Yuliia Zatula/iStock via Getty Images

A Quick Take On Brera Holdings Plc

Brera Holdings Plc (BREA) has filed to raise $7.5 million in an IPO of its Class B shares, according to an F-1 registration statement.

The firm seeks to acquire and operate football (soccer) teams and related tournaments in Europe.

Given BREA’s unproven business model, ultra-high-risk stage of development and excessive valuation expectations, my outlook for the IPO is on Hold.

Brera Overview

Dublin, Ireland-based Brera Holdings Plc was founded to focus on ‘expanding social impact football (soccer)’ by acquiring and developing emerging clubs in amateur sports.

Management is headed by Chief Executive Officer Sergio Carlo Scalpelli, who has been with the firm since October 2022 and was previously Chief of Institutional and External Relations for Fastweb, a fiber optic connections company in Italy.

The company’s primary portfolio assets include:

-

Brera FC – Italy

-

FENIX Trophy tournament

As of June 30, 2022, Brera has booked fair market value investment of $39,000 as of June 30, 2022, from investors.

Brera – Visitor Acquisition

The company advertises locally and through word of mouth.

Management is also developing its Global Football Group concept as a way to hold future local football clubs it plans to acquire in other global regions.

General & Administrative expenses as a percentage of total revenue have increased sharply as revenues have decreased, as the figures below indicate:

|

General & Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

168.9% |

|

2021 |

7.1% |

|

2020 |

7.0% |

(Source – SEC)

The General & Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General & Administrative spend, swung to negative (0.1x) in the most recent reporting period, as shown in the table below:

|

General & Administrative |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

-0.1 |

|

2021 |

6.8 |

(Source – SEC)

Brera’s Market & Competition

According to a 2022 market research report by Inside World Football, the European football (soccer) market was an estimated EUR27.6 billion by the end of 2021.

The Big 5 leagues accounted for an estimated EUR15.6 billion of the total.

Also, the sport has seen a drop in event activity during the primary COVID-19 period of 2020 – 2021 but is being ‘buoyed’ by a recovery during 2022.

Major competitive or other industry participants include:

other businesses seeking corporate sponsorships and commercial partners such as sports teams, other entertainment events and television and digital media outlets;

providers of sports apparel and equipment seeking retail, merchandising, apparel and product licensing opportunities;

digital content providers seeking consumer attention and leisure time, advertiser income and consumer e-commerce activity; and

other types of television programming seeking access to broadcasters and advertiser income.

(Source: Inside World Football)

Brera Holdings Plc Financial Performance

The company’s recent financial results can be summarized as follows:

-

Decreasing topline revenue

-

Reduced gross profit but increased gross margin

-

Increased operating losses

-

Higher cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 130,206 |

-12.8% |

|

2021 |

$ 415,965 |

95.6% |

|

2020 |

$ 212,608 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 100,736 |

-12.5% |

|

2021 |

$ 306,483 |

120.8% |

|

2020 |

$ 138,808 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

77.37% |

|

|

2021 |

73.68% |

|

|

2020 |

65.29% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$ (89,717) |

-68.9% |

|

2021 |

$ (7,019) |

-1.7% |

|

2020 |

$ (9,907) |

-4.7% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ (94,877) |

-72.9% |

|

2021 |

$ (86,185) |

-66.2% |

|

2020 |

$ 2,483 |

1.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ 34,657 |

|

|

2021 |

$ 26,581 |

|

|

2020 |

$ 28,616 |

|

(Source – SEC)

As of June 30, 2022, Brera had $18,973 in cash and $927,672 in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was $42,973.

Brera Holdings Plc IPO Details

Brera intends to raise $7.5 million in gross proceeds from an IPO of its Class B shares, offering 1.5 million shares.

Class B shareholders will receive one vote per share and Class A shareholders will receive 10 votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest to purchase shares at the IPO price. The company also registered up to 1.53 million shares for resale by existing shareholders.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $48.6 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 13.45%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

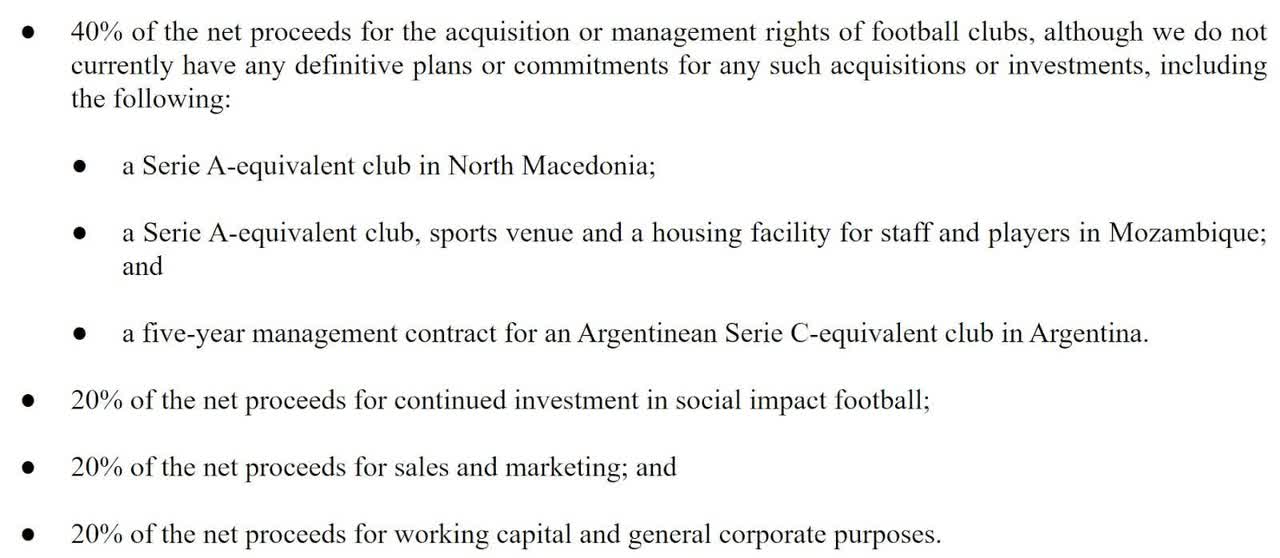

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of Proceeds (SEC)

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘currently not a defendant to any material legal proceedings, investigation, or claims.’

The sole listed bookrunner of the IPO is Revere Securities.

Valuation Metrics For Brera

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$55,750,000 |

|

Enterprise Value |

$48,606,621 |

|

Price / Sales |

140.48 |

|

EV / Revenue |

122.48 |

|

EV / EBITDA |

-493.06 |

|

Earnings Per Share |

-$0.01 |

|

Operating Margin |

-24.84% |

|

Net Margin |

-39.03% |

|

Float To Outstanding Shares Ratio |

13.45% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

$42,973 |

|

Free Cash Flow Yield Per Share |

0.08% |

|

Debt / EBITDA Multiple |

-3.12 |

|

CapEx Ratio |

8.33 |

|

Revenue Growth Rate |

-12.80% |

|

(Glossary Of Terms) |

(Source – SEC)

Commentary About Brera’s IPO

BREA is seeking U.S. public capital market funding to expand its portfolio of small football club assets.

The company’s financials have shown reduced topline revenue, decreased gross profit but increased gross margin, higher operating losses and growing cash flow from operations.

Free cash flow for the twelve months ended June 30, 2022, was $42,973.

General & Administrative expenses as a percentage of total revenue have grown sharply as revenue has decreased; its General & Administrative efficiency multiple swung to negative (0.1x) in the most recent reporting period.

The firm currently plans to pay no dividends and intends to retain any future earnings to reinvest back into the company’s growth initiatives.

The market opportunity for football in Europe is moderately large but the system has relatively low barriers to entry at the lowest levels.

Revere Securities is the lead underwriter and there is no data on the firm’s IPO involvement over the last 12-month period.

The primary risks to the company’s outlook as a public company are its lack of performance history and the costs of managing a far-flung portfolio of tiny assets.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 122x despite decreasing topline revenue from a tiny base.

Given the firm’s unproven business model, ultra-high-risk stage of development and excessive valuation expectations, my outlook on the IPO is on Hold.

Expected IPO Pricing Date: To be announced.

Be the first to comment