sankai

Investment Thesis

In today’s challenging global economic environment, commodities are a crucial asset class that can diversify portfolios and hedge against tail risks. We believe the Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF (NYSEARCA:BCI) provides investors with a compelling investment opportunity, thanks to its cost-effective and diversified structure.

Overview

The BCI ETF tracks the Bloomberg Commodity Index, which comprises 23 commodities weighted by trading volume and world production levels. It is a passively managed ETF that is collateralized with short-term U.S. Treasuries, generating interest income to support portfolio management. The “K-1 Free” structure of BCI means investors do not have to worry about the tax implications of investing in futures contracts, as they receive income and dividends through a standard Form 1099, like with other stocks and ETFs.

Powerful Diversification

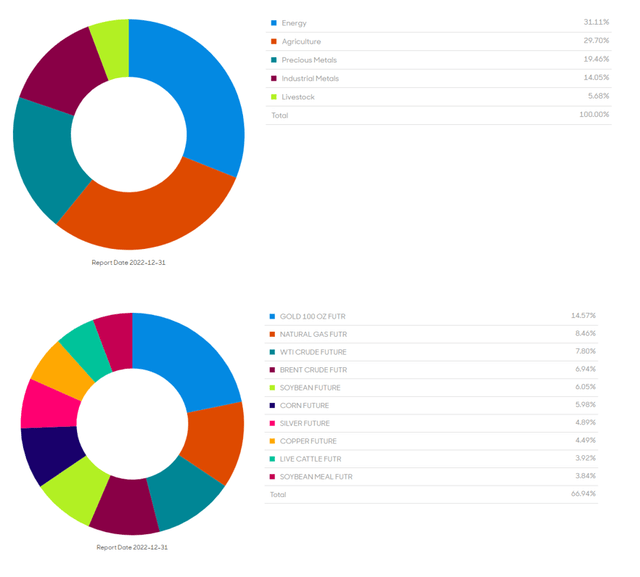

The BCI ETF has holdings in energy, agriculture, and precious metals, with gold futures as the largest position at 15%, followed by natural gas futures at 8.5% and crude oil at 8%.

Performance

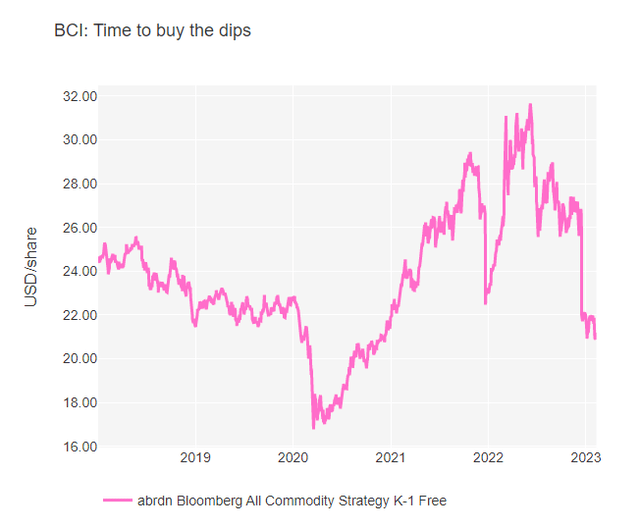

According to Yahoo Finance, BCI had a negative price return of 4% in 2022, which was more resilient than global equities (-20%), US equities (-19%), or EM equities (-22%). The ETF’s performance is influenced by global macro trends, such as supply and demand levels for each commodity. The recent sell-off in BCI since the second half of 2022 was mainly driven by macroeconomic factors, such as China’s zero Covid policy and the aggressive monetary policy tightening in the United States. However, we anticipate these headwinds will turn into tailwinds in 2023, leading to a bottom in BCI’s performance.

Cost

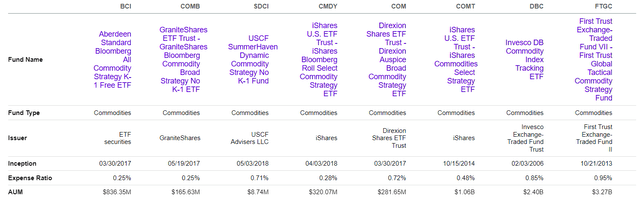

BCI has a low expense ratio of only 0.25%, making it one of the most cost-effective ETFs in its category.

Commodity Outlook

We believe a new bull market in commodities has emerged since the Covid-19 pandemic, with most commodities currently in deficit and the supply-demand imbalance expected to persist.

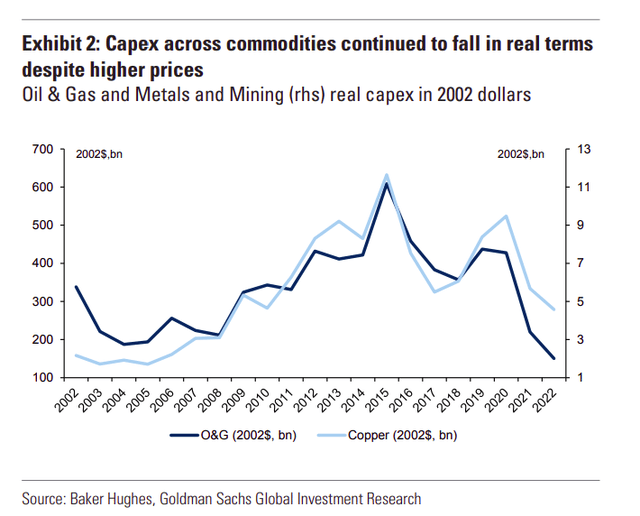

On the supply side, commodity producers are reluctant to spend on Capex, resulting in constrained supply dynamics.

According to estimates from Goldman Sachs, Capex across most commodities have continuously fallen since their peak in 2015. For example in copper, Goldman Sachs estimates that sanctioned projects amounted to only 263,000 tonnes in 2022, the lowest level over the past 15 years. The supply response will therefore take time.

On the demand side, although the global economic outlook for 2023 remains uncertain, China’s reopening to the world is expected to boost economic activity and demand for commodities. In the long-term, demand for commodities will be robust, driven by population growth, urbanization, and the Green Transition, with the structural supply-demand imbalance across most commodities resulting in higher prices.

Conclusion

The BCI ETF provides investors with exposure to a range of important futures contracts in energy, agriculture, metals, and livestock. Its “K-1 Free” structure makes it a more accessible investment option, and its diversified portfolio balances the inherent uncertainty of investing in commodities. With its low expense ratio and higher relative positioning in agriculture, BCI is a cost-effective and compelling option for investors seeking commodity exposure.

Be the first to comment