Joa_Souza

Dear readers/followers,

It’s time for an update on Braskem (NYSE:BAK). This is a Brazil-based petrochemical specialist company with operations spanning continents. This company is a higher-risk play, despite the fundamentals of this business. It does have some insulation from troubles due to its geography – but it comes with its own subset of very specific problems – which is also why things have been dropping since my last piece.

Let’s look at what we have going on here.

Updating on Braskem

Braskem is attractive. It’s the #1 thermoplastic resin producer in all of the Americas, both south and north, and the largest petrochemical company in all of LATAM. It owns industrial plants across Brazil, the US, Mexico as well as Europe, with capacities and assets in Germany as well. The company has the annual capacity to produce over 15M tons of resins, petrochemical products, compounds, and advanced materials.

Additionally, the company produces biopolymers, meaning it produces PE for bags from ethanol from sugar cane. Braskem has a plant with the capacity to produce 200,000 tons of the stuff.

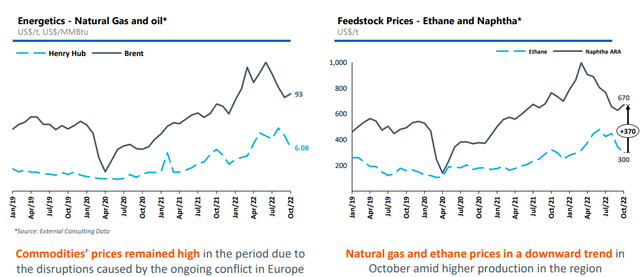

Still, on a high level, Braskem is as most chemical producers are, a play on feedstock pricing and trends.

Because we’ve seen high commodity prices for things like Brent, Gas, and Ethane as well as Naphtha, this has influenced the company’s products as well as its results.

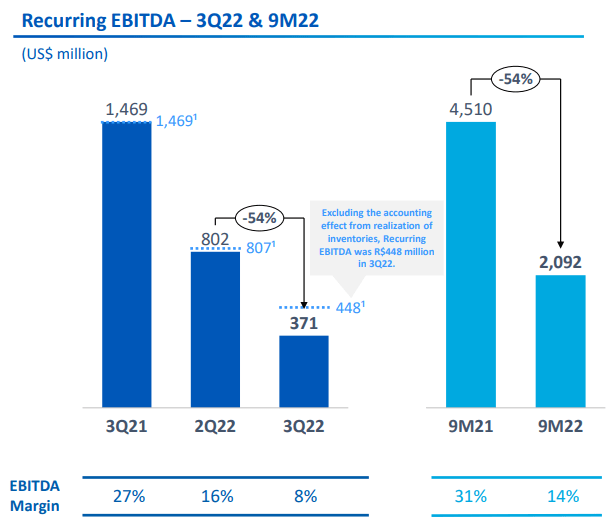

There are significant macro uncertainties and geopolitical tensions as well as issues in China – at least during 3Q22 – influencing the company’s current results. Braskem reported recurring EBITDA of just north of $370M. It also gave an FCF yield of 31%.

However, in context, this is a massive decline for the company from both YoY quarterly, and YoY 9M22.

Braskem IR (Braskem IR)

You can see the significant decline in EBITDA margin and trends. Braskem saw a relatively high, near-80% utilization rate for its complexes – so it’s not a production issue. However, it saw a double-digit non-Brazilian drop in sales, as well as accounting effects, contribution margins, and other headwinds. There was also a significant geological event some time ago – namely, the Alagoas disaster back in -21, which continues to weigh down the company’s financials – and this is expected to continue for some time. The company’s provisions so far are R$13B, with current provisioning as of 3Q22 of R$7.2B, including such things as relocation and comp provisions, closing and monitoring of wells, sociourbanistic measures, and additional measures. It’s a meaty process and one that’s unlikely to finish up in the near term.

Investing in Braskem requires looking beyond this – and similar scandals – such as bribery (Source), environmental issues like accusations of salt mine damage (Source) and other concerns like this Alagoas disaster, because they’re not unlikely to be repeated by and regarding this company here.

The company has an interesting set of shareholders, combining Petrobras (PBR) at 32.15%, and the Brazilian Conglomerate Odebrecht S.A, more commonly known as Novonor, a private company. This in turn is a holding company for the largest engineering and contracting company in LATAM. It is said that Odebrecht, through its 38.25% shareholding, controls Braskem.

The end products that Braskem is primarily known for are PE, PP and PVC – or polyethylene, polypropylene, and polyvinyl chloride, where the company has the capacity to produce 5.7M tons on an annual basis in Brazil alone.

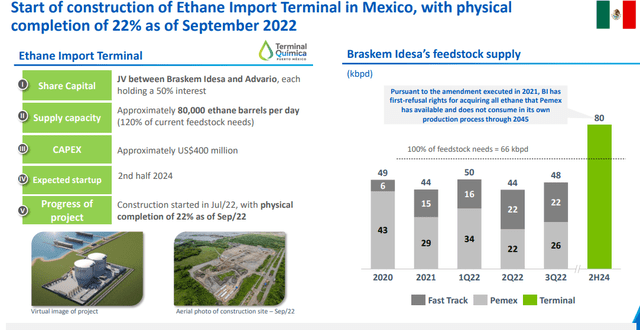

The market for these products is likely to remain solid even going forward, and the company is expanding its nameplate capacity for various parts of its business. Recently, the company began construction of an Ethane import terminal in Mexico.

The event in Alagoas back in -21 which saw the company take a $1.85B impact, or R$10.1B is the key influence in terms of company cash flow. These events are not unique – the salt mine event in Maceio sa Braskem recorded a R$9.1B settlement as well.

Without that future non-recurring event, we’d have cash flow much closer to normalized recurring EBITDA for the previous period.

Now, some positives. The company’s debt is fully under control, with significant maturities well beyond 2024, and current liquidity to cover the next 5+ years without any sort of income, with an average debt maturity of 13.4 years. That’s one of the best in the entire business – even if the interest rate of 5.7% is definitely not – but acceptable given the interest rate trends in the south American geography.

The company is also investment-grade rated by both Fitch and S&P Global, albeit at a BBB-. So a focus on conservative credit metrics is a good view to have when looking at Braskem.

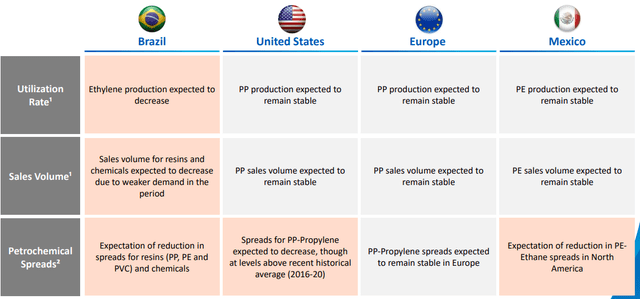

The spreads for the company’s petrochemicals are normalizing – even beyond normalizing to the 2016-2020 average. The current forecasts are negative for Brazil, but at least stable for the company’s remaining markets, with the exception of petrochemical spreads.

The company’s history goes back to 2002 when it was the leading petrochemical company in LATAM with units across the nation, but it consolidated based on no less than six companies at the time: Copene, OPP, Trikem, Nitrocarbono, Proppet, and Polialden. The company also M&A’ed Politeno, the third-largest PE company in Brazil.

In terms of current operational and result-related attractiveness, I would say the following. The current volatility in the macro and geopolitical tensions continue to inject uncertainty into the world, the sector, and into Braskem.

Whenever a company focuses on its ESG metrics and its ongoing projects, you know that things are likely to be unstable. So is the case too for Braskem. The 54% lower EBITDA on a sequential basis is nothing to sneeze at, and it illustrates how international spreads as well as sales volatility impacts company trends. You also know things aren’t going the right way for the quarter when the company focuses on the utilization rates for key assets and plants – especially when export numbers are down double digits.

So all in all, I will say that Braskem fully deserves the share-price-related beating it’s been taking for the past few months.

But it’s more than that. The company expects the spreads not to normalize for the next few quarters, forecasting further deterioration. This also brings into question the company’s near-term CapEx plans, and with deteriorating spreads due to Macro and China, it’s unclear if the company’s plans can be kept on track. The challenges are broad-based.

But based on macroeconomic news, global-wise, when we look at polyethylene next year, we see a growth in supply more than the growth in demand, not the tune of this year, but higher.

(Source: Pedro van Langendonck Teixeira de Freitas)

The company doesn’t currently forecast a clear full reversal or trend break until 2024E due to global investments for 2025 currently being somewhat dialed back.

The company also more or less confirmed that CapEx dialing down is on the table and something that the company will consider if results come in at the levels that the bearish camp expects here.

Based on current forecasts, I expect not the greatest sort of results for 2022, and I expect things to be more negative for 2023 than these forecasts currently spell out.

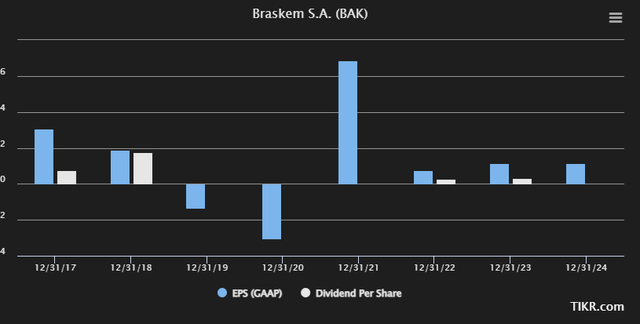

Braskem Forecasts (TIKR.com/S&P Global)

Let’s move on to company valuation and see what we have there in terms of buying appeal.

Braskem Valuation

In my previous article, I made perfectly clear why the company is a troubled sort of business to invest in. Yes, every company does have a price where it becomes attractive – theoretically – but Braskem is one of those businesses that we need to be careful about, because there are so many better potentials out there, even in the case of “cheap” valuation, which we have for Braskem here.

The analyst average for the company is nearly double the current share price – and that’s even with 8 analysts going down more than 25% in their average PT in the last 8 months. The current average is $18.37 from a range of $12.25 average up to $23. The upside to the current share price is 97.8%, and the company has crashed too far even for the current trends to be logical.

Braskem makes its petrochemical peers look stable by comparison, despite this being a volatile segment. The combination of Brazilian exposure, FX, and the overall volatility of this market makes for a very interesting investment. You can go years with zero dividends or EPS, as well as declines – just look at 2019-2020 or the like. Still, this is then weighed up by the “good years”, which see the company delivering double-digit yields and payouts.

It’s a stomach-twisting ride from a historical perspective, owning this stock – and the current volatility doesn’t really suggest that the volatility is going down by any significant amount.

However, remember what I said in my last article? That stomach-twisting ride has been absolutely market-beating, with a ~1,400% 20-year RoR.

From any conservative multiple, this company is currently undervalued. The 10-year average P/S is around 0.4x. It’s currently at half that. Even to the most conservative views over time here, there’s a decent undervaluation to this company that maybe we should not ignore if we’re interested in cold, hard profit.

On a peer basis, the company trades among giants like Dow, Sherwin-Williams (SHW), PPG (PPG), LyondellBasell (LYB), and other companies along the Petrochemical value chain – and it’s several levels cheaper than all of these from a multiple perspective.

All I could really conclude in my last article was that Braskem was undervalued to both peers, historicals, and to any sensible sort of forward valuation – but that it comes with the sort of volatility I tend to avoid.

I still do see the company as undervalued – even attractively so. I’m sticking with my “BUY” target because you do give a “BUY” target in those sorts of circumstances.

The company’s valuation is far more attractive than any of its peers in terms of straight multiples – but there are risk explanations for this, and I wouldn’t jump into Braskem without knowing the risk.

My last PT for the company was $14/share. We’re now well below that. Due to the current trends, I’m cutting that target to $12/share to account for the near-term risks, but that’s all I’m doing.

Still, if your risk tolerance does not include rollercoaster rides – I would avoid this one.

Thesis

- Braskem is an attractive company from a fundamental viewpoint, and it does have the potential of granting you some massive returns if bought at trough and held to an upcycle. The recent 2021 is an excellent example.

- Based on this, it’s a speculative “BUY” when it’s cheap. While it can go lower from $13/share, I would say that at less than 0.6x revenues and lower-priced than almost every peer, I see it as a “BUY”.

- The company is undervalued here – though I want to really emphasize the speculative nature of the investment, and my initial position will likely be low to reflect this.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italic).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

While the company does fulfill all of my valuation-related criteria, it does not fulfill the dividend and conservatively-run criteria, and therefore is a bit of a wildcard. This one is for the most risk-tolerant investors.

Be the first to comment