miromiro

Earnings of Bankwell Financial Group, Inc. (NASDAQ:BWFG) will likely remain flattish next year. Loan growth will continue to support earnings through the end of 2023. However, slight margin compression, above-average provisioning, and inflation-driven growth in operating expenses will pressurize earnings. Overall, I’m expecting Bankwell Financial to report earnings of $4.86 per share for 2022 and $4.81 per share for 2023. Compared to my last report on the company, I have raised my earnings estimates mostly because I’ve increased my loan balance estimates. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Bankwell Financial Group.

After 3Q’s Amazing Performance, Loan Growth to Slow Down

Bankwell Financial’s loan portfolio surged by an exceptional 11% during the third quarter, or 44.5% annualized, which not only beat my expectations but also smashed historical records. Going forward, loan growth will moderate because of the high interest-rate environment which should dampen the credit appetite of borrowers. Further, Bankwell Financial closed a branch effective October 7, 2022. The bank now has only nine branches operational. The branch closure should also have some negative effects on loan originations.

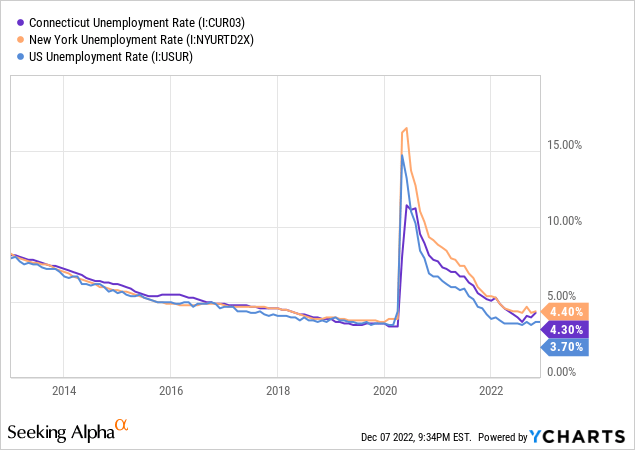

Meanwhile, economic factors will have a mixed impact on loan growth. Bankwell Financial is based in Connecticut, with a majority of its loans in Connecticut and New York. The company also has some exposure to Florida, Texas, New Jersey, and Ohio. Currently, both Connecticut and New York have high unemployment rates compared to other states. However, compared to their historical trends, the unemployment rates have remained very low this year. Strong job markets provide a positive signal for loan growth in the commercial business segment, which makes up around 19% of total loans. Commercial real estate loans make up an additional 72% of total loans; however, this segment is less closely related to the employment situation.

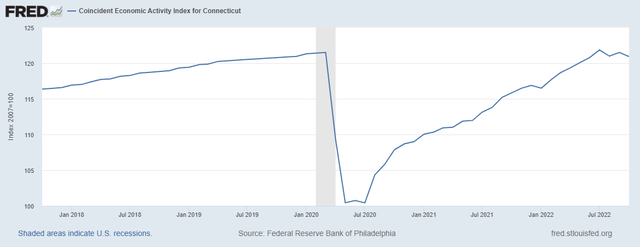

Connecticut’s coincident economic activity index is another good gauge of demand for commercial loans. The index below shows that economic activity has been faltering lately.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 3% in the last quarter of 2022, taking full-year loan growth to 24%. For 2023, I’m expecting the portfolio to grow by 10%. Compared to my last report on the company, I’ve reduced my loan growth estimates for next year. Nevertheless, my loan balance estimate is higher than before. This is because of the surprisingly high loan growth during the third quarter, which has raised the base for the percentage.

The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 1,587 | 1,589 | 1,602 | 1,875 | 2,331 | 2,573 |

| Growth of Net Loans | 4.3% | 0.1% | 0.8% | 17.1% | 24.3% | 10.4% |

| Other Earning Assets | 119 | 101 | 111 | 161 | 125 | 130 |

| Deposits | 1,502 | 1,492 | 1,827 | 2,124 | 2,355 | 2,600 |

| Borrowings and Sub-Debt | 185 | 175 | 200 | 84 | 160 | 167 |

| Common equity | 174 | 182 | 177 | 202 | 236 | 257 |

| Book Value Per Share ($) | 22.4 | 23.4 | 22.8 | 26.0 | 31.0 | 33.8 |

| Tangible BVPS ($) | 22.1 | 23.1 | 22.5 | 25.7 | 30.7 | 33.4 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Further Margin Contraction Ahead

Bankwell Financial’s net interest margin grew by eleven basis points in the third quarter due to the large loan addition at higher rates. Going forward, the anticipated loan additions will continue to support the margin. However, the repricing of existing loans and deposits will pressurize the margin. Due to a large balance of adjustable rate deposits, the average deposit cost reprices faster than asset yields. These adjustable-rate deposits, namely NOW, savings, and money market accounts, altogether made up 60% of total deposits at the end of September 2022. Further, certificates of deposits representing 13% of total deposits are scheduled to mature before year-end. In comparison, only $500 million of loans are floating or set to re-price in the next twelve months, representing just 22% of total loans, as mentioned in the earnings presentation.

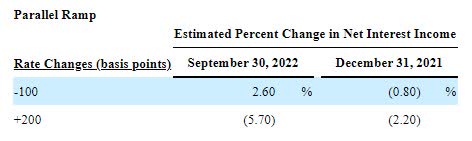

According to the results of the management’s interest-rate sensitivity analysis given in the 10-Q filing, a 200-basis points hike in interest rates could reduce the net interest income by 5.7% over twelve months.

3Q 2022 10-Q Filing

The management expects the margin to contract in the fourth quarter of 2022 and the full year of 2023. Considering these factors, I’m expecting the margin to decline by 15 basis points in the last quarter of 2022 and 20 basis points in 2023.

Provisioning Likely to Remain Above Normal

Bankwell Financial Group reported an above-average provisioning for the third quarter of 2022, which beat my expectations. This is natural considering loan growth was also surprisingly high during the quarter. Non-performing loans were 0.73% of total loans, while allowances were 0.80% of total loans at the end of September 2022. This allowance coverage seems uncomfortable to me ahead of a possible recession. Therefore, I believe Bankwell Financial will need to make above-average contributions to allowances for loan losses. The company is not yet subjected to the Current Expected Credit Losses (“CECL”) accounting standard, which makes it more prone to credit shocks.

Overall, I’m expecting the net provision expense to make up 0.23% of total loans in 2023, which is much higher than the average of 0.16% for the last five years.

Expecting Earnings to be Flattish Next Year

The anticipated loan growth will likely support earnings through the end of 2023. On the other hand, slight margin compression and above-average provisioning will drag earnings. Further, operating expenses will rise due to balance sheet growth as well as persistent inflation.

Overall, I’m expecting Bankwell Financial to report earnings of $4.86 per share for 2022, up 45% year-over-year. For 2023, I’m expecting earnings to dip by 1% to $4.81 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 56 | 54 | 55 | 68 | 93 | 103 |

| Provision for loan losses | 3 | 0 | 8 | (0) | 4 | 6 |

| Non-interest income | 4 | 5 | 3 | 6 | 3 | 3 |

| Non-interest expense | 36 | 36 | 43 | 40 | 44 | 52 |

| Net income – Common Sh. | 17 | 18 | 6 | 26 | 37 | 37 |

| EPS – Diluted ($) | 2.21 | 2.31 | 0.75 | 3.36 | 4.86 | 4.81 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on Bankwell Financial, I estimated earnings of $4.60 per share for 2022 and $4.57 per share for 2023. I’ve revised upwards my earnings estimates mostly because I’ve raised my estimates for the loan balance following the third quarter’s performance.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

BWFG is Trading at a Big Discount to its Target Price

Bankwell Financial has a long-standing tradition of increasing its dividend every year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.22 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 18% for 2023, which is close to the 2017-2021 (ex-2020) average of 20%. Based on my dividend estimate, Bankwell Financial is offering a forward dividend yield of 3.0%.

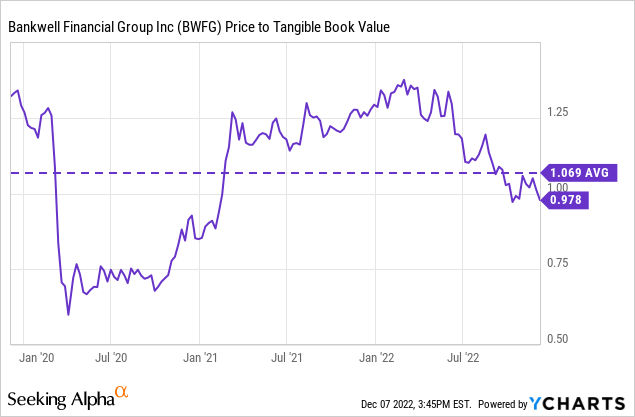

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Bankwell Financial Group. The stock has traded at an average P/TB ratio of 1.069 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $33.4 gives a target price of $35.7 for the end of 2023. This price target implies a 22.9% upside from the December 7 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.87x | 0.97x | 1.07x | 1.17x | 1.27x |

| TBVPS – Dec 2023 ($) | 33.4 | 33.4 | 33.4 | 33.4 | 33.4 |

| Target Price ($) | 29.1 | 32.4 | 35.7 | 39.1 | 42.4 |

| Market Price ($) | 29.1 | 29.1 | 29.1 | 29.1 | 29.1 |

| Upside/(Downside) | (0.1)% | 11.4% | 22.9% | 34.4% | 45.9% |

| Source: Author’s Estimates |

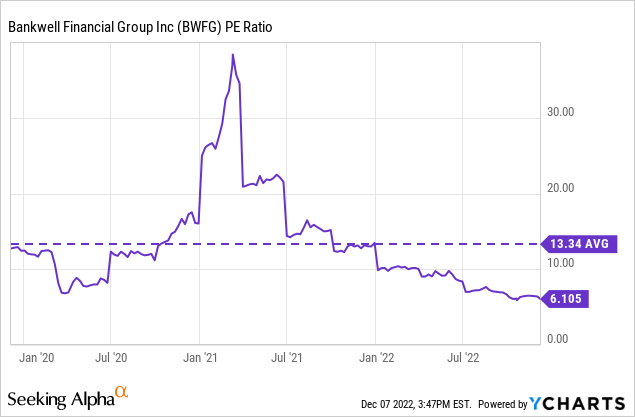

The stock has traded at an average P/E ratio of around 13.34x in the past, as shown below. Excluding the anomaly in the first half of 2021, the P/E multiple has tended towards 10.0x.

Multiplying the P/E multiple of 10.0x with the forecast earnings per share of $4.81 gives a target price of $48.1 for the end of 2023. This price target implies a 65.4% upside from the December 7 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.0x | 9.0x | 10.0x | 11.0x | 12.0x |

| EPS 2023 ($) | 4.81 | 4.81 | 4.81 | 4.81 | 4.81 |

| Target Price ($) | 38.5 | 43.3 | 48.1 | 52.9 | 57.7 |

| Market Price ($) | 29.1 | 29.1 | 29.1 | 29.1 | 29.1 |

| Upside/(Downside) | 32.3% | 48.8% | 65.4% | 81.9% | 98.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $41.9, which implies a 44.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 47.2%. Hence, I’m maintaining a buy rating on Bankwell Financial Group.

Be the first to comment