BING-JHEN HONG/iStock Editorial via Getty Images

TSMC Stock Key Metrics

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), or TSMC, is my top semiconductor pick for 2022, as I said in my April 18, 2022 Seeking Alpha article entitled “TSMC: Top Foundry As Computing And Automotive Chip Demand Rises.” As a foundry, it makes semiconductor chips on a contract basis for other semiconductor companies. It doesn’t use the chips it makes for internal needs, unlike competitor Samsung Electronics (OTCPK:SSNLF), with numerous end products like smartphones, TVs, and washing machines.

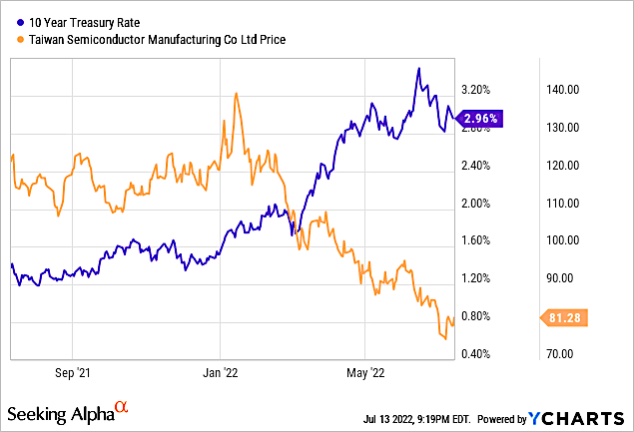

Over the past 1-year period, TSMC’s share performance has dropped 34% since reaching a high of $140.66 on January 14, 2022 that followed its excellent 4Q 2021 earnings call. The stock has retreated, closing at $81.29 on July 13, 2022.

Headwinds

ASML Sanctions Impacting TSMC in China

I discussed in a July 6, 2022 Seeking Alpha article entitled “ASML: Impact Of U.S. Government Attempt To Block DUV Lithography Systems To China,” that possible sanctions of DUV lithography equipment to China would also block these systems from being installed at TSMC’s China fabs.

TSMC is building production capacity for 28nm process technology at its 12-inch wafer fab in Nanjing, China, with the process capacity set to come online starting the second half of 2022. An additional 40,000 wafers designed for 28nm processes will be installed at TSMC’s Nanjing fab by the middle of 2023. This fab expansion will require DUV equipment, which won’t be delivered under sanctions.

Oversupply of Logic Semiconductors in 2023

On June 25, 2021 I published on Seeking Alpha an article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.”

Tied to my initial thesis from 2021, 15 fabs are foundry facilities with capacities ranging from 30,000 to 220,000 wafers per month. Only 4 are memory fabs with higher capacities ranging from 100,000 to 400,000 wafers per month.

My analysis calls for two consecutive years of a downturn in 2023 and 2024, in which WFE equipment will exhibit a double digit YoY drop in 2023 and a low single digit drop in 2024.

The overbuild of foundry fabs will result in an oversupply of logic chips from Foundries, including TSMC. The dour and uncertain economy is adding memory chips to the mix primarily as a result of a slowdown of consumer products like PCs and smartphones.

Reduced demand for consumer products will also have a follow-on impact on foundry chips. My original thesis was that the oversupply of these chips would result in lowered ASPs. Now we add reduced demand, further exacerbating the problem.

Kowtowing to China

The U.S. government has pressed TSMC to cancel the foundry expansion plan in Nanjing, China. Instead, it expanded its US CHIPS for America Act, which involved a $52 billion package that would increase US chip manufacturing and research over the next five years to include foreign companies TSMC and Samsung Electronics, aided by lobbying by industry consortia SEMI.

Fab 21 that TSMC plans on constructing in Arizona will be outputting chips at 5nm, 5nm Enhanced, and 4nm – which TSMC refers to as its N5, N5P and N4 processes.

The CHIPS Act is intended to shore up America’s flagging chip industry as a hedge against China’s accelerated development of its own semiconductor capabilities and shift global production away from China’s shores.

But TSMC still has several headwinds that need to be dealt with:

- CHIPS Act funding of the $52 million has moved more slowly than expected

- TSMC CEO Mark Liu said the fab would go ahead only if the government could pay the difference in fabs running costs difference between the United States and Taiwan.

- In mainland China, Chen Wenling, chief economist and deputy director of the Executive Board and Academic Committee at the China Center for International Economic Exchanges, said Beijing should “reclaim Taiwan” so the US could not take away TSMC’s technological know-how. Chen’s comments were widely circulated by Chinese websites.

In anticipation of the passage of the CHIPS act, Ming-Hsin Kung, minister of Taiwan’s National Development Council and a TSMC board member said in an interview in Washington:

“TSMC has already begun their construction in Arizona, basically because of trust. They believe the Chips Act will be passed by the Congress. But the speed of construction depends on the subsidies coming through.“

These issues appear to put the CHIPs act on the back burner, particularly after Intel (INTC) halted construction plans for its Ohio fab until money was funded. But according to my sources, it goes beyond that. Is the US Government considering reversing Trump-era tariffs on goods from China imported into the U.S. a Coincidence?

Tailwinds

Dominant Foundry

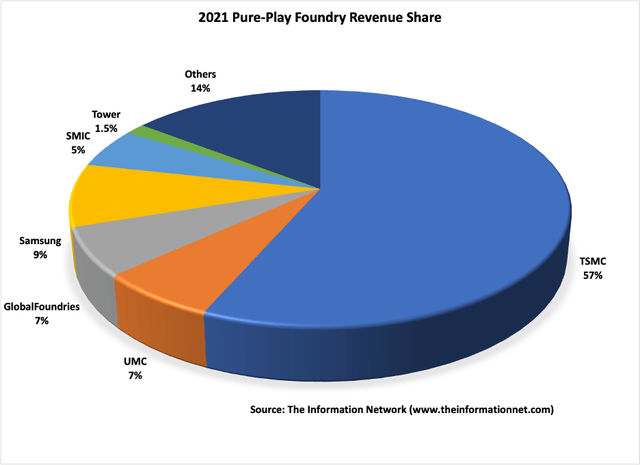

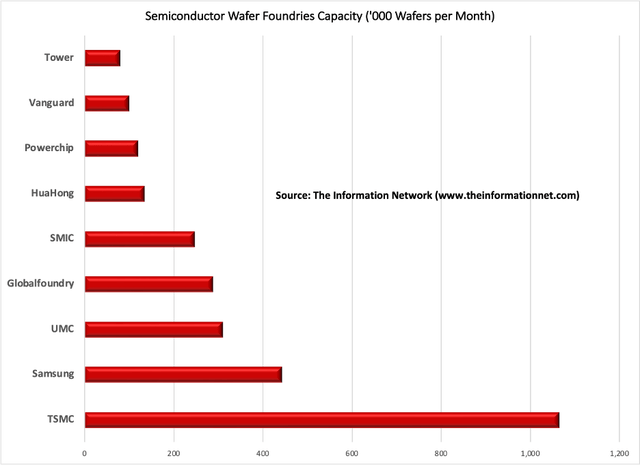

TSMC is the dominant foundry in the world, which held a 57% market share of a $100 billion industry in 2021, as show in Chart 1. Samsung Electronics is a distant second with a 9% share, along with UMC and GlobalFoundries, according to The Information Network’s report entitled “Hot ICs: A Market Analysis of Artificial Intelligence (“AI”), 5G, Automotive, and Memory Chips.”

Chart 1

Largest Capacity Among Foundries

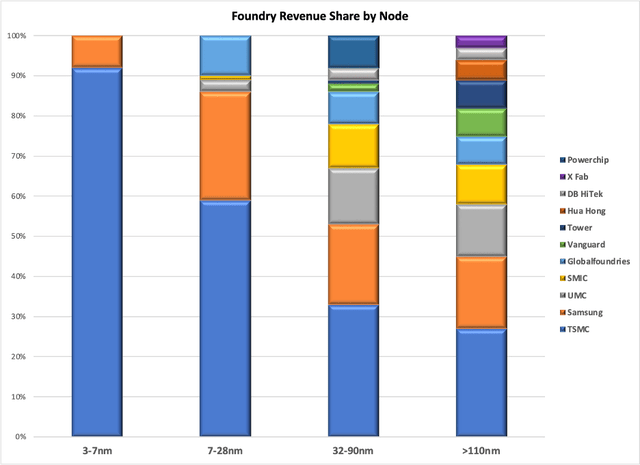

TSMC has the largest foundry capacity as shown in Chart 2 with more than one million 300mm wafers per month. Foundries, which are mainly based in Taiwan and South Korea, benefitted from strong demand from fabless chip designers such as AMD and MediaTek as the overall foundry utilization rate exceeded 95% in 2021.

Samsung Electronics, TSMC’s main competitor, will expand its foundry capacity in legacy nodes in 2022. The move is aimed at securing new customers and boosting profitability by increasing the production capacity of mature processes for such items as CMOS image sensors, which are in growing demand due to a prolonged shortage. In October 2021, the company announced that it will increase production efficiency by applying a new fin field-effect transistor (FinFET)-based 17-nm process to the production of image sensors and mobile display driving ICs that have been produced on existing 28-nm processes of a flat structure.

Chart 2

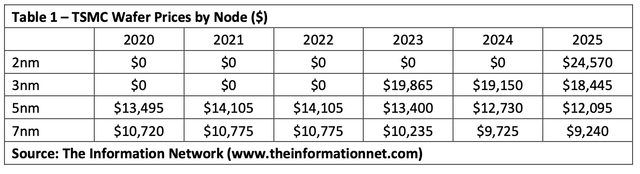

Chart 3 shows revenue by node for the top pure-play foundries. We can see that in the 3-7nm node range, there are only two foundries making chips, and TSMC has more than a 90% share of revenues. Likewise, TSMC also has a dominant position in the 7-28nm node range.

Chart 3

Table 1 shows estimates of TSMC’s ASP (average selling price) by node, according to The Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Share, Market Forecast.”

In 2021, ASP is $10,775 for 7nm wafers and $14,104 for 5nm wafers. In 2023 during full production, 3nm wafers will be priced at $19,865. I anticipate prices will decrease 5%/year following the start of full production.

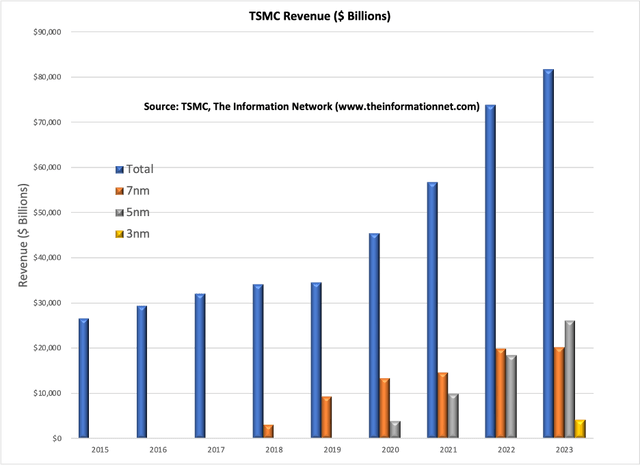

Chart 4 shows TSMC’s revenue by Node forecast to 2025 when its 3nm node chips will be in production (yellow bar). The Total Revenue (blue bar) increases dramatically starting in 2020 with the introduction of high ASP low node chips.

Chart 4

Investor Takeaway

Much of the press is covering the TSMC and Samsung competition at the <5nm node, in light of Samsung’s vision to rank first in system semiconductors by 2030. But the large gap in technology node production and revenues will be insurmountable for Samsung to overcome in the coming decade. That’s because TSMC continues to push the envelope to keep ahead of Samsung’s advancements.

TSMC started mass-producing 5-nm products in 2021. It is building a 3-nm facility in Taiwan with the goal of entering mass-production in 2022. It is also conducting research and development on a 2-nm process.

Although Samsung also started mass-producing 5-nm products in 2021, industry analysts say that Samsung’s yield is too low to be seen as a success in volume production. That is the reason for rumors that Qualcomm (QCOM) has decided to have TSMC manufacture all of its next-generation 3nm processors instead of Samsung. And low yield is attributed to these rumors around a percentage of QCOMs 4nm chipset, the Snapdragon 8 Gen 1 found in the Galaxy S22 series, even though Samsung Foundry was previously selected as the only manufacturer of this chip.

Why Has TSM Stock Been Dropping

According to my analysis, the drop in TSMC’s share price is largely due to macroeconomic factors and not due to any technological or financial headwinds. The drop, as noted in Chart 5, shows the inverse correlation of technology stocks, including TSMC, and the 10-year Treasury Rate. since January 2022 the rise in the 10-year due to inflation fears has significantly impacted technology stocks and TSMC, although analysts at Morningstar found minimal correlation between the 10-year treasury and technology stocks over a 15 year period.

YCharts

Chart 5

Can Taiwan Semiconductor Stock Reach $100 Again?

Clearly TSMC can reach $100 again, but macro factors, primarily inflation, and uncertainty of what the Fed will do next demands close scrutiny of economic conditions on the part of investors. Despite TSMC’s technology prowess, its share price is down nearly 37% YTD, when the 10-year rates started rising.

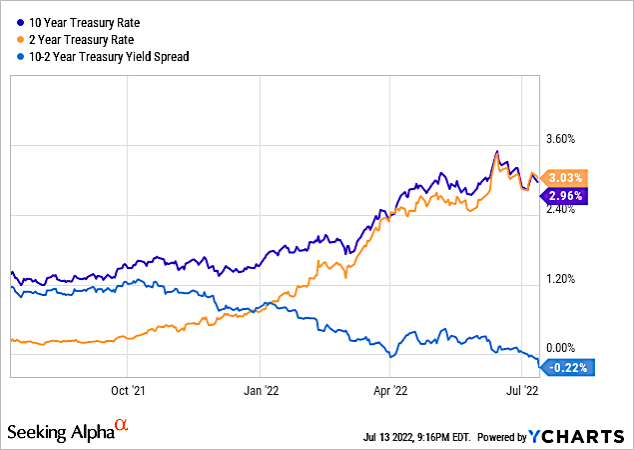

Now economists are looking at the yield curve. The yield curve is often viewed as a leading indicator of recessions and its ability to anticipate economic downturns. Thus, an inverted yield curve has been viewed as an indicator of a pending economic recession. When short-term interest rates exceed long-term rates, market sentiment suggests that the long-term outlook is poor.

Yields on two-year Treasuries briefly rose above those of 10-year Treasuries for the third time this year as shown in Chart 6, a phenomenon known as a yield curve inversion that has in the past preceded U.S. recessions. The two- to 10-year segment of the yield curve inverted in late March for the first time since 2019, again in June, and again on July 5. According to a 2018 report by researchers at the San Francisco Fed, the U.S. curve has inverted before each recession since 1955, with a recession following between six and 24 months.

YCharts

Chart 6

Is Taiwan Semiconductor A Good Long-Term Investment?

In parallel with the macroeconomic malaise underway, my thorough analysis of the semiconductor and semiconductor equipment market points to an oversupply of foundry chips brought on by excess fab construction and equipment purchases. I discussed this thesis in a June 24, 2021 Seeking Alpha article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.”

In addition, I updated my analysis in a July 11, 2022 Seeking Alpha article entitled “Assessing My 2021 Call For A Likely Semiconductor Equipment Meltdown In 2023 Impacting Applied Materials.”

I’m calling for an oversupply of foundry chips lasting in 2023 and 2024, which would result in a drop in ASPs. But despite that TSMC is clearly a good long term investment.

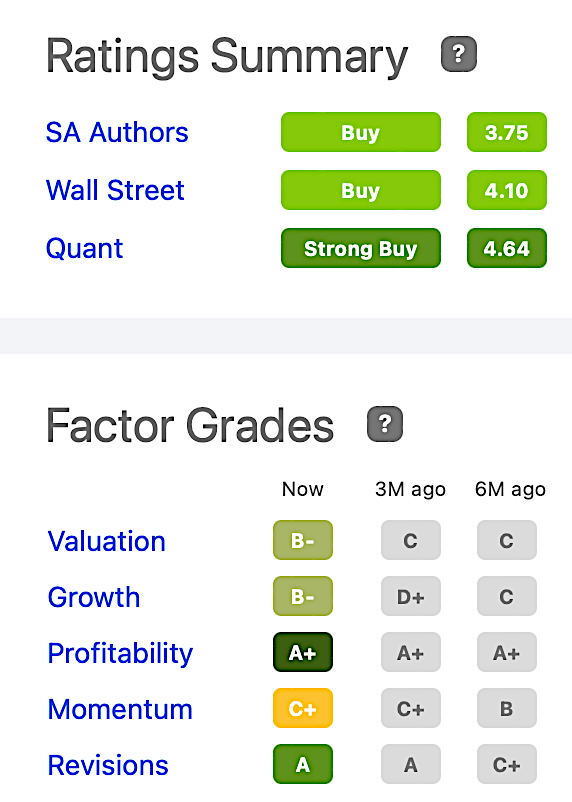

Is TSM Stock A Buy, Sell, or Hold?

TSMC has a strong rating summary as shown in Chart 7, with a Quant rating of 4.64. Seeking Alpha’s Factor Grades show improvement in the past 3 months in Valuation and Growth, but most importantly an A+ in Profitability.

Seeking Alpha

Chart 7

With so much macro uncertainty I’m forced to call the stock a Hold, as since the beginning of 2022, this has been an overbearing stain on the market, particularly technology stocks. TSMC has had a strong earnings call, share gains on advanced nodes, customer gain including Qualcomm, and node migration to much higher ASPs, and yet the share price is down nearly 37% YTD.

Be the first to comment