alvarez/E+ via Getty Images

Although Cal-Maine (NASDAQ:CALM) is a leading player in the highly consolidated domestic egg production and distribution industry, my analysis indicates the stock is overvalued and is highly dependent on the current outbreak of Highly Pathogenic Avian Influenza (HPAI) to continue and artificially support egg prices. I would recommend investors take advantage of this windfall move in egg prices and reduce their holdings of Cal-Maine.

Why Focus On The Egg Industry?

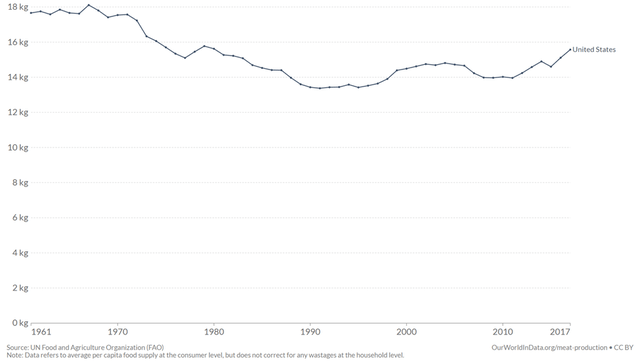

Eggs are one of the most nutritious and versatile cooking ingredients in the world. Cholesterol fears in the 1980s and ’90s caused egg consumption to fall precipitously, but per-capita consumption has steadily recovered from 13.5 kg in the 1990s to 15.5 kg in 2017 as more medical research have eased consumer fears toward eggs (Figure 1).

Figure 1 – US per capita consumption of eggs recovering (ourworldindata.org)

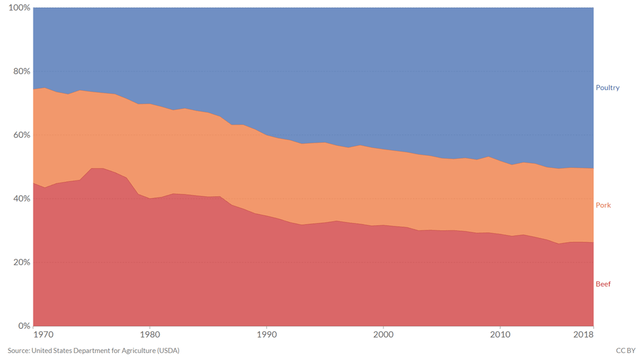

This rebound in egg consumption coincides with new medical research that shows the unhealthy characteristics of red meat such as beef and pork, causing consumers to shift their protein diet away from red meats (Figure 2 ).

Figure 2 – Poultry increasing consumption vs. pork and beef. (ourworldindata.org)

With galloping food prices being top of mind for most consumers, I have decided to take a deeper dive to see if there are any investment opportunities in the food and agriculture space, particularly with respect to eggs production.

Cal-Maine Overview

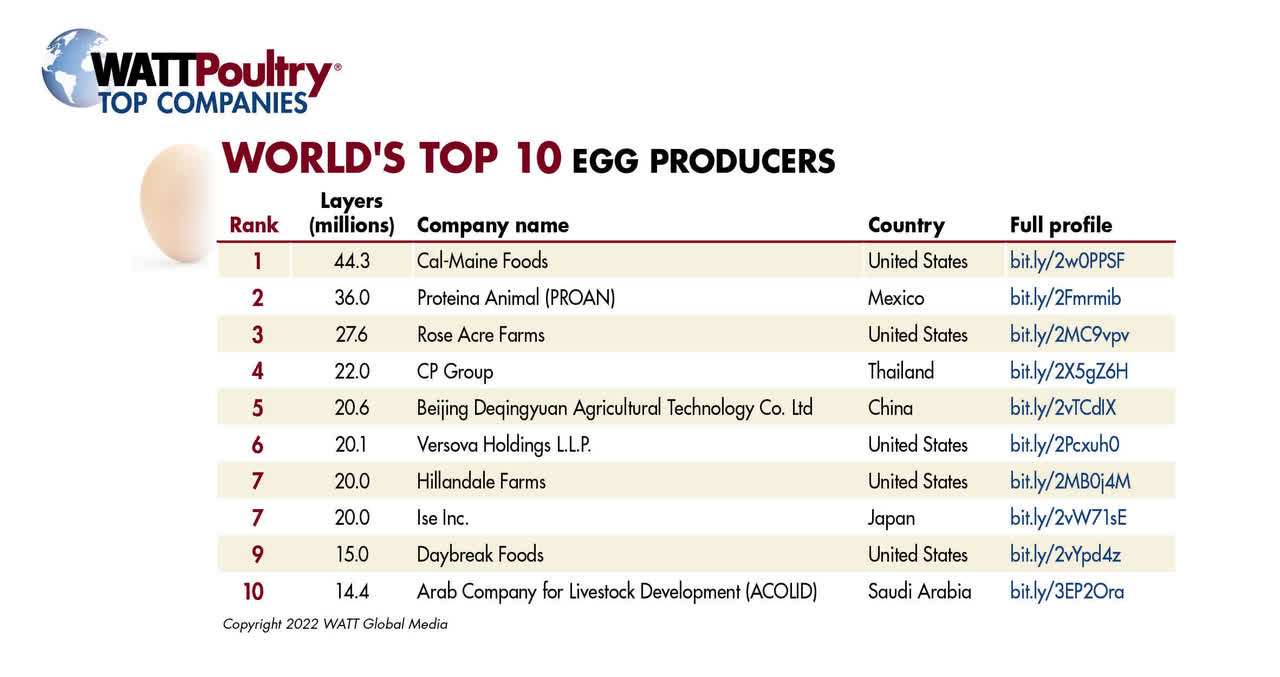

Cal-Maine is the No. 1 shell egg producer and distributor in the US and the world (Figure 3), with a dominant 19% market share in the US. It has almost 60% more capacity (as measured by egg laying hens) than the next largest US competitor, Rose Acre Farms. Combined, the top 5 domestic producers control more than 50% of the US market, which should argue for oligopolistic pricing and profitability.

Figure 3 – Cal-Maine is the largest egg producer in the world (WATT Global Media)

Cal-Maine was founded in 1957 by the late Fred R. Adams, Jr. and is headquartered in Ridgeland, Mississippi. The company has over 60 years of operating history and over the decades, have consolidated 22 acquisitions to become the #1 player in the domestic egg industry.

Cal-Maine Operations

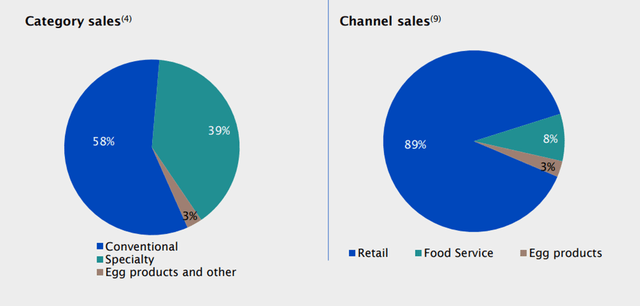

CALM produces both conventional eggs and specialty eggs (think Omega-3, organic, etc.) and primarily serves the retail channels. While specialty eggs contribute only 30% by volume, they amount to 40% of revenues due to their higher selling prices.

Figure 4 – category sales and channel sales (Cal-Maine Foods)

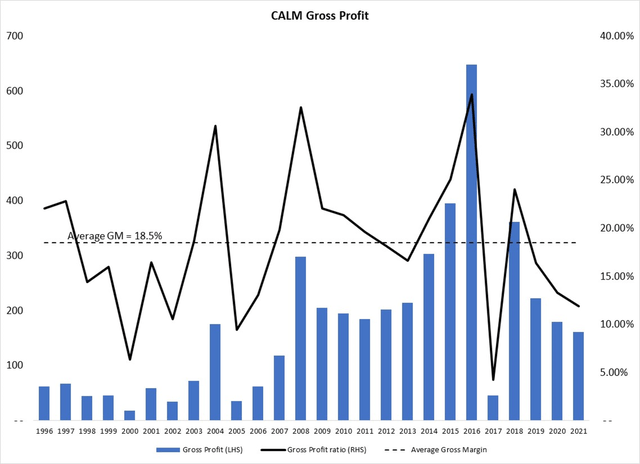

When looking at a commodity business, I tend to focus on gross margins instead of top-line revenue, as revenues are driven by commodity prices and are outside of management’s control. On the other hand, management’s ability to manage volatile commodity prices will show up in gross profit and gross margin. Figure 5 details Cal-Maine’s gross margins since 1996. What stands out is that CALM’s gross margin is very volatile, with many lean years interspersed with some windfall years such as 2004, 2008, and 2015/16. What is going on?

Figure 5 – CALM Gross Profits and Margins (roic.ai, macrotipstrading)

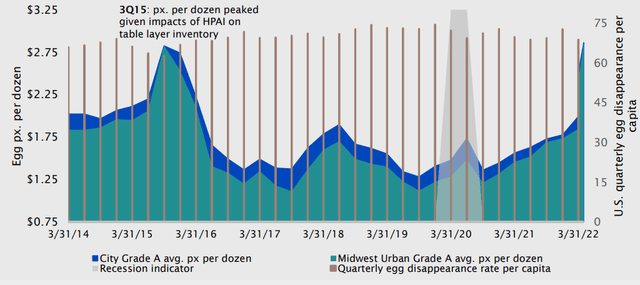

Egg Prices Driven By HPAI

The windfall margin years are the years where there was an outbreak of Highly Pathogenic Avian Influenza (HPAI) in the United States. The last outbreak in 2015/16 was also the one of the most severe, causing egg prices to spike to close to $3 a dozen (Figure 6). Currently, we are in the midst of an HPAI outbreak in the United States, and is the primary reason Cal-Maine reported stellar Q1 results and the stock price almost doubling to $60/sh in April before retreating to trade around $48 currently.

Figure 6 – Egg prices spike on HPAI (Cal-Maine)

Is CALM Profitable?

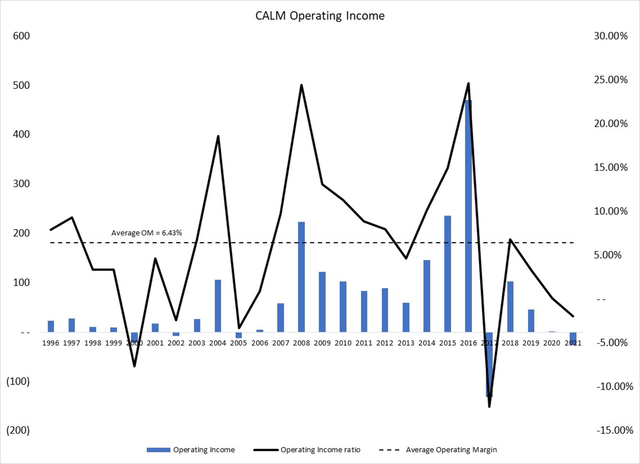

With the understanding that gross profit is highly volatile, another key metric to analyze is operating income, i.e. whether CALM stays profitable despite volatile gross profits. CALM’s average operating margin is a respectable 6.4%, although as can be seen in Figure 7, this series is highly skewed by the HPAI impacts.

Figure 7 – CALM operating margin (roic.ai, macrotipstrading)

Normalized Financials

Having established that CALM produces an average operating margin of 6.4%, let us now try to value the business to see if the current stock valuations are justified.

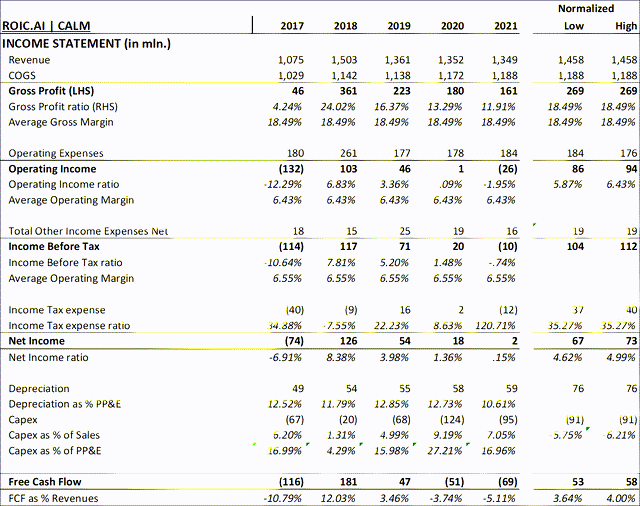

First, I want to value the core business through a cycle, so I will try to normalize the earnings by using the most recent gross margin and adjusting revenues such that an 18.5% gross margin is achieved. The reason I normalize revenues instead of COGS to achieve the desired GM% is because revenues (egg prices) are external and could be artificially depressed due to market factors.

Next, I will estimate the normalized operating income. Using 2021 operating expenses as normalized operating expenses will derive normalized operating income of $84 million. On the other hand, assuming CALM achieves normalized 6.4% operating margin will derive normalized operating income of $94 million.

Cal-Maine also earns dividends from its membership in Eggland’s Best Inc., a specialty egg cooperative. In 2021, this amounted to $16 million and has averaged $19 million over the past 5 years. so in the absence of more information, we will assume $19 million in other income in our model.

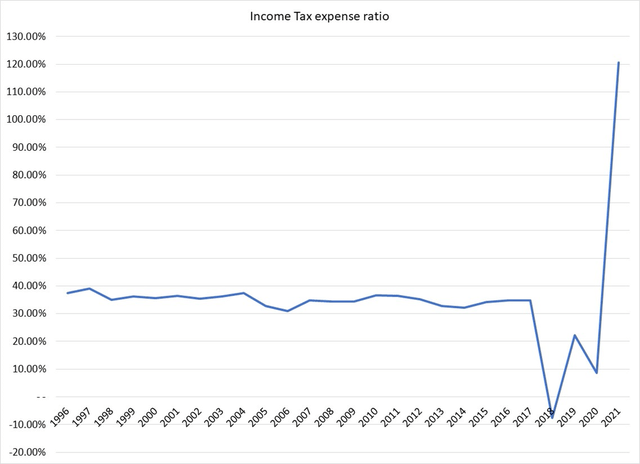

Putting this together and applying a normalized tax rate of 35% generates normalized NOPAT of $67 to $73 million. The normalized income tax rate of 35% appears high relative to the federal statutory rate of 21%. The company explains the difference between the federal statutory rate and its effective rate as due to state taxes, federal tax credits, and differences between financial reporting income or loss and taxable income. What is interesting is in the years before 2017, the income tax rate was stable in the mid 30% range, however, since 2018, the income tax rate has varied dramatically from -7.5% to 121%. In the absence of more information, I am conservatively using a 35% normalized tax rate in my valuation model. This rate can be adjusted in the future with additional information.

Figure 8 – CALM Income tax rate (roic.ai, macrotipstrading)

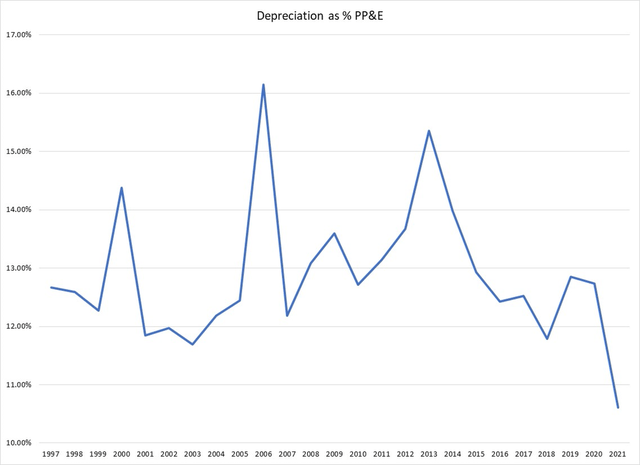

Next, we need to figure out normalized non-cash expenses and capital expenditures to figure out normalized free-cashflow. Going through the 25 years of financial data available on Cal-Maine, CALM appears to charge 12-13% of net PP&E as depreciation. This makes sense as it implies a useful life of 7-9 years for PP&E, which are principally farming equipment and structures. Hence, I will assume normalized depreciation of $76 million or 13% of net PP&E.

Figure 9 – CALM Depreciation as % of PP&E (roic.ai, macrotipstrading)

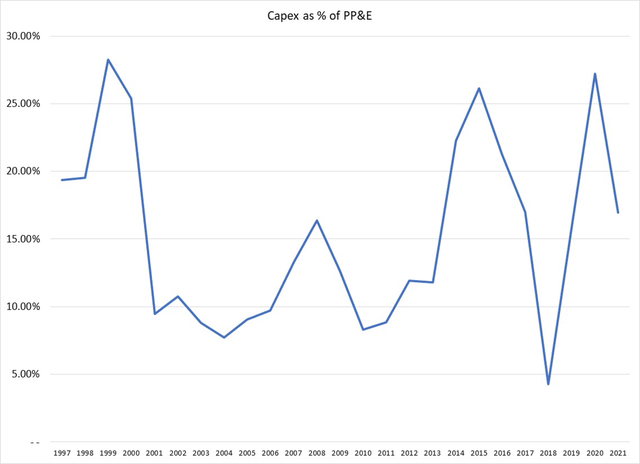

Capital expenditures is the final piece of the puzzle to our valuation model. Historically, capex has ranged from 5% to 25% of net PP&E, with an average of 15.3%. This also makes intuitive since, as we have established that the farming equipment has a useful life of 7-9 years, and will need to be replaced. The 2% gap between capex and depreciation accounts for normal inflation in replacement cost of plant and equipment.

Figure 10 – CALM capex as % of PP&E (roic.ai, macrotipstrading)

Figure 11 summarizes our financial model with normalized free cashflows of $53-58 million, depending on the assumption used for operating margin.

Figure 11 – CALM normalized financials (roic.ai, macrotipstrading)

DCF Valuation

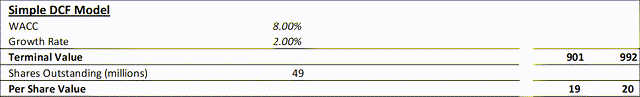

As the company has no long-term debt, its weighted average cost of capital is its equity cost of capital. Since CALM has been operating for over 60 years with no debt and stable businesses, I estimate its cost of equity to be 8%. Applying a 2% growth rate to be consistent with normal GDP growth, I arrive at a normalized per-share value of $19 to 20. A 1% change in the terminal growth rate or equity cost of capital adds $3 in value, all else being equal.

Figure 12 – Simple DCF model for CALM. (macrotipstrading)

With the stock trading over $40 recently, does this mean CALM is grossly overvalued and is a great short opportunity? Not necessarily.

HPAI Optionality

As I mentioned above when we analyzed CALM’s gross margins, egg prices are highly volatile and can produce windfall profits if an outbreak of HPAI occurs. We are currently in such an outbreak and hence the normalized valuation above needs to be supplemented with an analysis of the optionality of this HPAI outbreak lasting for longer than a few months.

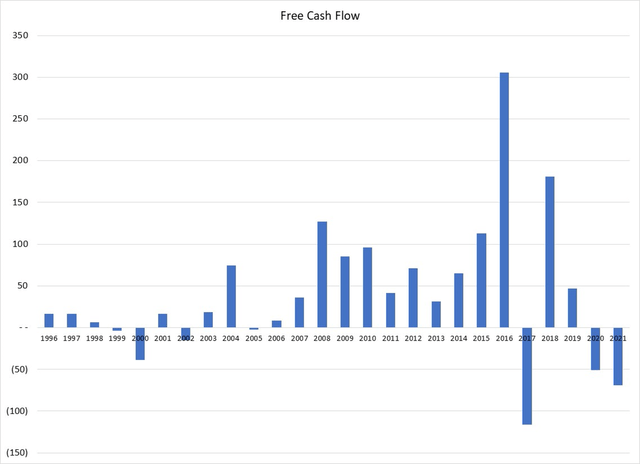

Looking at CALM’s free cash flow over the years, we notice that in the years 2015 and 2016, the last time the US experienced an outbreak of HPAI, CALM generated excess FCF of approximately $300 million or $6 per share.

Figure 13 – CALM FCF Profile (roic.ai, macrotipstrading)

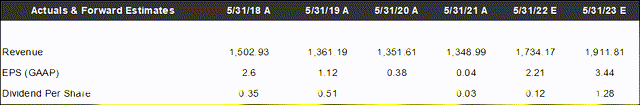

This windfall potential is confirmed by the latest quarterly results, where Cal-Maine earned net income of $39.5 million or $0.81 per share vs. $13.5 million and $0.28 per share in the same period last year. In fact, Wall-street analysts on average expect Cal-Maine to earn $2.21 / share for fiscal 2022 and $3.44 / share for fiscal 2023 from the HPAI induced egg prices and pay $1.40 in special dividends (Figure 14).

Figure 14 – Wall street estimates bullish for CALM. (TIKR)

So we must temper our bearish fundamental view of CALM’s valuation with the unpredictable nature of the HPAI outbreak.

Key Risks To Cal-Maine

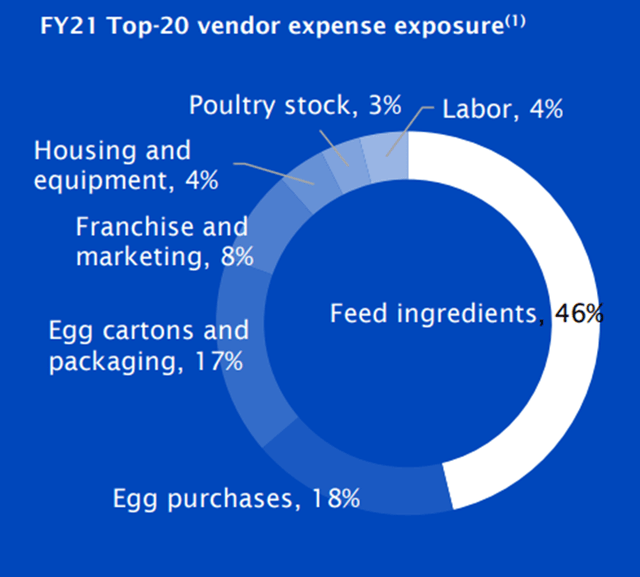

Aside from the risk of the HPAI outbreak subsiding and egg prices collapsing, another key risk has to do with CALM’s costs. Specifically, spikes to grain prices due to the Russian/Ukraine war could have a detrimental impact to Cal-Maine’s results, as 46% of costs are feed ingredients (Figure 15).

Figure 15 – Cost breakdown for CALM (Cal-Maine Foods)

In fact, Cal-Maine provides some sensitivity analysis on its feed costs (Figure 16). A $0.28 / bushel increase in corn (roughly 3.5% increase) increases per dozen egg feed costs by a penny (1.8%). A $25.50 / ton increase in soybean meal cost (1.5% increase) also increase feed costs by a penny. Since the end of February, corn prices have increased by ~$1.30 / bushel while soybean mean prices had increased by over $100 / ton, so potentially, feed costs could be 15-20% higher than last quarter.

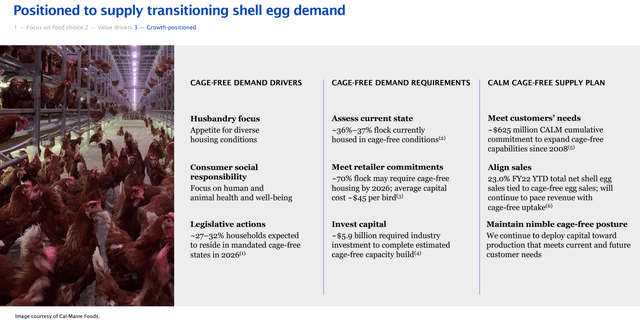

Another key risk is that capital expenses could be much higher than we have envisioned in our valuation model. Recently, Cal-Maine announced a large $82 million capital project to expand cage-free egg production. This does not appear to be a one-time expense, as Cal-Maine’s investor presentations highlight ongoing transition cage-free egg production driven by customer demands and legislative actions. The worry is that this could accelerate capex far above the 15% of net PP&E that we had modeled previously.

Figure 16 – CALM presentation shows cage-free is the trend. (Cal-Maine)

Technical Analysis

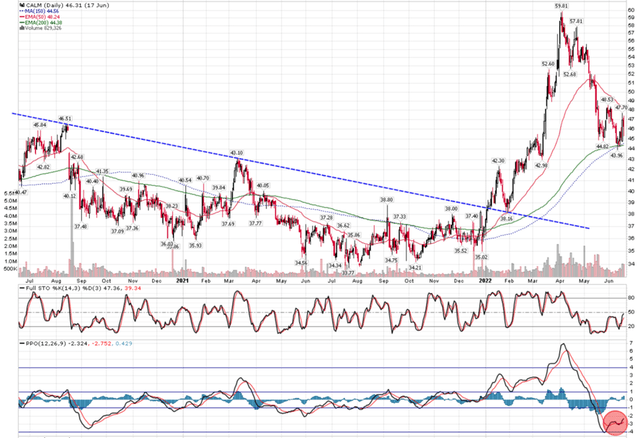

Coinciding with the current wave of HPAI in the US and corresponding spike in egg prices, we saw Cal-Maine stock price break out of a multi-year downtrend in early January before ultimately running to almost $60 / share. It has since come back to test the 150 day moving average support at $44, and has a mechanical buy signal from MACD.

Figure 17 – CALM benefited greatly from egg prices; MACD recently turned bullish again. (stockcharts.com)

Short-term traders may want to capitalize on the short-term HPAI-induced stock momentum as earnings are set to stay elevated in the coming quarters. However, long-term investors are recommended to use this opportunity to lock in windfall profits.

Conclusion

Cal-Maine is a leading egg producer in the US. It enjoys an oligopolistic position in the egg industry, however, its financial results are highly volatile and is dependent on commodity egg prices.

Recently, CALM’s business and stock momentum has benefited greatly from the latest outbreak of HPAI. However, my fundamental analysis of the business shows that the stock is worth approximately $20 per share on a normalized basis. At its current price of over $45, I believe it is overvalued, driven largely by short-term momentum traders capitalizing on the HPAI earnings potential.

If investors currently hold the stock, I would recommend using the current rally to reduce holdings and lock in the HPAI windfall.

Be the first to comment