Tony C French/DigitalVision via Getty Images

Early investors in Clean Energy Fuels Corp. (NASDAQ:CLNE) likely believed that renewable natural gas (‘RNG’) would become a leading energy source in the future. The company has recently released its Q3 financial results, resulting in mixed reviews due to growth in sales volumes but increased losses. Betting on futures is risky and even more so if the company has had less than impressive top and bottom-line results for over a decade and questionable decisions.

Stock Price Trend 5-Year Glance (SeekingAlpha.com)

However, the geopolitical environment and 2022 green energy legislation in the USA have sped up industry-wide agendas to switch to alternative renewable energy sources. The demand for natural gas trucks has increased by 18% over the last year. Today there is inadequate RNG fueling infrastructure to meet demand, which is why CLNE, intending to complete 27 additional fueling stations by the end of this year, and a further 43 stations in backlog, is an exciting stock to consider. This is also due to the immense demand and the growth phase that CLNE, a leader and front-runner in RNG, is experiencing. I think there is a lot more upside potential for this cheap small-cap stock and investors may want to take a bullish stance on this company.

Overview and Growth Catalysts

In my previous article, I gave an overview and introduction to CLNE. Although CLNE continues to deliver negative income, sales of RNG have increased significantly. Furthermore, the company has onboarded a growing number of large customers. It benefits from partnerships with large oil companies such as BP (BP) and TotalEnergies (TTE), racing to increase their renewable energy portfolios to meet the demands of the changing global energy markets. Although the company may require restructuring or a takeover to reach its full potential, and we should be cautious of the high and fluctuating industry costs, its current capacity and the growing demand are indicators of future growth potential.

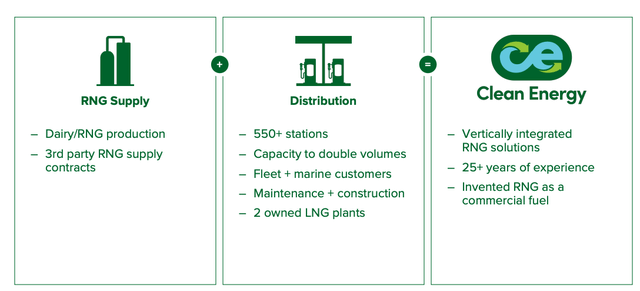

Company Overview (Investor Presentation 2021)

CLNE is the largest renewable natural gas provider in the States with the most established infrastructure; simultaneously, there is a growing demand and a shortage of supply. It is a favorable situation for a company investing in growing its supply and accessibility while experiencing little competition in the market.

A key catalyst for growth is the large long-term customers CLNE is onboarding. It already has a strong and growing partnership with Amazon (AMZN), which includes increasing the number of renewable natural gas-powered transport trucks and building stations to accommodate its fleet. Amazon uses more than 80 of CLNE’s current stations across the States. CLNE is connected to various consumers, including trucking, airport, refuse and transit. There are 27 station projects to be completed this year and 43 in the construction pipeline in the backlog. These numbers are on top of the already 500+ stations.

Truck-producing companies are also pushing the demand by creating top-end solutions, such as the 15-litre RNG from Cummins heavy-duty truck to be released in 2024, which can further increase the demand for RNG.

Lastly, CLNE has already benefited from the green energy bill established earlier this year to increase renewable energy infrastructure and use across the country. CLNE will benefit from a $0.50 a gallon credit for providing RNG fuel transport, one of the benefits of the Inflation Reduction Act.

Financials and Valuation

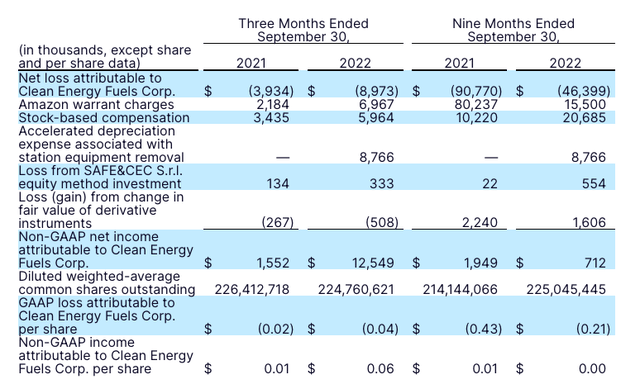

The third quarter indicated impressive revenue growth but a decline in net income. The change was primarily due to an increase in RNG volumes and receiving the alternative fuel tax credit, and natural gas costs were, however, higher. The third quarter saw a 50% increase in revenue year on year to reach $126 million. The net loss of Q3 2022 was $9 million, an increase of 128% from last year’s third quarter. The company beat Non-GAAP EPS expectations by $0.02 to reach $0.06, an increase of $0.05 from the prior year’s quarter.

Third Quarter 2022 and 2021 Financial Comparison (CLNE Financial Report Q3 2022)

The financials are important, but a key indicator we should look at is the growth in demand and volume sold. CLNE sold 28% more gallons of RNG year on year to reach 54 million gallons. Year to date, there has been an 18% increase in RNG sold, totaling 122 million gallons.

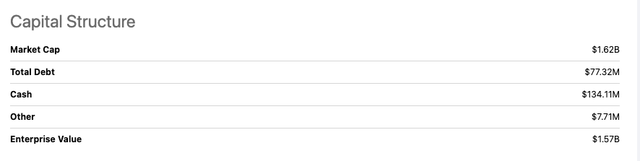

The company has two very positive forms of potential capital, long-term incentives from government initiatives to increase the renewable energy infrastructure and use and, on the other hand, strong partnerships with TotalEnergies and BP, two oil giants looking to improve their renewable energy portfolios across the globe. Below we have an overview of the current capital structure. CLNE has successfully used its operational cash flow to reinvest in growing the business and reducing its long-term debt.

Capital Structure (SeekingAlpha.com)

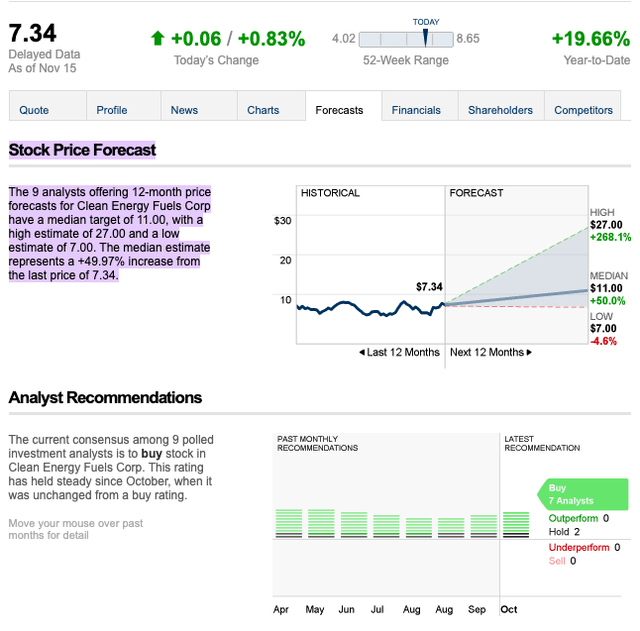

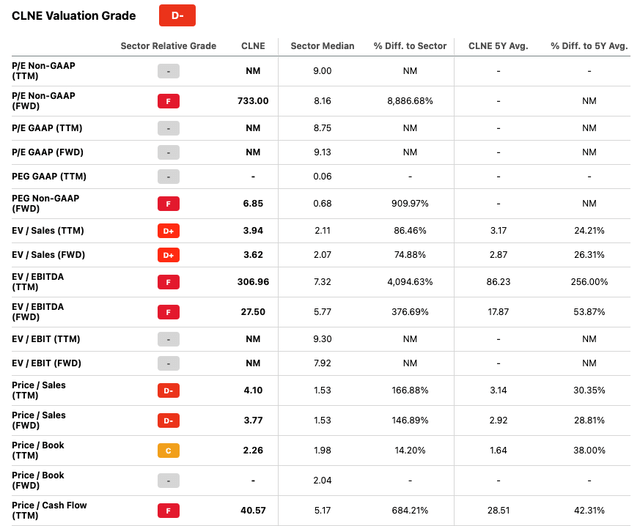

Analysts have mixed reviews about the stock. Its current price is well below the one-year target estimate of $11.00, as seen below, which could indicate that it has upside potential. SeekingAlpha’s Quant rating scores it as a Hold, while YahooFinance has a rating of 2 Buy. If we look at the valuation in SeekingAlpha’s Quant, we can see that over the last three months, the valuation has improved from an F to a D-.

Stock Price Forecast (Money.CNN.com) Quant Rating Valuation (SeekingAlpha.com)

Risk

Short term, there are some red flags. Although it is a front-runner and the leader in delivering RNG to consumers, the company has had poor performance and weak fundamentals for over a decade. However, it is in a very compelling industry right now. On top of that, the government has long-term funding incentives to grow and improve clean energy projects throughout the country.

It is a loss-making company with a GAAP loss of $46.4 million. Furthermore, the margins have been poor due to the industry-wide increase in costs, and there is pressure on the last quarter to deliver results. However, the management is confident in the increased demand for fuel and that prices will be lower than in Q3.

Final Thoughts

Renewable energy is on everybody’s agenda, and CLNE is a front-runner in RNG with little direct competition. Although there are alternative sources, RNG has excellent benefits for the long-haul and heavy-load trucks. There is a growing demand across all of its customer sectors, and CLNE is meeting that demand through planned and already completed and initiated fuel station projects. Furthermore, there are guaranteed growth incentives through the Inflation reduction act, from which the company already benefits. As the owner of the most extensive infrastructure in place, in addition to significantly large contracts with significant and long-term customers, I think this company has a lot of upside potential.

Be the first to comment