Justin Sullivan

AT&T (NYSE:T) is scheduled to report its Q2 results before markets open today. The media and telecom conglomerate will be reporting its first quarterly results after the divestiture of its WarnerMedia business, amidst a challenging macroeconomic environment, and investors are curious to see how its revenue is impacted. But in addition to tracking its top line figure, investors may also want to monitor its subscriber adds, average revenue per user (or ARPU) and its segment financials. These items will better highlight the company’s operational and financial positioning and are likely to influence where its shares head next. Let’s take a closer look to gain a better understanding.

Operating Metrics

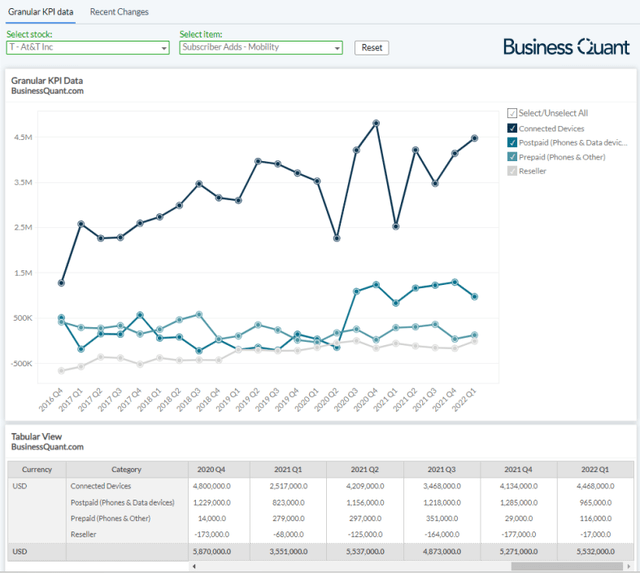

Now that AT&T has divested its media assets, the company is more streamlined and its management is focused on growing their core telecommunications business. Although the telecom giant has been investing heavily in wireless 5G and fiber broadband rollouts, the ongoing macroeconomic turmoil could variably affect its upcoming results. Some bears argue that rising jobless claims could result in account disconnections. So, once AT&T’s Q2 results are out, the first order of business should be to track its subscriber adds across its wireless and broadband products.

AT&T has been consistently adding subscribers across connected devices, postpaid and prepaid mobility offerings. Although its reseller division lost subscribers in the last several quarters, the pace of these subscriber losses has dramatically reduced of late and a similar improvement this time around could very well be its turnaround quarter. I personally believe that one bad quarter of macroeconomic uncertainty isn’t enough to trigger widespread customer disconnections for AT&T. Hence, for Q2, I’m expecting the company to add subscribers in all four of its mobility divisions.

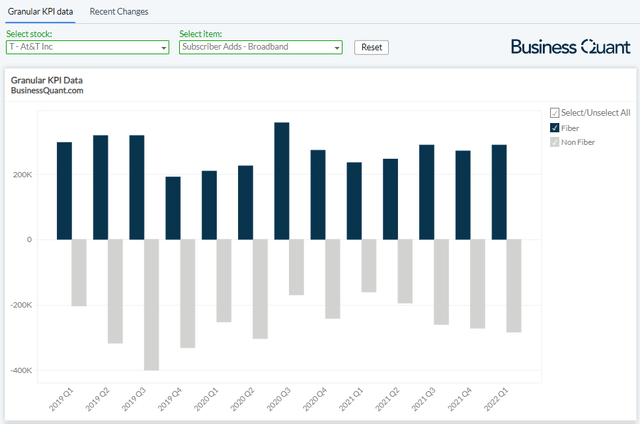

Besides, our database at Business Quant reveals that AT&T has been consistently adding fiber broadband subscribers and losing non-fiber broadband subscribers. This is actually a good dynamic to have as the latter has high maintenance capital and operating expenditures involved. Plus, the latter has lower speeds due to copper broadband’s inherent data transmission limitations, which reduced AT&T’s competitiveness and limits its room for price hikes. Fiber broadband addresses these concerns which is why it’s in the best interest of AT&T’s shareholders if the company’s fiber subscriber additions remained at elevated levels in Q2 as well. So, also look out for this metric.

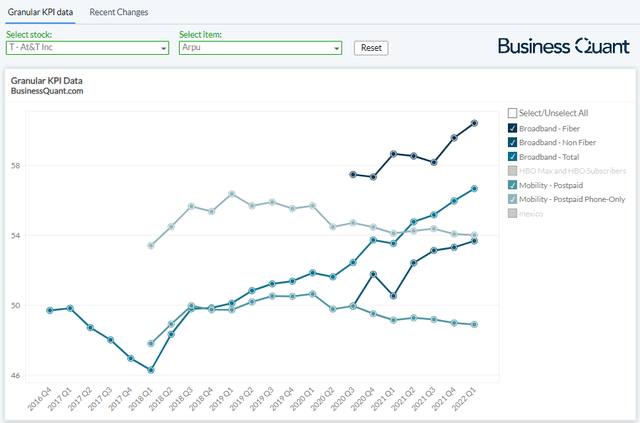

Lastly, pay attention to AT&T’s average revenue per user (or ARPU) across different categories. This indicates how well is AT&T able to monetize its subscriber base. A dropping ARPU figure suggests that the company is slashing its prices to remain competitive, or its subscribers are downgrading their subscription plans. Conversely, a rapid growth in the ARPU figure suggests that the company is hiking its prices and/or a broad swath of its customers are upgrading their subscription plans. So, the ARPU figure is a good gauge to measure the operating performance of telecom companies such as AT&T.

As AT&T continues to add fiber subscribers and drops non-fiber subscribers, I expect its blended broadband ARPU to continue rising at a rapid rate (at least by $1) in each of its upcoming 3 to 4 quarters. But other than that, the telecom behemoth’s postpaid ARPU declined in recent quarters, in spite of its aggressive investments in the wireless 5G space, which points to intensifying competitive pressures from other wireless service providers.

I expect AT&T’s mobility ARPU to decline in Q2, in-line with the declines posted during prior quarters. The rising jobless claims might just prompt a portion of AT&T’s subscribers to limit, if not completely slash, their telecom-related discretionary spending. So, pay attention to AT&T’s ARPU figures when the company reports its Q2 results on Thursday. But having said that, let’s now shift attention to AT&T’s financials.

Bifurcated Financials

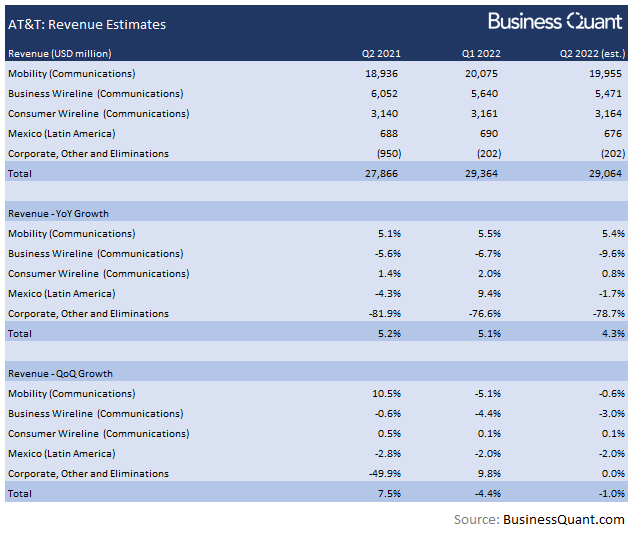

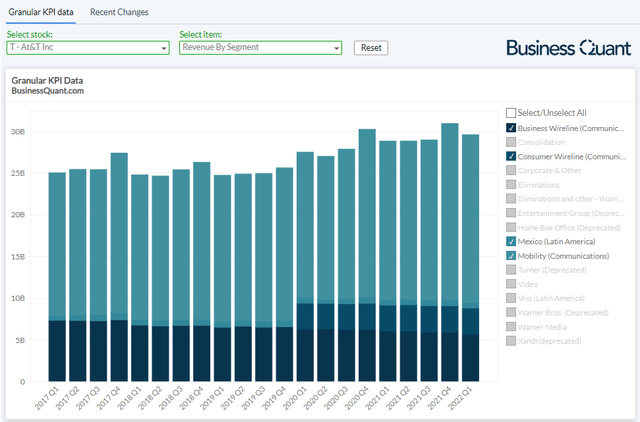

AT&T generates its revenue from Mobility, Business Wireline, Consumer Wireline and Mexico/Latin America segments.

It’s worth noting that AT&T’s Mobility division has an element of cyclicality to it. The segment’s revenue has sequentially declined in 4 of its prior Q2s in the last 5 years alone, with the decline averaging at around 0.6%. So, I expect this trend of cyclicality to continue in AT&T’s upcoming Q2 results as well and forecast its mobility revenue to come in at around $19.95 billion.

The telecom giant’s consumer wireline revenue seems to have plateaued in recent quarters and I expect it to remain more or less flat sequentially, at $3.16 billion. Its business wireline revenue has been on a continuous decline, even as workplaces reopened over the last 12 months across the US. In fact, the pace of this segment’s revenue decline actually accelerated in Q1 FY22. So, as far as Q2 FY22 is concerned, I’m expecting this revenue stream to decline 3% sequentially and post revenue of $5.47 billion.

Assuming AT&T’s corporate and eliminations figure remains flat sequentially, we arrive at a total company-wide revenue estimate of $29.06 billion for Q2 FY22. To have a fair comparison, I’ve removed the financial contribution from divested and/or discontinued operations in AT&T’s prior quarters, in the table below. With that said, my Q2 revenue estimate is coincidentally within range of the Street’s forecasts spanning from $28.9 billion and $30.5 billion.

BusinessQuant.com

But having said that, investors must also closely listen in on AT&T management’s guidance for Q3 FY22 and for the rest of the year. The earnings season has just begun and managements of telecom companies, in general, are yet to issue their outlooks for Q3. Specifically, how are AT&T’s financial and operating results likely to be affected due to the rising jobless claims and the intensifying inflationary pressures.

Final Thoughts

There’s no denying that AT&T has made the right moves by divesting certain businesses to cut down on its debt levels and to focus on its telecommunications business. However, these times of economic uncertainty bring along challenging operating conditions for the telecom giant, for the time being at least. So, as far as AT&T’s Q2 is concerned, investors should closely monitor its subscriber adds, ARPU, bifurcated financials and its management’s outlook for Q3 and for the rest of the year. These items will highlight how AT&T is positioned to perform in a recessionary environment and are likely to influence where its shares head next. Good Luck!

Be the first to comment