DisobeyArt

Ninety-five percent of my bandwidth and ninety-eight percent of my capital are deployed on the long side. Even though it has become a cottage industry to write doom and gloom, the sky is falling articles (short the overall market) type articles, I don’t waste any bandwidth doing it, as it doesn’t lead to generating strong returns. And just to be crystal clear, all of the names in my portfolio are small cap value or special situations. Moreover, I’m very much a contrarian and willing to selectively make a bold call – see my recent four-part series on Carvana Co. (CVNA), as these articles were written from June 21, 2022 – July 16, 2022. Lo and behold, all four articles were written when Carvana shares were trading in the low to mid-twenties. And in case you aren’t aware, yesterday, CVNA shares closed north of $54.

That said, when you are playing Liar’s Poker, no question there is always an element of timing and the recent market ‘melt up’ and extraordinary bearishness towards Carvana was the jet fuel that empowered the big leg up. Had the bearishness not been so extreme, as there were so many people that literally thought Carvana was going to file bankruptcy, like in Q3 2022, the stock wouldn’t have ever traded so low and wouldn’t have made an explosive 137% move higher.

So with my background out of the way, the reason for the preamble was to avoid the standard mud throwing in the comments section that the author is just a notorious short seller or the conspiracy theories suggesting that the author has a big short position and therefore an agenda to write this negative piece on Bed Bath & Beyond (NASDAQ:BBBY).

In fact, the only reason I wrote today’s article was to point out that BBBY shares had shifted into “ludicrous mode” and are wildly untethered from their intrinsic value.

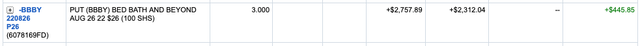

And to be clear, and I discussed the topic a bit, with my group in “live chat” yesterday, when BBBY shares were then trading close to $27, I did buy a few BBBY August 26, 2022 $26 puts. This was a very modestly sized bet, at about 60 Bps of portfolio exposure. The reason I sized it so timidly was that the implied volatility was mid-400%, meaning these puts were crazy expensive. Secondly, we are talking about options that expire in less than two weeks. For perspective, again when BBBY shares were trading at close to $27, I had to pay $7.71 per contract, for the right to sell BBBY shares at $26, on August 26th. As I happened to read the poker table well, at least this time, in less than two hours, BBBY shares crashed from $27 to $21, and actually traded as low as $18. So just to be clear, I closed out my puts, for a modest profit (see below), when BBBY shares were then trading in the mid $21s.

Why I’m So Bearish On Bed Bath & Beyond Shares In the Mid-Twenties

My strongest bearish argument is BBBY’s financials are a hot mess. And a hot mess might be a charitable way to describe the state of affairs of this business.

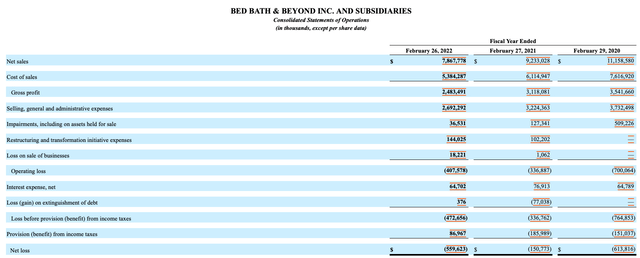

Bed Bath & Beyond sales have gone from $11.2 billion in the fiscal year ending February 29, 2020 to $7.9 billion in the fiscal year ending February 26, 2022. Operating losses excluding all special restructuring charges were $509 million in FY 2019, $107 million in FY 2020, and $209 million in FY 2021. For perspective, most healthy retailers posted all-time record profits and cash flow from the second half of calendar 2021 – full year 2022.

Let’s not forget, there were three rounds of stimulus, record low unemployment and a surging housing market. During that period, consumer sentiment was very strong, and this was an amazing time to be a retailer. Yet, despite hiring the former CEO of Target (TGT), Mark Tritton, a person who experienced extraordinary success during his tenure at Target, he couldn’t fix it.

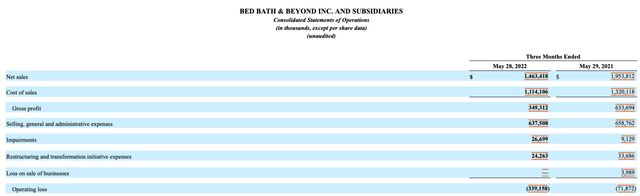

In calendar year 2022, as the economy got much more difficult with the highest inflation in 41 years, record gas prices, the lowest consumer sentiment readings ever (as of June 2022), and housing slowing considerably, BBBY operating losses spiraled, in Q1 FY 2022, the period ending May 28, 2022.

As you can see, sales were down 25%, YoY, during Q1 FY 2022, and operating losses were $288.2 million, excluding impairment and restructuring add backs.

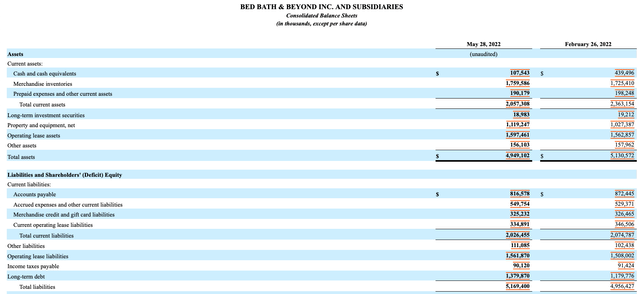

Turning to the balance sheet, as BBBY spent an inordinate amount of money on buybacks, that is also a hot mess. A once very strong balance has gone from healthy to very bad.

Merchandise inventory is way too high on a much lower sales base, cash has shrunk down to $108 million and long term debt is $1.4 billion.

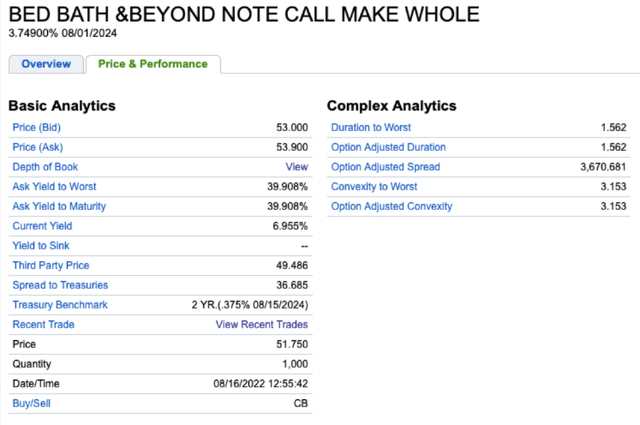

Lo and behold, as of yesterday, as a proxy for how pessimistic bond investors are towards a business transformation, BBBY’s 3.75% 8/1/2024 bonds were trading institutional sizes at $52. This is a two-year piece of paper, trading at close to fifty cents on the dollar, with a 40% year to maturity.

Outside of a commodity business at the trough of the cycle or a deeply cyclical industrial business, also at or near the trough of its sector cycle, I can’t ever recall two-year bonds trading at 50 cents on the dollar where the business goes on to experience a transformation and there was a miraculous recovery. It can and does happen, but very rarely.

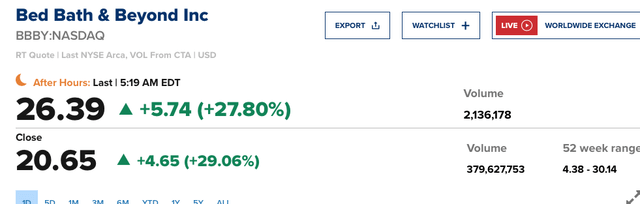

Lo and behold, today, August 17, 2022, as of 5:19 AM, BBBY shares are bid up, currently changing hands at $26.39, up 28%. Keep in mind, the vast majority of online broker platforms don’t enable pre-market trading until 7 AM. So who the heck has traded north of 2 million shares or $50 million dollars worth of stock, in the wee hours of the morning?

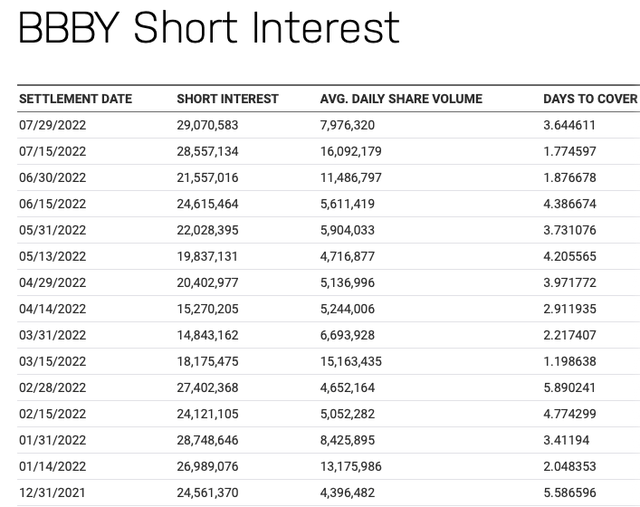

Lastly, we all know that BBBY is a highly shorted stock. However, it has been a highly short stock for a long time. Coming into the year, by late January 2022, short interest was just as elevated compared to the most recent July 29, 2022 period.

The difference now is the Ryan Cohen factor combined with this recent market melt-up, over the past six weeks.

For perspective, shares of BBBY closed the month of July 2022 at $5.03. They traded as high as $28.60, yesterday. The big notable difference is the volume has become ludicrous. There are only 80 million total shares of BBBY outstanding, and yet, yesterday, nearly 5 times the entire share count changed hands.

Lo and behold, there wasn’t some transformative business update, there was simply news that Ryan Cohen bought more January 2023 $60 to $80 call options. And speaking of Ryan Cohen, if Mark Tritton badly failed to transform BBBY, and I mean crash and burn type of failure, what is Ryan Cohen going to do? Is BBBY going to roll out a series of bath towel and bath mat NFTs? If you look at the actual business, you have a high-cost structure business, with way too many stores, high prices, and a lousy shopping experience. Moreover, no one gets excited about buying bath towels, shower mats, or bedsheets. Not to mention that you’re competing against Amazon with its vast selection, lower prices, and the convenience of Amazon Prime.

Putting It All Together

If you are looking for a signpost that markets are once again becoming psychedelic, look no further than BBBY shares leaping from $5.03 to as high as $28.60, in a span of 15 days. There are zero tangible signs of any business recovery whatsoever, the macro backdrop continues to be rocky, at best, and housing has fallen off. The bond market has yawned at the five-fold increase in BBBY shares and has simply written it off as a short squeeze.

Despite being a contrarian that was bold enough to write four articles on Carvana, back when CVNA shares were trading in the low- to mid-twenties, I just don’t see the business case, or contrarian case for getting long BBBY.

Either way, I’m looking forward to seeing BBBY roll out bath towel or bath mat NFTs, I’m sure they will fetch big bucks this fall at Sotheby’s or Christie’s.

In terms of my recommendation, I think a very modest short position, sized at no more than 2%, at say $25 per share or higher, can make sense. In terms of puts, they are very expensive, so these are only well suited as short-term trading vehicles only. The only scenario under which I would shift my super bearish outlook, again, and we are talking about BBBY in the context of its current trading price, changing hands in mid-$20s, would be if they did a monster equity raise and earmarked the proceeds for debt repayment. That said, under that scenario, the relative short interest, as a percentage of available float, would decline and the optionality/ingredients for a monster Cat 5 squeeze would diminish.

Be the first to comment