THEPALMER/E+ via Getty Images

In conjunction with releasing 2Q24 results, Blackstone Mortgage Trust (NYSE:BXMT) announced a dividend cut of over 24%. A dividend cut was inevitable based on the deterioration of BXMT’s loan book, as I pointed out in both “Diving Into Blackstone’s Mortgage’s Portfolio Reveals 2024 Is Darker Than It Appears In The Muddy Waters’ Report” and “Blackstone Mortgage Trust: Beware of Charge-Offs And More Loan Modifications Ahead“. I believe the market was anticipating a dividend cut. Prior to 2Q24 earnings, BXMT was trading at a 12.6% dividend yield based on its closing price of $19.63. While BXMT traded off sharply on the announcement and now yields 10.3% based on the new dividend, I do not think the pain is over for BXMT’s investors. I believe additional impairments are likely from BXMT’s office loans as well as its $571 million loan secured by the assets of Blackstone’s Joint Venture with Santander, which holds toxic assets from the remains of Banco Popular. Additionally, it seems as though cracks are beginning to show in BXMT’s multifamily portfolio. As I will discuss, BXMT’s new run rate for Distributable Earnings basically matches the new dividend; as such, I believe further impairments will necessitate future dividend cuts.

Management was overly optimistic about their loan book over the course of the last year, as I outlined in previous articles. Despite being forced to cut the dividend, they continue to present an optimistic view of the future to investors. To me, it seems part of their optimism may be based on their new strategy of splitting loans into mezz and senior pieces. This allows them to recognize income on the senior piece, while only impairing the mezz piece. While this strategy allows BXMT to recognize some income on the senior piece from an accounting perspective, it does not change the economics of the loan, as I will discuss in more detail below. While this strategy may allow BXMT to recognize income for a few more quarters, in my opinion, it will not change the economics of their loan portfolio and will only slightly delay further dividend cuts.

Another step management seems to be taking to try to address trouble with their office loans is helping to facilitate short sales (sales for less than the mortgage) for borrowers with troubled loans and then providing financing to the new buyer. This allows management to tell the analyst they have successfully dealt with impaired office loans and start recognizing income on the loans. However, based on my experience, the new loans have terms that are not in line with the current market, as will be discussed later. As yield-hungry investors flock to BXMT’s still attractive current yield, they should ask themselves why they trust management’s assurances on the sustainability of the new dividend level after the recent cut.

The Dividend Cut

I admit that I was surprised (and lost money on options) when BXMT announced on June 14th that they were maintaining their dividend at $0.62. I believe something must have happened between June 14th and the 2Q earnings announcement that surprised management and/or the board, leading to the decision to cut the dividend. I suspect the impairment of the Woolworth Building and 799 Broadway was not expected as their final maturity dates were in May 2025 and June 2027, respectively (See Loan Portfolio Details 1Q24 and 2Q24 BXMT 10Q). This suggests to me that the borrowers refused to make a required payment or contribute to a reserve account, forcing BXMT to impair the loan. I highlighted that the Woolworth Building was likely to be impaired in both “Diving Into Blackstone’s Mortgage’s Portfolio Reveals 2024 Is Darker Than It Appears In The Muddy Waters’ Report” and “Blackstone Mortgage Trust: Beware of Charge-Offs And More Loan Modifications Ahead“.

New Dividend Level Leaves No Room For Impairments

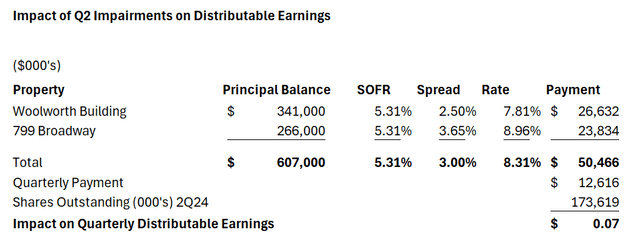

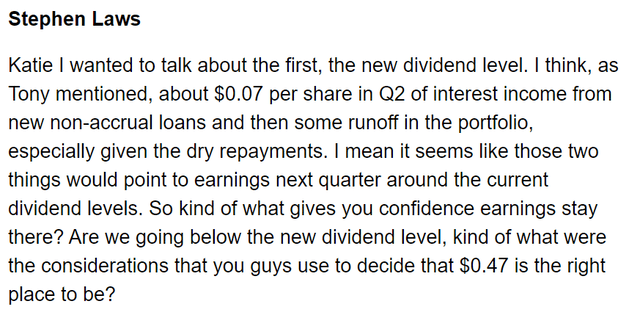

Based on the impairment of the Woolworth Building and 799 Broadway in 2Q24, BXMT’s Distributable Earnings will fall by $0.07, as illustrated below.

BXMT 2Q24 Loan Portfolio Detail, Shares from Face of Balance Sheet, SOFR from NY FED

If my math is correct, this means that for the 3rd quarter, BXMT’s distributable earnings prior to charge-offs will likely be close to $0.47. Not surprisingly, an analyst asked about the issue on the call.

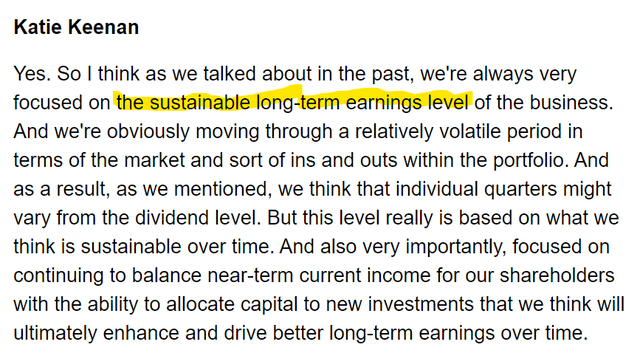

Management provided the same response to the sustainability of the dividend on this call as they did on prior calls. Below is the language from the Q2 call.

Given the dividend cut in the 2nd quarter, it is surprising that management is using the same line as before. Here is the language from the CFO’s response to a question on the dividend level on the 1st quarter call.

As I will discuss below, more impairments are very likely, so in my opinion, the new dividend level will not be sustainable for very long.

More Impairment Surprises may be in store for BXMT

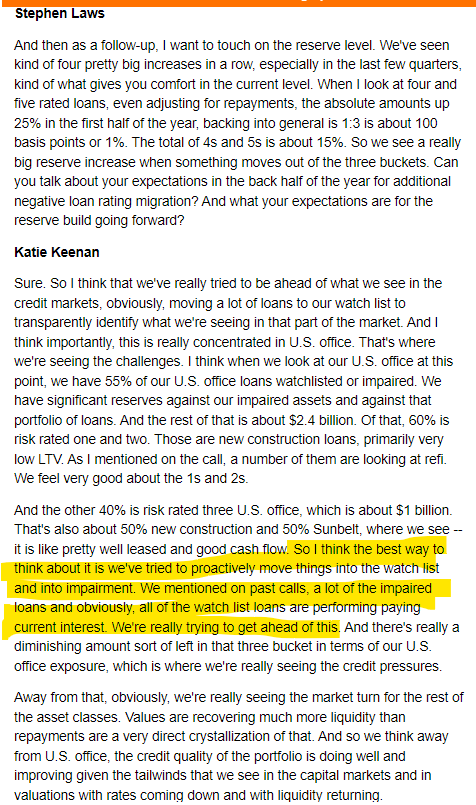

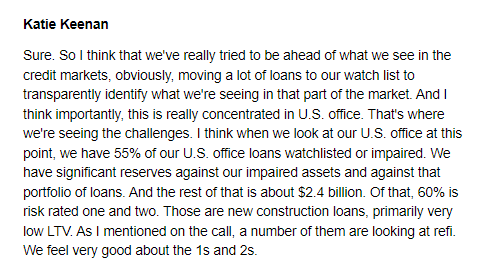

On the 2Q24 earnings call, BXMT’s management team tried to assure investors they have already taken the necessary impairments.

BXMT Earnings Call 2Q24

Despite management’s claims that they are getting ahead of the impairments, a quick review of some of the 4 (watch listed) and 3 (medium risk) loans reveals significant risks of impairments in my opinion. It is also important to remember, as I pointed out in “Blackstone Mortgage Trust: Beware of Charge-Offs And More Loan Modifications Ahead“, many loans that management classified as 3 ended up impaired a couple of quarters later.

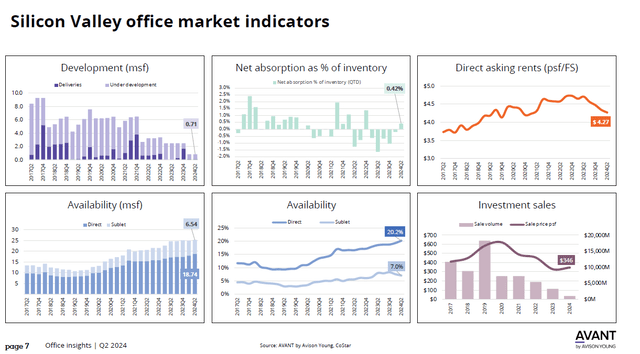

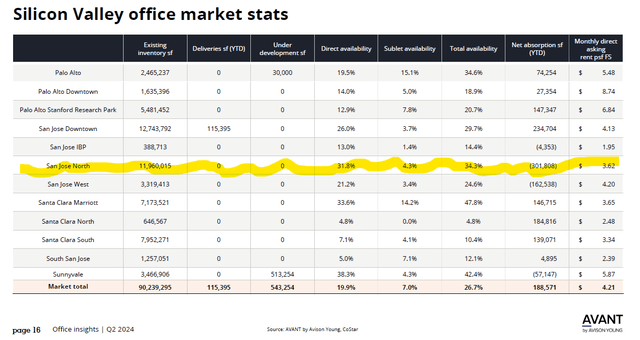

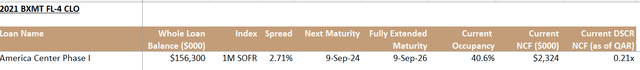

As I discussed in my last article on BXMT, it has a $156 million loan on America Center Phase 1, an office building in San Jose, CA. The whole Silicon Valley office market is facing highly challenging times due to leases signed before the pandemic expiring and limited interest from new tenants due to the work-from-home trend. As the following charts show, for all of Silicon Valley, availability is rising, absorption has been anemic, and property sales have been almost non-existent for the last two years.

Silicon Valley/San Francisco Peninsula office market report 2Q24 Avison Young

The San Jose North submarket, where American Center Phase 1 is located, has been particularly hard hit, as shown below.

Silicon Valley/San Francisco Peninsula office market report 2Q24 Avison Young

Currently, the property’s NOI only covers 25% of its debt service, and its occupancy has been stuck at 40.6% since 2022. (See Below)

Despite these severe challenges, BXMT and its auditors have not impaired this loan. It is hard for me to imagine that a borrower facing these circumstances would purchase a new interest rate cap when it expires with the next maturity date on September 9th. I think this loan could likely be impaired by the time of the third quarter conference call.

A Spanish Crisis

Another 4-rated loan that I could easily see being impaired with 3rd quarter results is BXMT’s loan to Project Quasar.

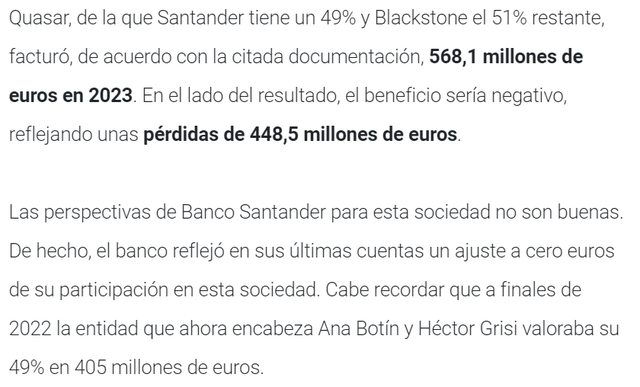

As I discussed in “Diving Into Blackstone’s Mortgage’s Portfolio Reveals 2024 Is Darker Than It Appears In The Muddy Waters’ Report“, this loan was originated in 2018 to finance Santander and Blackstone’s JV, which allowed Santander to move the toxic assets from its acquisition of Banco Popular off its balance sheet. While the original loan of €1 billion has been partially paid down, it is currently on BXMT’s loan schedule at $571 million. (Loan Portfolio Details BXMT 10Q 2Q24) As I showed in my earlier piece, when the loan was originated in 2018, its Loan-To-Value (LTV) was 73%, and by 9/30/2023, based on Santander’s valuation, it was 93%. Santander has recently written off its entire investment in Project Quasar, according to elEconomista.es.

Below is the English translation based on Google Translate.

This means BXMT’s loan has an LTV of at least 100%. I think it will likely be impaired at some point in the not-too-distant future. If BXMT is forced to impair this loan, based on a loan size of $571 million, an all-in yield of 3.31% (Loan Portfolio Details BXMT 2Q24 10Q), and a (SOFR) rate of 5.31%, my math indicates it would cost BXMT $12.3 million a quarter or $0.07 a quarter.

Even some of BXMT’s 3-rated loans raise questions about its business and future capital allocation. While BXMT has tried to assure investors about its liquidity by noting that it only has $1 billion of future loan commitments remaining, it is interesting to look at the projects where those dollars will flow.

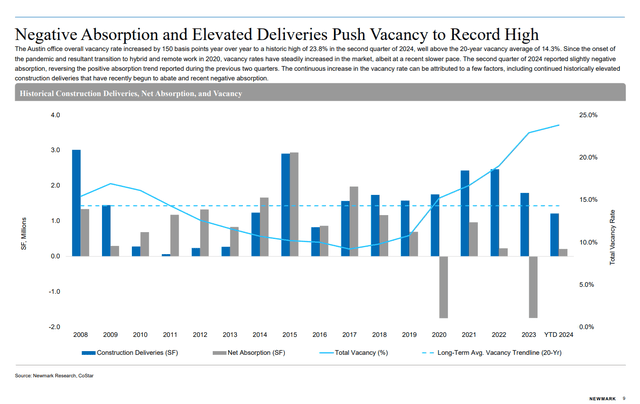

BXMT’s most significant outstanding loan commitment is to fund an additional $364 million on its $675 million construction loan for the Waterline Project in Austin. (See Loan Portfolio Detail p. 75 of BXMT 2Q24 10Q – Loan Commitments less Principal Balance.) Meta was originally going to anchor the office portion of this 74-story building by occupying 35 floors. However, they have backed out of the project. This is occurring while many other big-tech companies are shrinking their real estate footprint in Austin. According to Newmark, a respected brokerage firm, the Austin Office market saw negative absorption in 2Q24 (less space leased), and significant new supply.

2Q24 Austin Office Market Overview, Newmark

Looking at the above chart, I think any rational investor would say the last thing this market needs is more office space. Perhaps that is why it seems like the current plans for the Waterline only include 27 floors of office space, as opposed to the 35 that Meta was slated to take. It looks like the plan now has the top 33 stories dedicated to luxury residential units.

Austin’s multifamily market is also choking on supply, and in the first quarter, Austin experienced the largest rent decreases in the U.S., according to Marcus & Millichap. Despite these challenges, BXMT is continuing to fund this loan. In 2Q24, BXMT’s loan on this property increased by $40 million. (Loan Portfolio Detail 1Q24 and 2Q24.) It may take a couple of quarters, but I believe it is not hard to see this loan on a path toward impairment.

Splitting loans

Although it was not discussed on the quarterly conference call, one of the more interesting steps that management has taken to address trouble in its loan portfolio during the last two quarters was splitting an impaired loan into multiple pieces. To follow management’s steps, one needs to read the notes in the 10-Q on Loan Modifications.

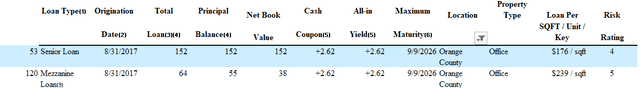

Below is a description of their handling of their Orange County Office Portfolio Loan and its presentation in the loan portfolio detail.

Loan Portfolio Details, BXMT 10Q 2Q24

This structure allows BXMT to continue recognizing income on the $152 million senior portion of the loan while not taking a full write-off on the mezzanine portion of the debt. Note that there is no impairment on the senior loan, and the mezzanine loan simply accrues payments in kind. I think it is unlikely that BXMT will realize any recovery on the mezzanine loan. I believe they have tacitly admitted this by saying even the senior loan is on the watch list (4 rated). It is also important to note that it is rare for a sponsor to put additional equity into a property once there is a mezzanine loan with payment-in-kind interest in place, as often the mezzanine lender will get more value from the incremental investment than the sponsor will.

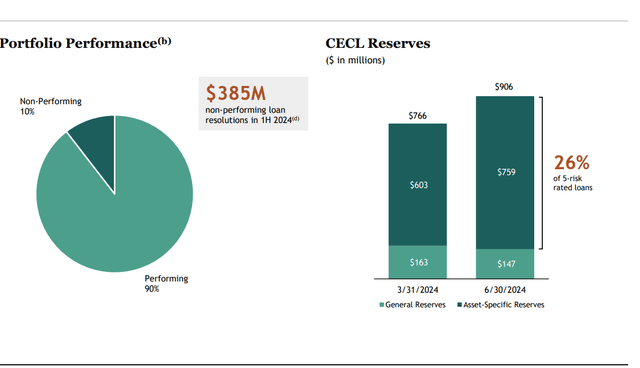

This structure also calls into question many of the statistics cited by management about their supposedly conservative accounting, in my opinion. On their conference call and in the investor presentation, management often mentions the level of impairments they have recorded against 5 (high risk) rated assets. The below graphic is from their 2Q Earnings Package.

However, if they only impair a portion of the loan as opposed to the whole loan, these impairment levels look less conservative. I believe many real estate investors would argue that only reserving 26% against a mezzanine loan backed by office properties is aggressive. More importantly, BXMT takes almost no reserves and is still recognizing income from the watch-listed senior loan, which is collateralized by office properties that are in decline.

Short Sales

On the 1Q24 earnings call, management highlighted that they were resolving impaired loans at levels in line with their CECL reserve.

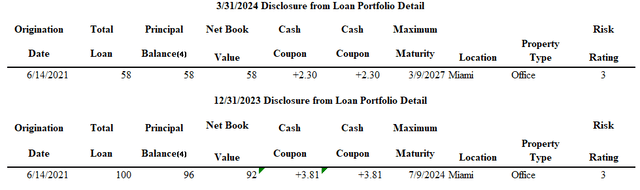

What they failed to mention is that one of the resolutions involved a sale where BXMT provided financing for the new buyer. Douglas Entrance is an office complex in Miami BXMT, and as of 12/31/2023, BXMT had a $93 million loan on the property. (Loan Portfolio Details, BXMT 10K 2023) In March, the asset was sold for $76 million. (Loan Portfolio Details, BXMT 10Q 1Q24)

BXMT has not moved on from the asset. It has provided a loan for the new owner. The new loan terms do not look to be consistent with current market rates. The new loan has a 76% LTV ($58 million loan and $76 million purchase) and a spread of 2.3%. Below is BXMT’s disclosure on the loan from its 2023 10K and 1Q24 10Q.

BXMT 2023 10K and BXMT 10Q 2Q24

As I discussed at length in my prior articles, financing is basically unavailable for office properties in the current environment. A loan on a transitional office property with an LTV of 76% and a spread of 2.3% would have been attractive in 2019; in 2024, such financing is simply not available. This means it is unlikely the buyer would have paid $76 million without the attractive financing; therefore, the price a buyer would have paid for the asset without the benefit of the financing would be lower, which means the actual LTV on the asset is higher.

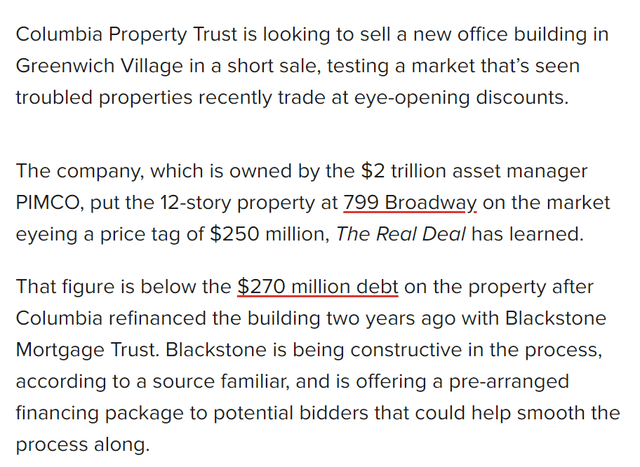

It looks like BXMT is trying to do something similar with 799 Broadway. In June 2022, BXMT provided Columbia Property Trust with a $270 million loan secured by the asset. The asset is now being marketed for a short sale with a price of $250 million, and BXMT has indicated it will provide financing.

The Real Deal, August 6th, 2024

While BXMT’s cooperation may help with the sale of the asset and allow BXMT to start recognizing income again for a period of time, BXMT’s shareholders will not be done with their exposure to the asset. Once again, they will find themselves lending against a property that I believe no other lender would currently consider financeable. Given the risks associated with the office sector, I think they may see this loan impaired again in a couple of quarters.

Like many of BXMT’s loans on recently constructed office properties, this loan was assigned a risk rating of 3 (medium risk) as of 12/31/2023. (BXMT Loan Portfolio Detail 2023 10K) I believe that BXMT’s management and auditors reasoned that since the final maturity was not until 2027, it was unlikely that the borrower would stop making payments in the near term. Clearly, the borrower decided that it was not worth spending any additional money on the asset, hence the short sale, as opposed to holding on to the asset until maturity. Given the increasing clarity on office valuation, I think it is likely that many other borrowers of newly constructed properties will come to the same conclusion in the coming quarters, forcing BXMT to recognize significant reserves on office assets that are currently rated 3 or 4.

Office is not the only problem

As discussed above, management would like investors to think its only troubled assets are office properties. On the 2Q earnings call, the CEO continued to suggest almost all of the problems are limited to office assets.

BXMT 2Q24 Earnings Call

However, in addition to the loan secured by the former assets of Banco Popular, multifamily assets are beginning to add to BXMT’s woes. This is not surprising, as fundamentals in the multifamily space have become more challenging as the market absorbs record supply.

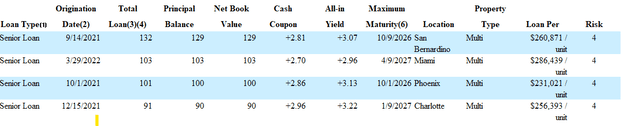

As discussed on BXMT’s 2Q24 earnings call, they took possession of two multifamily assets in San Antonio. While it sounds like these are very small assets, it should trouble investors that Blackstone had multifamily assets that could not cover their debt service due to poor management. No doubt, the same team that extended a loan to the San Antonio operator provided financing for much larger multifamily assets. BXMT now has four multifamily assets rated four or watch-listed, including one that was added in 2Q24.

BXMT Loan Portfolio Details 10Q 2Q24

Given that 27% of BXMT’s collateral is secured by multifamily assets (Company Presentation 2Q24 p.8), if fundamentals continue to weaken, I believe it could be another source of pressure on the dividend.

Conclusion

Since the beginning of 2023, when it became clear that a fundamental and permanent change had occurred in the office market, management has consistently told investors that their business is well-positioned and insulated from the troubles in the broader markets. Based on this, they told investors the dividend was safe. Despite the dividend cut, management has not changed their tune and, once again, they are telling investors the dividend is sustainable. They frequently cite their access to information and the power of the Blackstone platform to assure investors that they are able to navigate a challenging market with better outcomes than other operators. (BXMT Company Presentation 2Q24, p.4) Based on their recent track record of making numerous loans backed by office properties in 2021 and early 2022, I would think arguments about the benefits of the platform would seem shaky right now. I believe investors should look to the broader markets and not just assume that because an entity is associated with Blackstone, it can continue to support a stretched dividend indefinitely.

Risks to Shorting BXMT

My thesis for shorting BXMT revolves around the idea that the dividend, despite being reduced, may be cut again, which could lead to a sharp drop in BXMT’s stock price. Nonetheless, investors need to be prepared for the possibility that BXMT will be able to maintain its dividend for some time. BXMT could benefit from falling rates, which would reduce its borrowers’ payments and their financial stress. BXMT’s splitting of loans into senior and mezz pieces may also allow BXMT to recognize more income and avoid cutting the dividend for a couple of quarters. The key for investors who short BXMT is they need to have the capital and patience to wait for events to force BXMT to cut its dividend.

Be the first to comment