nespix/iStock via Getty Images

It’s been about 5 months since I wrote my bullish article on MSC Industrial Direct Co. (NYSE:MSM), and in that time, the shares have returned a loss of ~9.2% against a loss of 17% for the S&P 500. The company has since reported, so I thought I’d check in on the name again. Previously, I bought 50 shares and sold 5 September puts with a strike of $70, so it’s time to look at whether or not I should add to that position. As usual, I’ll make that determination by looking at the recent financial history here, and by looking at the stock as a thing distinct from the underlying business. I also need to comment on the puts described above because I love writing about my options trades.

Welcome to the thesis statement. It’s in this paragraph where I spare you the tedium of reading the entirety of my article, because reading 2,000 words is hard. Here goes. I like the combination of growth and valuation here, so I’ll be adding to my small position in the stock. While I can’t sell more puts on the name, I would recommend others who are just joining us do so if they can handle the risks associated with selling puts. The reason I continue to like this trade is because I think it represents a “win-win.” Either the shares don’t fall below the strike price, in which case the writer pockets a very nice premium, or the shares drop in price, and put seller will be “forced” to buy this stock at a price ~7.5% lower than the current, already attractive level. Those are my thoughts in a nutshell, and I offer them for people who missed the title, bullet points, opened this article, yet somehow don’t want to read it. I don’t know how large this “thesis statement paragraph appreciating audience” is, but I’ll keep soldiering on, because as long as there’s one of you who like the thesis statements, I’ll keep doing them.

Financial Snapshot

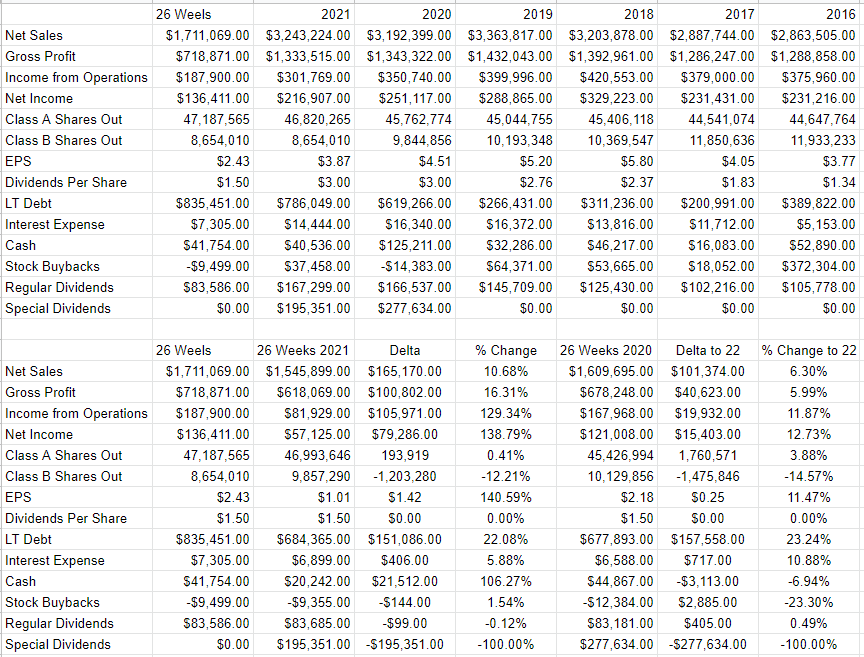

I think the financial history during the first 26 weeks was quite good relative to the same period a year ago in many ways. In particular, revenue, gross profit, and net income grew by 10.7%, 16.3%, and a whopping 139% respectively. Note that the net income grew in large part because impairment loss, and restructuring loss in 2021 impaired 2021’s net income fairly substantially. That said, net income in 2020 was just under 13% greater than the same period in 2020, so it wouldn’t be a stretch to call the most recent period fairly decent.

It’s not all licorice and jellybeans over at MSC Industrial Direct, though, as evidenced by the fact that long-term obligations have increased by $1501 million, or 22% relative to the same period a year ago. As might have been predicted, interest expense is up by just under 6% from the same period a year ago. At the same time, though, cash has increased by $21.5 million, or 106% relative to the same period a year ago.

So, I consider the performance to be reasonably good this year relative to last, and I remain of the view that the dividend is well covered. I’m still of the view that the dividend won’t likely be increased, and if you want more detail about why I think that, feel free to check out my earlier work. That said, I’m indifferent to the fact that the dividend likely won’t be increased, given how high the yield currently is. All in, I’d be comfortable adding to my small position here at the right price.

MSC Industrial Direct Co. Inc. Financials (MSC Industrial Direct Co. investor relations)

The Stock

Those who follow my stuff regularly for reasons known only to them know that I consider the stock and the business to be distinct things. I’ve made this point so often that I’ve likely veered into “tedium” territory. That doesn’t mean that I’m not willing to be tedious again, though, so here goes. A business is different from the stock that supposedly represents it. A business buys a number of inputs, including labour, performs value adding activities to those, and sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. The crowd changes its views very frequently which is what drives the share price up and down. The crowd may also drive a stock up or down based on results of a different company in the same industry. For people interested in challenging this idea or learning more about it, I would research the concept of “Mr. Market.”

In my experience, the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

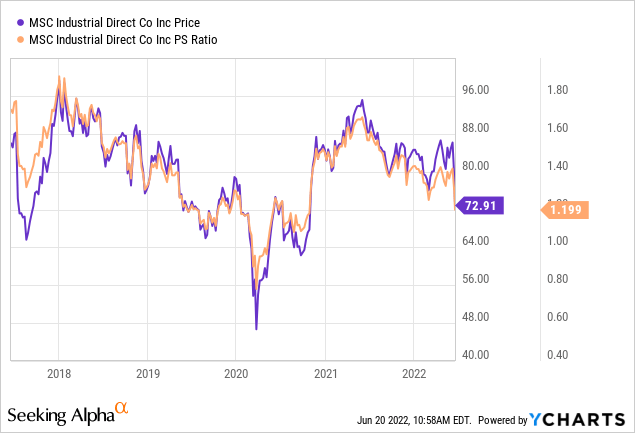

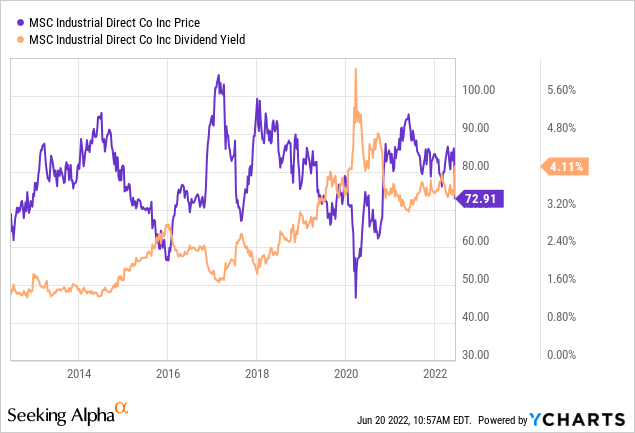

Anyway, as my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. This is why I like to see a company trading at a discount to both its own history and the overall market. In my previous missive on this name, I suggested that the shares were neither cheap nor were they expensive, but I did acknowledge that investors were getting more for their money with the nice dividend yield. Specifically, price to sales was hovering around 1.4 times, which is about average for the firm, but I was attracted by the dividend yield, which had jumped to 3.7%.

The dividend yield is now 10% higher, as you’d expect, and the price to sales ratio has declined by 12%. More interesting still is the fact that the valuation is cheap by historical standard, and the dividend yield is much higher than usual. This has me intrigued.

Given the above, I’ll buy another 150 shares at current prices. Assuming things remain constant between now and September, and my puts expire, I’ll likely buy more shares then. Speaking of my puts…

Options Update

In my previous missive on this name, I pointed out that most of my bullishness here was expressed by the fact that I sold 5 September puts with a strike price of $70 for $3.20 each. I considered this to be a decent return, and considered the trade to be one of my “win-win” trades. Either the shares remain above $70 over the next few months, in which case I’ll pocket the premium, or the shares fall in price, in which case I’ll be obliged to buy at a net price of $66.80. Holding all else constant, that price represents a dividend yield of just under 4.5%, which I consider to be very attractive. Hence, “win-win.” In spite of the fact that the shares have declined fairly dramatically in price, these puts are now priced at only $2.50-3.50, so I think my short puts have worked out reasonably well.

While I’m not in a position to sell more of these, if you’re just joining us I think you could do worse than selling these puts for $2.50 each. Either the shares will remain above $70 for the next three months, in which case you’ll pocket a 3.5% cash yield ($2.50/$70). If the shares fall, you’ll be obliged to buy at $$67.50, which lines up with a very nice 4.4% dividend yield. This is why I consider such trades to be “win-win.”

We now come to one of my favourite portions of the article, namely the section where I get to write about the risk of put options. This is one of my favourite sections because I get to indulge in my semi-sadistic tendency to spoil people’s moods by pointing out that the phrase “win-win” is really just a bit of rhetoric. This trade, like all others, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional, and you should be aware of these before you sell these or any other puts.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. So, don’t go selling puts just because the premia is high. Trust me on this one, because I used to sell puts based only on the high premium, and let’s just say that the results were awful.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that MSC stock price climbs massively to, say, $100 per share between now and the third Friday of September. Obviously, my puts will expire worthless, which is a great outcome in some ways, and my small stock position will do well, but I won’t catch as much upside as those who only bought the stock. This is because short put returns are capped by the premium received. This is emotionally painful for some people more than others. You should try to work out whether you can handle this emotional risk, because I’ve seen some people absolutely “lose it” because they missed out on a price pop.

Secondly, it can be emotionally painful when the shares crash below your strike price. Whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. So, if you’re considering selling puts, think deeply on this question of how you’ll handle it if the shares fall in price below your strike.

If you understand these risks, and can tolerate them, I would recommend that you sell the MSC Industrial $70s. These offer either a 3.5% return over a few months or they allow you to buy this stock at a 7.5% discount to today’s already reasonable price. Reminding you of the “win-win” characteristics of these short puts might be a strange way to end a discussion of risk. If you’re only discovering now that I can be strange, you haven’t been paying attention.

Conclusion

I like the relationship between historically low valuation and the growing business, and for that reason I’ll be adding to my position. If I hadn’t yet sold puts on this name, I would be doing so this week. So, if you’re just joining us, and are comfortable selling puts, I would recommend selling those at the moment. I consider these to be “win-win” trades. The shares may drop in price from here, but buying at $70 represents good value in my estimation. I think an underlying assumption of this whole Seeking Alpha enterprise is the idea that “price” and “value” can be quite different. In my view, the price is below value here, and so I recommend either picking up some shares and/or selling the puts described here before “price” rises to match “value.”

Be the first to comment