BitsAndSplits/iStock via Getty Images

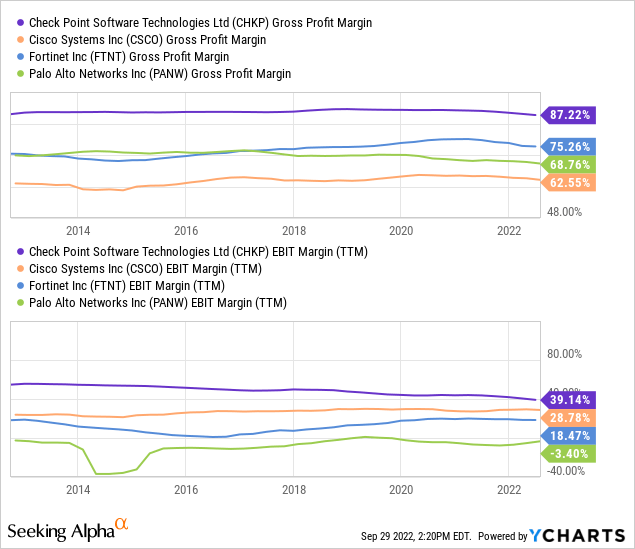

Mr. Gil Shwed founded and developed, what appears to be, a great company that almost has it all. Check Point Software Technologies (NASDAQ:CHKP) is highly stable, profitable, scalable, has no debt, has high returns on capital, is asset-light, and is managed by its founder. The financials from the last ten years are excellent.

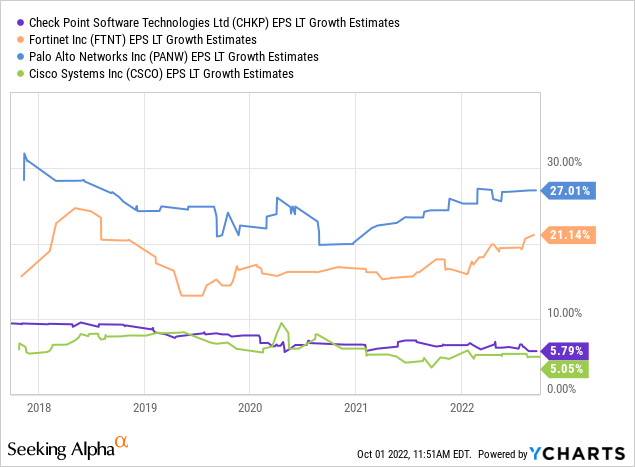

A company that would have it all if it could provide decent growth. Although last quarter appeared different, recent growth rates have been below market which displays a small, but steady, loss in market share. I would argue that the management should (if possible) use the cash cushion available to invest heavily in projects with returns higher than its cost of capital, even if that will bring down its best-in-class margins, as explained by the economic profit idea. I would love to see last quarter’s growth rates continue.

Business

As stated in previous articles, CHKP is an Israeli cyber security company that benefitted from being a first mover in the computer firewall protection area. Since being founded in 1993 and later listed in 1996, the company has been successfully growing in size and consolidating its product offerings with now focusing on three major areas: network security (Quantum), cloud security (CloudGuard), and users and access security (Harmony). The revenues are then divided between products, licenses, subscriptions; and software updates and maintenance.

The cyber security business is expected to grow CAGR double digit going forward and it’s benefiting from the current world instability and increased online attacks. The industry profits from the increased digitalization with also being connected to some tailwinds like cloud expansion.

It’s mostly a software business with high gross margins and low capital investment requirements, but the need to innovate and overcome competition is enormous. Companies in this sector should be able to quickly adapt to new trends and technologies either by acquiring smaller businesses or organically hence the low debt and high cash on balance. This is why, in my opinion, the management is keeping a strong unleveraged balance sheet.

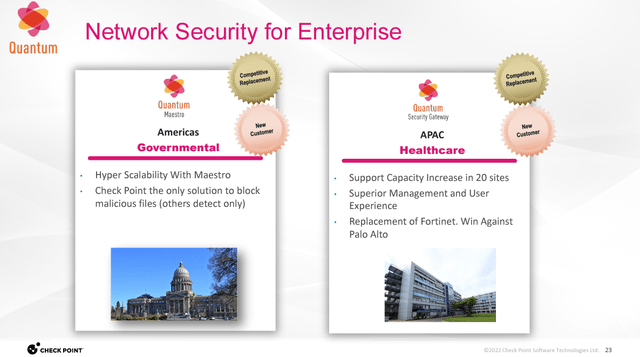

It’s hard for me to access, besides the rearward financials check, how the products are performing in terms of quality and, more importantly, if the moat is widening or quite the opposite. The high returns call competitors from all sizes and segments into the area and changes might happen fast. Despite my concern, Check Point provides some status on hand-picked won battles with the reasoning behind them and even who they replaced.

New Contracts for Quantum (CHKP Investor Presentation)

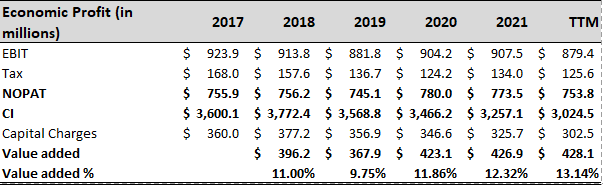

Economic Profit

The economic profit theory, explained briefly, is the idea that one should take into consideration opportunity costs when assessing the accounting results of a company. The theory is that the accounting earnings should be able to compensate (at least) the cost of capital deployed. This is a great way to estimate the value created or the “excess profits” produced. The literature also reflects a link between stock returns and the economic profit created, the more “excess returns” the better the stock performs.

It’s also stated that businesses that already earn high returns on capital, like Check Point, should privilege growth above WACC over improvements to the value creation process. This idea is stated in a McKinsey article.

Historical CHKP Economic Profit (Seeking Alpha and Own Calculations)

Check Point Software has been great producing and also improving its value creation since 2019 by the way of less capital invested, while the operating profits have been mostly flat over the years. I believe this is the main reason for the stock underperforming its market despite delivering more returns to the shareholders than expected and required. I also noticed this to be a concern in the latest earnings report and I’m optimistic to see the results in the next few quarters.

Valuation

To have a price target range supported by calculations, I’ve used three scenarios: a base scenario with a growth rate slightly lower than historical per-share free cash flow growth, a more optimistic scenario where they can capitalize on the recent quarter boost, and by last, a more negative approach where its FCF per share decline even with the large buybacks that they are constantly providing.

DCF Scenarios (Own Calculations)

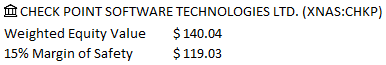

Final Value with MoS (Own Calculations)

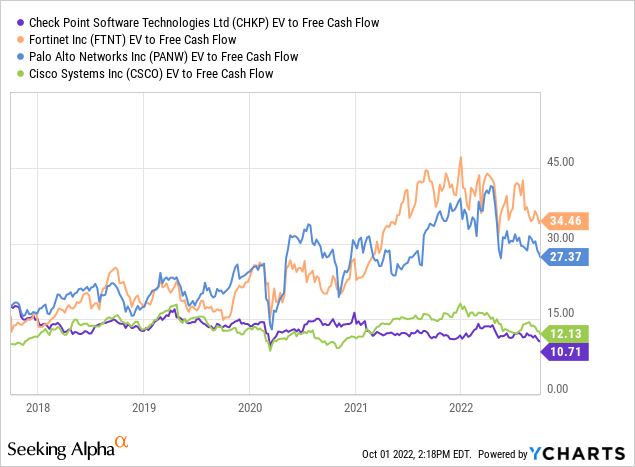

The results displayed are in line with what was expected. Because of its $3.7B cash position, they are trading at close to a 10x EV/FCF multiple which is a very interesting valuation considering the underlying business in question, even considering no growth. I believe the under $119 per share range to be an attractive entry point that adequately compensates inherent risks with a reasonable margin of safety.

Risks

Competitive Landscape – The first risk that comes to my mind when considering Check Point is the competition. Similarly to other fast-changing industries, like the pharmaceutical, software companies need to constantly improve and evolve to stay ahead of the pack. This is sometimes very hard and can result in a loss of market position.

Distribution – They are surprisingly highly dependent on distribution partners. The annual report states that 40% of their 2021 sales go through just two distributors. Being this dependent on external players might be a cause for concern if they decide to negotiate prices, go bankrupt or simply leave Check Point out of their portfolio.

Security Incident – There’s a possibility that a cyber security incident damages the reputation of Check Point to the point that it might affect future sales. Like the airlines, I tend to think that just one small (notorious) breach in security is enough to be fatal to the public’s perception of the company.

Loss of Competitive Position – As mentioned before, failure to innovate or to keep its network effect running might result in loss of market share and reduced profitability fast.

Conclusion

Check Point should be a buy even believing that the growth will remain equal to historical records. The double-digit growth, developed in the last quarter update, if maintained could be the “cherry on top” upside potential to provide additional returns. It’s my opinion that growth should be the priority to achieve at the moment, it should be the best way to increase value to the company even if it comes at some margin costs.

It appears to be a proven great business with stable competitive advantages that should remain that way. Management is trying to pivot the business to some high-growth areas with some recent successes. I enjoyed the “small family business vibe” from the earnings call and I think it’s great that the founder maintains a 20% stake.

Be the first to comment