Versace is the jewel of the portfolio and could help push Capri shares higher moving forward as margins expand and top line revenues continue to grow. Evgenia Tsvirko/iStock Editorial via Getty Images

European Luxury Sales Holding Up

We were a little taken aback last week as we saw LVMH Moet Hennessy Louis Vuitton (OTCPK:LVMHF) (OTCPK:LVMUY) report strong revenue numbers for Q1, despite a tough environment in Asia. As we were looking through the numbers to try and glean some data that would be applicable to names on our watchlists, we were a bit stunned at which geographies helped deliver the impressive results. For those who were not watching, the French luxury-goods house brought in revenues of $19.5 billion, which was up by 23% on an organic basis vs the consensus 17% which was expected by analysts. Organic revenue in the US grew by 26% and in Europe it grew by 45%, with Asia (excluding Japan) the disappointment as it only saw growth of 8%. It all sounds pretty boring, until you start to look at management’s comments and the trickle of news that came out after the release from competitors discussing their bullish views for the industry.

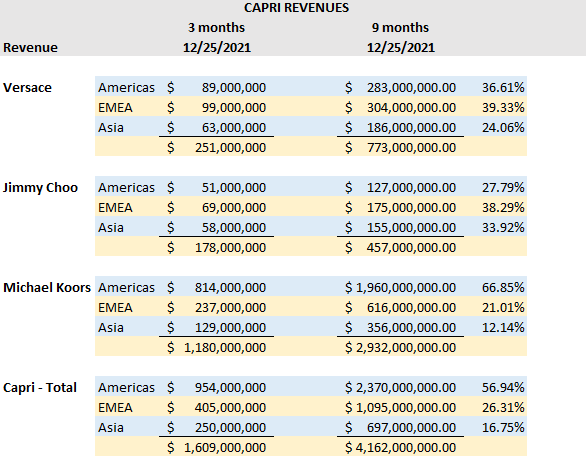

While we do follow LVMH, as anyone who follows names in this particular industry should, we were not so much interested in what LVMH had to say as it related to the company itself, but the insight it could provide for names with decent European exposure. So while we have previously written about how Tapestry, Inc. (TPR) is a name that we really like (article available here), we have to admit that we are warming up to Capri Holdings Limited (NYSE:CPRI), as their geographic sales footprint might provide some diversification away from Asia, while also providing additional exposure to all of the markets which are currently delivering outsized growth. Those other markets are specifically the Americas and Europe, and although we were initially worried about sales in Europe due to the Russian invasion of Ukraine, it seems that consumers have not been deterred from luxury purchases thus far. The lockdowns in China are affecting current demand, so while names like Tapestry should do well long-term with that growing market, others, such as Capri, might outperform in the near-term due to lower revenue exposure to the region.

With less than 17% of total sales coming from Asia, the Chinese lockdowns should have less of an impact on Capri compared to competitors. (Data compiled from Capri Holdings Financial Reports and Investor Presentations)

Also, Tapestry does not really compete at the higher end of the luxury spectrum, but Capri (due to its Versace brand) might find itself able to benefit from some of the moves being made by the European luxury houses; specifically, their ability to raise prices to offset inflationary pressures and strong performances of currencies against the euro. According to Bloomberg (see article here), Cartier will likely raise prices by 3%-5% while Chanel was much more aggressive and raised prices on certain handbags, “by more than 50%.”

Versace is on its way to being a $2 billion+ brand, and it is a true European fashion brand with the ability to join its peers in walking prices higher. That, coupled with Capri’s European revenues through the first nine months of this year (just over 26% of total revenues), could help the stock not only outperform in the next few quarters, but when paired with other names, like a Tapestry for instance, could help balance out a portfolio and diversify some of the geographic risk investors are facing right now.

Brand Premiumization

The purchase of Versace was a once-in-a-lifetime acquisition, and over the last few years has proven that this management team can operate with the “big boys” of European luxury brands. While Versace will become a $1 billion+ brand this year and is on its way to becoming a $2 billion+ brand in the near future, management has previously discussed how they have room to grow revenues significantly simply by matching the activity in their physical stores to those of their European competitors. Their current footprint could do up to 4x more business simply by matching that activity, and with the store refreshes that have been ongoing, it does appear that management is working on addressing this issue to continue to harvest the low-hanging fruit.

No one will argue Versace’s place among the premium luxury brands, but Capri’s other brands are much more approachable for consumers. Management is currently working on the premiumization of these brands, i.e., making them more luxurious and desirable for consumers. This is not something that is done overnight, or with one new product line, but is a process that takes time. Management believes that they are succeeding in their plans, as they are seeing higher AUR (average unit retail), having to discount less, and seeing strong demand for items featuring logos. While that is true across all of their brands, it is good to see, especially for the Michael Kors brand.

Operating margins remain strong at Michael Kors, and probably have a bit more room to expand in the next few years, but we think that investors should watch Versace margins, as they have ample room to expand from current levels. As Versace becomes a larger portion of the business, that margin expansion could become a bigger driver for EPS growth than revenue growth (depending on timing and the actual top-line growth, of course).

Capri’s Capital Allocation Strategy

We really appreciate companies who reward shareholders by returning excess cash to them rather than wasting it on acquisitions that do not make a lot of sense or showering executives with obscene pay packages. Capri does not currently pay a dividend, however, the company has been repurchasing shares under the new share repurchase program of $1 billion it announced last quarter (and has a history of buybacks). Since the announcement, Capri repurchased approximately 3.2 million shares for roughly $200 million. The Company’s share repurchase program has $800 million remaining as of February 2, 2022.

Management reiterated on the last conference call that they are really only interested in European luxury brands for M&A activity and right now there are not any available that interest them; so, expect Capri to continue to pay down debt and repurchase shares, as they are very bullish on their ability to grow the current business and believe that shares do not reflect their full value.

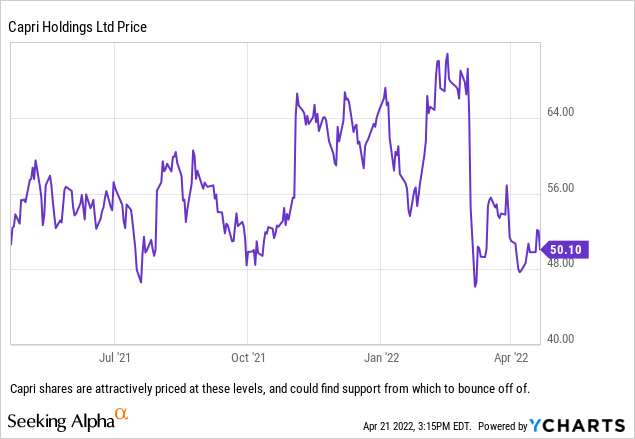

How We Would Trade This

We already own Tapestry shares and want to use Capri Holdings to gain more exposure to Europe and the ultra-luxury market, so we are buyers of shares here. We do believe that consumers are going to eventually shift from buying things to experiences, but continue to see value in some of these American fashion names which have repaired or built up their brands over the last few years.

While we are outright buyers of the name at current levels, we are also going to try to sell the CPRI April 29, 2022 Puts at a strike price of $50/share. The current bid/ask is $1.40/$1.75, so at the midpoint of $1.53 the 8-day option generates a 3.06% option premium (based off of the $5,000 of capital it is tying up) for us, or $123 per contract. We will sell one put contract for each 100 shares that we purchase, as we have a number of call options in Tapestry that we can pair with these puts. If Capri shares go down and the shares are put to us, then we can exercise some of our in-the-money calls that we have on Tapestry to further this trade.

Be the first to comment