Bruce Bennett

Elevator Pitch

My Buy rating for Verizon Communications Inc.’s (NYSE:VZ) shares remains unchanged.

VZ’s stock price rose by +13.8% since I published my earlier article for Verizon on October 14, 2022. During this period, the S&P 500 increased by +8.4%. In my previous mid-October 2022 write-up for Verizon, I outlined my expectations of VZ meeting market expectations with its Q3 2022 earnings at the very least, and I turned out to be right.

The focus of my current article is discussing whether there is further upside for Verizon’s shares. My analysis suggests that VZ’s stock price can potentially go up by another +19% to reach the $50 mark. Above-expectations wireless postpaid phone net additions will likely be the catalyst required to drive VZ’s stock price up, and the implied valuations based on a $50 target price are still quite reasonable. Therefore, I have left my Buy rating for Verizon unchanged.

Why Did Verizon’s Share Price Drop In 2022?

VZ’s shares have fallen significantly by -25% in the prior year.

It is important to understand what led to Verizon losing a quarter of its market value last year. This is because the key issue which was a drag on Verizon’s share price in 2022 might become a potential re-rating catalyst for 2023.

It is noteworthy that Verizon’s peers, AT&T (T) and T-Mobile US (TMUS) saw their respective stock prices increase by +27% and +22%, respectively in the previous year.

As such, it is reasonable to assume that Verizon’s stock has done so badly on an absolute and relative basis in 2022, because VZ’s 2022 operating performance wasn’t as good as that of its peers.

VZ Stock Key Metrics

The key metrics to focus on are Verizon’s wireless retail postpaid phone net additions in the first nine months of 2022.

VZ recorded modest wireless postpaid phone net additions of around +8,000 and +12,000 for Q3 2022 and Q2 2022, respectively as disclosed in its third quarter results presentation. The company even registered negative wireless postpaid net additions of -36,000 in the first quarter of the prior year.

Verizon’s 9M 2022 wireless retail postpaid phone net additions metrics were much worse than what the company had done in the past and also inferior to that of the company’s competitors.

Prior to the first quarter of 2022, Verizon had achieved reasonably decent positive wireless postpaid phone net additions amounting to +275,000, +429,000, and +558,000 for Q2 2021, Q3 2021, and Q4 2021, respectively.

The company’s peers reported stronger wireless postpaid phone net additions growth over the same period. The wireless postpaid phone net additions for T-Mobile and AT&T were approximately +2.17 million and +2.21 million, respectively for the first nine months of last year. As a comparison, VZ suffered from wireless postpaid phone net losses of roughly -16,000 in the same time period.

What Do Analysts Think?

My opinion is that Wall Street analysts are becoming incrementally more positive on Verizon.

The changes to VZ’s consensus fiscal 2022 and FY 2023 bottom line projections in the past one month have been insignificant. Specifically, Verizon’s consensus FY 2022 and FY 2023 normalized earnings per share or EPS have been reduced slightly by -0.1% and -0.4%, respectively in the last month. If the analysts had been pessimistic about Verizon’s prospects, they would have taken the opportunity to slash their financial forecasts for VZ before it releases Q4 2022 results and 2023 guidance towards the end of this month.

Also, the average sell-side analyst rating for Verizon increased from 3.24 as of August 30, 2022 to 3.38 as of January 15, 2023. With analyst ratings of 5 and 1 corresponding with Strong Buy and Strong Sell ratings, respectively, the increase in the mean sell-side rating for VZ sends a positive signal about the improved analyst sentiment for the stock.

What Are Recent Price Targets?

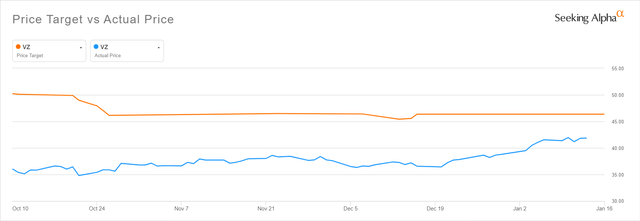

Since late last year, the consensus sell-side analyst price target for Verizon’s shares has gone up slightly from $46.14 as of October 26, 2022 to $46.35 now as per the chart presented below.

Changes To The Wall Street Analysts’ Target Prices For VZ In The Past Three Months

It is apparent that the majority of analysts take the view that the worst is over for VZ and that current valuations have already factored in headwinds for the company. This is reflected in the increase (albeit marginal) in the average sell-side target price for Verizon in the past couple of months.

Can Verizon Stock Recover To $50 In 2023?

I think that VZ’s share price can recover to $50 this year for two key reasons.

The first reason is that Verizon should report better than expected wireless retail postpaid phone net additions going forward.

Earlier on December 5, 2022, VZ revealed that the company’s CEO Hans Vestberg “has assumed responsibility for leading the Consumer Group in addition to his day-to-day responsibilities.” This shows that Verizon is very serious about improving the performance of the company’s Consumer segment, as the appointment of its group CEO to be in charge of the Consumer segment makes this business a key area of focus.

Separately, Verizon also disclosed at Citi’s (C) Communications, Media & Entertainment Conference on January 4, 2023 that it achieved positive consumer net additions in Q4 2022. As a reference, VZ’s +8,000 wireless retail postpaid phone net additions for Q3 2022 comprised of -189,000 consumer net losses being offset by +197,000 business net additions. As such, it is encouraging to know that Verizon has engineered a turnaround to generate positive consumer net additions in the fourth quarter of the prior year.

The second reason is that $50 is a reasonable price target for VZ.

Verizon’s shares were trading at above $50 as recent as mid-July 2022. A $50 target price for VZ will be equivalent to a consensus forward FY 2023 normalized P/E of 10.0 times and a consensus forward FY 2023 dividend yield of 5.3% as per S&P Capital IQ data. These don’t seem to be very demanding valuation metrics for defensive and stable telecommunications businesses.

Is VZ Stock A Buy, Sell, or Hold?

Verizon’s shares continue to be rated as a Buy. VZ’s stock has lagged behind its peers in 2022, but the expected improvement in its wireless retail postpaid phone net additions for this year could be a major re-rating catalyst.

Be the first to comment