details on cobalt pricing (in particular the more relevant cobalt sulphate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt spot prices – 5-year chart – USD 22.11

Cobalt demand vs. supply forecasts

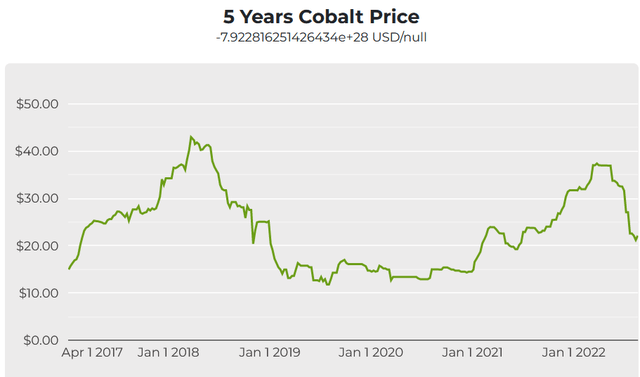

UBS cobalt supply and demand forecast – Growing deficits from 2023

Source: Fortune Minerals company presentation

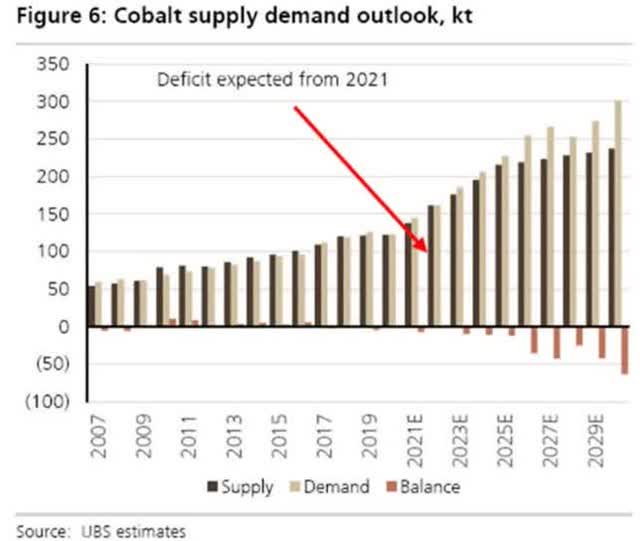

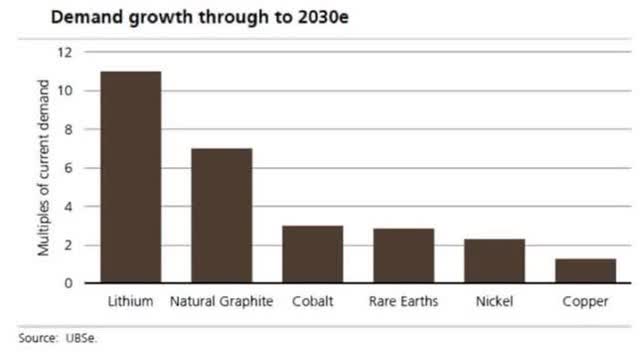

UBS’s EV metals demand forecast (from Nov. 2020)

UBS forecasts Year battery metals go into deficit

UBS Source: UBS courtesy Carlos Vincens LinkedIn

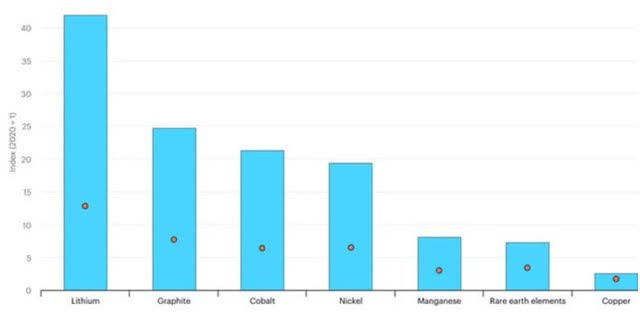

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

Source: International Energy Agency 2021 report

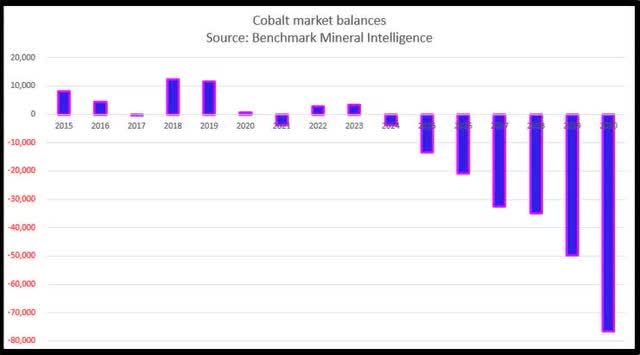

BMI 2022 forecast for cobalt – Deficits building starting from 2024

Source: Reuters and courtesy Benchmark Mineral Intelligence

Cobalt market news

On July 27 Bloomberg reported:

Race to secure battery metals heats up as GM, Ford ink deals. Carmakers are scouring the world to diversify their supplies of raw materials needed to power EV fleets… General Motors Co. announced three deals Tuesday for supplies of raw materials needed to build a million EVs a year. Less than a week ago, Ford Motor Co. revealed a list of suppliers of inputs ranging from Argentine lithium to Indonesian nickel – enough to build 600,000 EVs a year. The world’s shift into electric vehicles means demand growth for lithium, nickel, cobalt and other key ingredients in EV batteries is outpacing supply that’s been hampered by Covid-related logistical woes and a general lack of investment, pushing up prices.

On August 2 Investing News reported:

Cobalt Market Update: Q2 2022 in Review… “Price dynamics shifted considerably in Q2 as Shanghai experienced a long COVID-19 lockdown, and battery demand growth in China softened,” Harry Fisher of CRU Group… Looking over to supply, last year cobalt mine output rose 12 percent year-on-year to 160,000 metric tons [MT] after falling in 2020. The Democratic Republic of Congo [DRC] remained the top producer, accounting for 74 percent of global output and 87 percent of annual growth. In 2022, CRU forecasts that mined supply will rise by over 42,000 MT, up 26 percent year-on-year. “This will mean that the market should certainly be more balanced than in 2021, when a significant deficit developed… Hughes echoed this sentiment, saying the cobalt market is projected to be well balanced in 2022 as the ramp-up of new and existing projects in the DRC and Indonesia increases supply by 17 percent year-on-year… “Prices are likely to plateau once demand starts to pick up more markedly, and then possibly rise again later in the quarter or in Q4…”

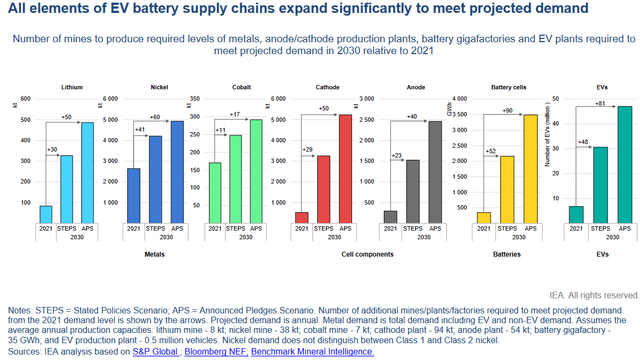

In August the IEA released:

Global supply chains of EV batteries… Battery and minerals supply chains will have to expand ten-fold to meet government EV ambition… Demand for EV batteries will increase from around 340 GWh today, to over 3500 GWh by 2030… For example, demand for lithium – the commodity with the largest projected demand-supply gap – is projected to increase sixfold to 500 kilotonnes by 2030 in the APS, requiring the equivalent of 50 new average-sized mines.

IEA: 17 new cobalt mines needed this decade

Source: Global supply chains of EV batteries page 48

On August 22 the WSJ reported:

Deep-sea mining is close to reality despite environmental concerns. The ocean floor contains a trove of metals that can be used in making batteries for electric vehicles. Companies could start mining the ocean floor for metals used to make electric-vehicle batteries within the next year…

On August 24 Reuters reported:

Volkswagen, Mercedes-Benz team up with Canada in battery materials push. German carmakers Volkswagen and Mercedes-Benz struck battery materials cooperation agreements with mineral-rich Canada on Tuesday, intensifying efforts to secure access to lithium, nickel and cobalt… VW is targeting initial capacity of 20 gigawatt-hours at the North American plant… the company aims to announce the North American plant location and potential mining and refining partners by the end of the year.

Cobalt company news

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

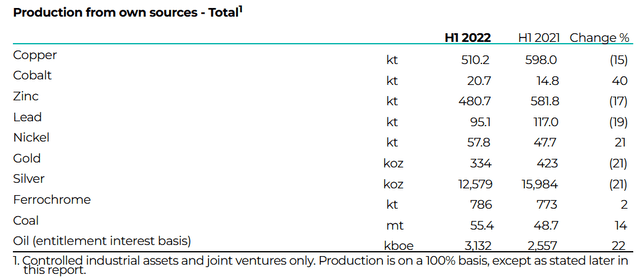

On July 29, Glencore announced: “Half-year production report 2022.”

Glencore H1 2022 production report – Cobalt 20,700t, up 40%YoY

Source: Glencore

On August 4, Glencore announced:

2022 half-year report. Glencore’s Chief Executive Officer, Gary Nagle, commented: “Notwithstanding what has clearly been a very complex environment for our markets, our operations, and the world in general, we are pleased to report an exceptional financial performance for Glencore over the period. “Global macroeconomic and geopolitical events during the half created extraordinary energy market dislocation, volatility, risk, and supply disruption, resulting in record pricing for many coal and gas benchmarks and physical premia, underpinning a $10.3 billion increase (119%) in Group Adjusted EBITDA to $18.9 billion. Marketing Adjusted EBIT more than doubled to $3.7 billion, with energy products the standout, while Industrial Adjusted EBITDA increased $8.4 billion to $15.0 billion period-on-period… significant cash was generated, which reduced Net debt to $2.3 billion, allowing for today’s announcement of $4.5 billion of “top-up” shareholder returns, comprising a $1.45 billion special distribution ($0.11 per share) alongside a new $3.0 billion buyback program (c.$0.23 per share). Today’s additional returns lift total 2022 shareholder returns to c.$8.5 billion…

On August 4, Glencore announced:

Share buy-back programme. Glencore plc (the “Company”) announces the commencement of a programme to make market purchases of its ordinary shares (the “Shares”) of an aggregate value of USD3 billion (the “Programme”), subject to market conditions, which may continue until the 2022 full year results are announced in February 2023.

China Molybdenum [HKSE:3993] [SHE:603993] (OTC:CMCLF)/CMOC Group Limited (English name change)

On August 21, CMOC announced:

Interim results announcement for the six months ended 30 June 2022. The Company’s performance hit a new high by virtue of the expansion of production capacity and the prosperity of the industry. The Company recorded an operating revenue of approximately RMB91.77 billion, representing a year-on-year increase of 8%. EBITDA amounted to approximately RMB11.28 billion, representing a year-on-year increase of 59%. Operating cash inflow amounted to approximately RMB8.50 billion, representing a year-on-year increase of 545%. Net profit attributable to the parent company amounted to approximately RMB4.15 billion, representing a year-on-year increase of 72%, of which IXM’s net profit attributable to the parent company contributed USD98 million.

Zheijiang Huayou Cobalt [SHA:603799]

On August 1 Bloomberg reported:

Tesla inks battery materials deals with two China suppliers… Huayou, CNGR to provide ternary precursor products till 2025… Huayou Cobalt will supply the materials to Tesla from July 1, 2022 to the end of 2025. The miner said the prices of the products will be subject to market prices for nickel, cobalt and manganese, as well as refining fees. CNGR will supply the EV automaker between 2023 and 2025…

Jinchuan Group International Resources [HK:2362]

On August 5, Jinchuan Group International Resources announced: “Operational update for the six months ended 30 June 2022; and profit warning.”

On August 19, Jinchuan Group International Resources announced: “Jinchuan International announces 2022 interim results revenue surges 50% to US$539.4 million. Development projects make breakthroughs consolidated foundation for grasping opportunities.” Highlights include:

- “Revenue amounted to US$539.4 million, up by a significant 50% year-on-year. Cobalt revenue from mining operations surged 157% to US$130.8 million, and revenue from trading of mineral and metal products was US$174.1 million, rocketed by 373%.

- During the Period, the Group produced 28,789 tonnes of copper and 2,603 tonnes of cobalt, and cobalt output was up 80% year-on-year.

- During the Period, the Group sold 27,148 tonnes of copper and 2,210 tonnes of cobalt, and the volume of cobalt sold increased by 86% year-on-year.”

Chemaf (subsidiary of Shalina Resources)

No news for the month.

GEM Co Ltd [SHE: 002340]

On July 27, GEM Co Ltd announced: “…signed strategic cooperation agreement on green recycling of power batteries with REPT BATTERO Energy Co., Ltd.”

On July 27, GEM Co Ltd announced: “…signing a strategic cooperation agreement with SUNWARD on the electrification of construction machinery and battery recycling…”

Investors can read more about GEM Co in the Trend Investing article: “A Look At GEM Co Ltd – The World’s Largest Battery Recycling Company” when GEM Co was trading at CNY 5.08.

Eurasian Resources Group (“ERG”) – private

ERG own the Metalkol facility in the DRC where ERG processes cobalt and copper tailings with a capacity of up to 24,000 tonnes of cobalt pa.

On August 22, ERG announced: “Eurasian Resources Group to invest USD 230m in building the most powerful wind power plant in Aktobe, Kazakhstan…”

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On July 29, Umicore SA announced:

Umicore reports strong performance in the first half of 2022… Umicore’s revenues for the first 6 months amounted to € 2.1 billion, stable compared to the record levels of the first 6 months in the previous year… In line with the dividend policy, an interim dividend of € 0.25 per share will be paid on August 23.

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

On August 8, Sumitomo Metal Mining Co. announced: “Consolidated financial results for the first quarter ended June 30, 2022 [IFRS]…” Profit increased 77% YoY in the June quarter.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTCPK:NILSY) (ADRs to remain in circulation until April 28, 2023)

On July 28, MMC Norilsk Nickel announced: “Norilsk Nickel announces consolidated production results for 1H 2022.” Cobalt numbers were not shown.

On August 2, MMC Norilsk Nickel announced: “Nornickel reports first half 2022 interim consolidated IFRS financial results.” Highlights include:

- “Consolidated revenue was flat year-on-year amounting to USD 9 billion. Higher base metal prices and recovery of production volumes after temporary suspension of operations caused by the incidents at Oktyabrsky and Taimyrsky mines and Norilsk concentrator in 1H2021, were negatively offset by lower realized palladium price and lower overall metal sales volume owing to logistical disruptions…

- EBITDA decreased 16% y-o-y to USD 4.8 billion owing to higher operating cash costs driven mainly by increase in labour expenses and mineral extraction tax. EBITDA margin amounted to 53%.

- Net income increased 18% y-o-y to USD 5.1 billion mostly driven by stronger rouble exchange rate as of the end the reported period resulting in revaluation of foreign currency debt.

- CAPEX increased 83% y-o-y to USD 1.8 billion…

- Net working capital amounted to USD 3.8 billion…

- Free cash flow decreased 25% y-o-y to USD 1.1 billion…

- Net debt doubled to USD 10.2 billion as a result of the decrease of free cash flow and payment of dividends for 2021 totaling USD 6.2 billion…

- Various economic restrictions imposed on Russia by a number of countries have created risks for operating, commercial and investment activities of the Company. To mitigate these risks Nornickel has developed a set of responses and has launched a new procurement strategy aiming at the substitution of some imported goods and services with alternative suppliers.”

Recent Developments

- “On July 5, 2022, the Board of Directors of Nornickel decided to hold Extraordinary General Meeting of Shareholders on August 11, 2022 to reduce the authorized capital of the Company by RUB 791,227 to RUB 152,863,397 by cancelling 791,227 repurchased ordinary shares with par value of RUB 1.”

On August 18 Nornickel reported:

Nornickel, the world’s largest producer of palladium and high-grade nickel and a major producer of platinum and copper, informs holders of American depositary receipts representing rights to the Company’s shares (“ADRs”) that in accordance with the requirements of Part 13 of Article 6 of the Federal Law No. 114-FZ “On Amendments to the Federal Law on Joint Stock Companies and Certain Legislative Acts of the Russian Federation” dated April 16, 2022, a notification was sent to JSC Raiffeisenbank, the ADR program custodian, about the requirement to conduct an automatic conversion, as a result of which holders of ADRs issued for shares of PJSC MMC Norilsk Nickel, the rights to which are recorded in Russian depositories, will be credited with the respective number of shares of PJSC MMC Norilsk Nickel.

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

On July 25, OZ Minerals announced:

Second quarter report 2022 for the three months ending 30 June 2022… H1 net revenue of $909 million enabling net cash position of $82 million after reinvesting $210 million in growth projects.

On August 8, OZ Minerals announced: “OZ Minerals rejects Indicative Proposal from BHP…”

On August 15, OZ Minerals announced: All regulatory approvals now in place for West Musgrave project.” The main focus is copper and nickel.

Sherritt International [TSX:S] (OTCPK:SHERF)

On July 27, Sherritt International announced: “Higher nickel, cobalt and fertilizer prices drive Sherritt’s strong second quarter results.” Highlights include:

- “…Net earnings from continuing operations were $81.5 million, or $0.21 per share, compared to a net loss from continuing operations of $10.4 million, or $0.03 per share, in Q2 2021…”

Nickel 28 [TSXV:NKL] [GR:3JC]

On August 4, Nickel 28 announced: “Nickel 28 releases Ramu Q2 2022 operating performance.” Highlights include:

- “Ramu Q2 2022 production of 8,128 tonnes of contained nickel in MHP.

- Ramu Q2 2022 production of 695 tonnes of contained cobalt in MHP…”

On August 15, Nickel 28 announced:

Nickel 28 releases update on Giga Royalty: Secures Mitsubishi as development partner. Nickel 28 Capital Corp. (“Nickel 28” or the “Company”) (TSXV: NKL) (FSE: 3JC0) is pleased to provide an update on its 2.0% Net Smelter Return (“NSR”) royalty from Giga Metal’s (“Giga”) Turnagain Nickel/Cobalt deposit. Earlier today, Giga announced the formation of a joint venture with Mitsubishi Corporation to pursue the development of the Turnagain Nickel Deposit in northern British Columbia, Canada…”

Investors can view the company presentations here.

Possible mid-term producers (after 2022)

Jervois Global Limited [ASX:JRV] [TSXV: JRV] (OTC: JRVMF) [FRA: IHS] (formerly Jervois Mining)

On August 23, Jervois Global Limited announced: “Interim condensed financial report for the half-year ended 30 June 2022…”

Upcoming catalysts include:

- Sept. 2022 – Idaho Cobalt Operations commissioning, with full production in February 2023.

- 2023 – First production targeted from the São Miguel Paulista Refinery.

Electra Battery Materials [TSXV:ELBM] (ELBM)

On July 26, Electra Battery Materials announced:

Electra signs benefits agreement with Métis Nation of Ontario… In connection with the Benefits Agreement, Electra has agreed to issue 20,000 common shares of the Company to the MNO as a means of providing a measure of economic participation in the success of Electra’s low-carbon battery materials visions.

On August 2, Electra Battery Materials announced: “Electra identifies new mineralization in Idaho Cobalt Belt.”

On August 11, Electra Battery Materials announced: “Electra reports Q2 results and provides update on cobalt refinery project.” Highlights include:

- “Held cash of $41.8 million as at June 30, 2022, down from $51.9 million as at March 31, 2022. Electra’s cash balance at the end of Q2 does not include the remaining $6.5 million of government investments expected to be received or $17.5 million of available funding from the Company’s At-the-Market (ATM) program.

- Total incurred costs for the refinery construction project at quarter end were $30.1 million.

- Net income for the period was $7.5 million or $0.23 per basic share. The totals were driven by a gain of $12.7 million on the fair value of the embedded derivative liability portion of the convertible debt.

- Commenced trading on Nasdaq Capital Market effective April 27, 2022 under the ticker symbol “ELBM” and consolidated its outstanding common shares on the basis of one post-consolidated share for every 18 pre-consolidated shares.

- Announced preliminary discussions with the Government of Quebec to construct a new cobalt sulfate refinery in Bécancour, Quebec that will integrate with an emerging battery materials park in the province. In support of the effort, Electra will develop a pre-feasibility study to identify project costs, timelines, potential synergies from integration with other battery materials companies in the process as well as potential funding from federal and provincial governments…

- Signed two memorandums of understanding for off-take cobalt sulfate supply agreements pending the signing of definitive agreements.”

Highlights Subsequent to Quarter End

- “Signed a benefits agreement with the Métis Nation of Ontario that will provide employment, training, procurement, and business opportunities related to the construction and expansion of Electra’s battery materials refinery north of Toronto.

- Exploration program at the Ruby prospect to date suggests that Ruby could be a new mineralized cobalt and copper target located in close proximity to Electra’s Iron Creek cobalt-copper deposit in Idaho. Assay results are expected in Q3 2022.”

Upcoming catalysts include:

Early 2023 – Target to have their North American cobalt refinery operational with ore feed from Glencore.

Investors can view the company presentations here and a good Crux Investor CEO interview here.

Sunrise Energy Metals Limited [ASX:SRL](OTCQX:SREMF)(formerly Clean TeQ)

Sunrise Energy Metals has 132kt contained cobalt at their Sunrise project.

On August 23, Sunrise Energy Metals Limited announced: “2022 annual report.”

Upcoming catalysts include:

2022 – Possible off-take agreements and project funding/partnering.

Investors can also read the latest company presentation here.

Fortune Minerals [TSX:FT] (OTCQB:FTMDF)

On August 18, Fortune Minerals announced: “Fortune Minerals announces completion of 2015 debentures extension…”

Upcoming catalysts include:

- 2022 – Drill results, possible off-take or equity partners, project financing.

Investors can read the latest company presentation here, or a company pitch video here.

Australian Mines [ASX:AUZ] (OTCQB:AMSLF)

On July 28, Australian Minerals announced: “Quarterly activities report for period ended 30 June 2022.” Highlights include:

- “Appointment of Interim CEO – Les Guthrie, a Director of Australian Mines and an experienced large project development executive, was appointed to the position of interim CEO. The search for a permanent CEO is continuing.

- Equity Raising – Australian Mines raised a total of A$4.4 million (before costs), including through an Institutional Placement (A$3.7 million) and Entitlement Offer (A$0.7 million). The Company is seeking to place the shortfall (A$3.0 million) from the Entitlement Offer.

- Extension of Condition Precedent with LG Energy Solution – Australian Mines and LG Energy Solution agreed to extend the Offtake Agreement’s Condition Precedent of finalising project financing to 31 December 2022 (or such later date as the parties may agree).

- Sconi Project Studies – Australian Mines continued to progress various studies to support the development of the Sconi Project.

- Sconi Project Finance – Australian Mines has undertaken a strategic review of the project financing strategy for the Sconi Project.”

On August 10, Australian Minerals announced: “Proposed settlement of ASIC action against Australian Mines…”

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2022 – PFS on alternative nickel-cobalt laterite ore processing.

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

In total, Ardea has 5.9mt of contained nickel and 380kt of contained cobalt at their KNP Project near Kalgoorlie in Western Australia. Ardea is also exploring for gold and nickel sulphide on their >5,100 km2 of 100% controlled tenements in the Eastern Goldfields region of Western Australia.

No significant news for the month.

Upcoming catalysts include:

- 2022 – Possible off-take partner and funding for the GNCP Project. Further exploration results.

Investors can read the latest company presentation here.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

In total Cobalt Blue currently has 81.1kt of contained cobalt at their 100% owned Broken Hill Cobalt Project [BHCP] (formerly Thackaringa Cobalt Project) in NSW, Australia. LG International is an equity strategic partner.

On July 25, Cobalt Blue Holdings announced: “June 2022 quarterly activities Report…”

On July 26, Cobalt Blue Holdings announced: “Demonstration Plant transitioning to operations.” Highlights include:

- “Cobalt Blue Holdings Limited (COB) has completed mining 2,300 t of ore for the Broken Hill Cobalt Project (BHCP) Demonstration Plant Program.

- Comminution and concentrate circuits are commissioned with operations underway.

- Transitioning to operations for remainder of plant aiming to produce Mixed Hydroxide Precipitate (MHP) and cobalt sulphate.

- Large scale (industry pre-qualification) test samples expected to be shipped from August.”

Upcoming catalysts include:

- 2022 – Possible off-take agreements. Feasibility Study & project approvals. Final Investment decision. Project Funding.

Investors can watch a CEO interview here and a recent presentation here.

Havilah Resources [ASX:HAV] [GR:FWL]

Havilah 100% own the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia. They also have the nearby Kalkaroo copper-gold-cobalt project (optioned to Oz Minerals), as well as a potentially large iron ore project at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit contains JORC Mineral Resources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 23,200 tonnes of cobalt.

On July 26, Havilah Resources announced: “OZ Minerals proposed transaction update.” Highlights include:

- “Havilah has executed full form binding transaction documents with OZ Minerals and OZ Exploration relating to the grant of an option to acquire the Kalkaroo Project and a strategic alliance.

- The Company will hold a general meeting of shareholders on Wednesday 31 August 2022 for the purposes of approving the Proposed Transaction, including the grant of the Kalkaroo Option, and upon exercise of the Kalkaroo Option, the disposal of the Company’s interest in the Kalkaroo Project.”

On August 12, Havilah Resources announced: “Proposed transaction with OZ Minerals: Board recommendation and presentation…”

Upcoming catalysts include:

- 2022 – West Kalkaroo gold starter open pit permitting and Feasibility Study.

Investors can learn more by reading the Trend Investing article “Havilah Resources Has Huge Potential and/or the update article. You can also view a CEO interview here, and the company presentation here.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia.

On July 29, Aeon Metals announced: “Quarterly activities report for the period ending 30 June 2022.” Highlights include:

- “Exploration drilling commenced at Walford Creek.

- CEI grant funded airborne electromagnetic survey (AEM) scheduled for next quarter.

- CEI grant funded gravity survey at Sugarbag prospect scheduled for next quarter.”

On August 17, Aeon Metals announced: “Drilling success at Walford Creek extends mineralisation.” Highlights include:

- “Initial assay results from first 3 holes of 2022 drilling at Walford Creek have been received.

- Significant results include: WFDH530 intersected: 76.5m at 1.27% CuEq* in PY1 from 273.5m… WFDH531 intersected: 32.0m at 0.60% CuEq in PY1 from 292.0m… WFDH532 intersected: 14.0m at 1.74% CuEq in PY3 from 485.0m.

- Results demonstrate proof of exploration concept, and potential for significant additional mineralisation within the Walford Creek system.

- Further assay results expected shortly.

- Overall program progressing well with 14 drillholes completed to date.”

Investors can view the latest company presentation here.

Upcoming catalysts include:

- Q1 2022 – Walford Creek revised PFS due.

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

On July 26, GME Resources announced: “Quarterly activities report June 2022.” Highlights include:

- “Updated PFS Outcomes delivers substantial increases to projected economic returns from development of NiWest Nickel Cobalt Project (“NiWest” or “the Project”).

- GME Board seeking to proceed to Definitive Feasibility Study (DFS) on NiWest, Scope of work and costing for study currently being developed.

- Subsequent to the end of the Quarter, Paul Kopejtka appointed as Managing Director effective from September 2022.”

Investors can read a company investor presentation here.

Global Energy Metals Corp. [TSXV:GEMC][GR:5GE1] (OTC:GBLEF)

No news for the month.

Giga Metals Corp. [TSXV:GIGA][FSE: BRR2] (OTCQX:HNCKF)

On August 15 Giga Metals reported:

Giga Metals and Mitsubishi Corporation agree to establish Joint Venture to develop Turnagain Nickel Project… Martin Vydra, President of Giga Metals Corporation (TSX.V: GIGA) announced today that the Company has entered into a binding agreement with Mitsubishi Corporation(“MC”) (Tokyo Stock Exchange: 8058) to form a new joint venture company, Hard Creek Nickel Corp. (“Hard Creek”), to jointly pursue the development of the Turnagain Nickel Deposit in northern British Columbia, Canada. MC will acquire a 15% equity interest in Hard Creek in exchange for cash consideration of Cdn $8 million. Giga will receive an 85% equity interest in Hard Creek in exchange for contributing all related assets for the Turnagain project.

the metals company (TMC)

On August 15, the metals company announced: “TMC secures $30m investment on path to commercial seafloor nodule production.” Highlights include:

- “Private investment in public equity (PIPE) financing secured primarily through existing TMC shareholders and insiders.

- The transaction includes an aggregate of $30.4 million in commitments to purchase common shares at US$0.80 per share.”

On August 15, the metals company announced: “the metals company provides Q2 2022 corporate update.” Highlights include:

Financial Highlights

- “Net loss of $12.4 million and loss per share of $0.05 for the quarter ended June 30, 2022.

- Total cash on hand of approximately $46.3 million at June 30, 2022.

- The Company announced today a private placement financing for an aggregate of 38 million common shares to investors at a price per share of $0.80 ($0.9645 for TMC Chairman & CEO Gerard Barron), with expected gross proceeds of $30.4 million.

- Approximately 70% of the commitments came from existing TMC shareholders and insiders, including Allseas, ERAS Capital (the family office of TMC Director Andrei Karkar), SAF Group Managing Partner and entrepreneur Brian Paes-Braga, Front End Chairman & CEO Majid Alghaslan, and Gerard Barron and his family.

- The Company believes that with the full proceeds expected this quarter from the private placement financing plus existing cash will be sufficient to fund operations for at least the next twelve months, past the July 2023 date targeted by the International Seabed Authority (ISA) as the date for the final adoption of the exploitation regulations for the industry.”…

Other juniors and miners with cobalt

Happy to hear any news updates from commentators. Tickers of cobalt juniors we will also be following include:

21st Century Metals (CSE: BULL) (OTCQB: DCNNF), African Battery Metals [AIM:ABM], Alloy Resources [ASX:AYR], Artemis Resources Ltd [ASX:ARV] (OTCPK:ARTTF), Aston Minerals [ASX:ASO] (formerly European Cobalt), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTC:AZRMF), African Energy Metals [TSXV:BANC] [GR:BC2] (NDENF), Battery Mineral Resources [TSXV:BMR], Blackstone Minerals [ASX:BSX], BHP (NYSE:BHP), Brixton Metals Corporation [TSXV:BBB](OTC:BXTMD), Canada Nickel [TSXV:CNC], Canada Silver Cobalt Works Inc [TSXV:CCW] (OTCQB:CCWOF), Canadian International Minerals [TSXV:CIN], Carnaby Resources [ASX:CNB], Castillo Copper [ASX:CCZ], Celsius Resources [ASX:CLA] [GR:FX8], Centaurus Metals [ASX:CTM], CBLT Inc. [TSXV:KBLT] (OTCPK:CBBLF), Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cruz Battery Metals Corp. [CSE:CRUZ][FSE: A2DMG8] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], TMC the metals company (TMC)/Sustainable Opportunities Acquisition Corporation, Dragon Energy [ASX:DLE], Edison Battery Metals [TSXV:EDDY], Electric Royalties [TSXV:ELEC], First Quantum Minerals (OTCPK:FQVLF), Fuse Cobalt Inc [CVE:FUSE] (WCTXF), Galileo [ASX:GAL], GME Resources [ASX:GME] (OTC:GMRSF), Stillwater Critical Minerals Corp. [TSXV:PGE] (OTCQB:PGEZF), Hinterland Metals Inc. (OTC:HNLMF), Hylea Metals [ASX:HCO], IGO Limited [ASX:IGO] (OTC:IIDDY), Lion Rock Resources (OTC:KBGCF) [TSXV:KBG], Latin American Resources, M2 Cobalt Corp. (TSXV: MC) (OTCQB: MCCBF), MetalsTech [ASE:MTC], Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Namibia Critical Metals [TSXV:NMI] (OTCPK:NMREF), Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (NYSEMKT:PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Regal Resources, Resolution Minerals Ltd [ASX:RML], Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), and Victory Mines [ASX:VIC].

Conclusion

August saw cobalt spot prices slightly lower and LME inventory was also slightly lower.

Highlights for the month were:

- Race to secure battery metals heats up as GM, Ford ink deals.

- Price dynamics shifted considerably in Q2 as Shanghai experienced a long COVID-19 lockdown, and battery demand growth in China softened.

- The cobalt market is projected to be well balanced in 2022 as the ramp-up of new and existing projects in the DRC and Indonesia increases supply.

- IEA: Battery and minerals supply chains will have to expand ten-fold to meet government EV ambition (this decade)… Demand for EV batteries will increase from around 340 GWh today, to over 3500 GWh by 2030. 17 new cobalt mines needed this decade.

- Deep-sea mining for EV metals is close to reality despite environmental concerns.

- Volkswagen, Mercedes-Benz team up with Canada in battery materials push.

- Glencore H1 2022 production report – Cobalt 20,700t, up 40%YoY. Glencore H1, 2022 $10.3b increase (119%) in Group Adjusted EBITDA to $18.9b. Announces special distribution ($0.11 per share) and a new $3b buyback program.

- Tesla inks battery materials deals with two China suppliers… Huayou, CNGR to provide ternary precursor products till 2025.

- Jinchuan Group H1 2022 cobalt revenue from mining operations surged 157% to US$130.8m.

- Electra identifies new mineralization in Idaho Cobalt Belt. Preliminary discussions with the Government of Quebec to construct a new cobalt sulfate refinery in Bécancour, Quebec.

- Cobalt Blue Demonstration Plant transitioning to operations.

- Aeon metals drilling success at Walford Creek extends mineralisation.

- Giga Metals and Mitsubishi Corporation agree to establish Joint Venture to develop Turnagain Nickel Project.

- TMC secures $30m investment on path to commercial seafloor nodule production.

As usual all comments are welcome.

Be the first to comment