Toby Jorrin

Since reaching its all-time high shortly before the dot-com crash of the early 2000s, AT&T (NYSE:T) stock has gone through a series of cycles. From 2000-2003 it fell from over $40 to ~$20 a share. It then slowly climbed back to ~$30 a share until falling again during the financial crisis of 2008. AT&T repeated this cycle until 2016 where since the stock price has depreciated by ~30%. Naturally, this raises the question: Why have AT&T shares not continued their predictable pattern of appreciation? The reason is simple, the failure of the telecommunications industry to diversify into the media business.

In the last decade, AT&T, Verizon (VZ), and other communication services conglomerates began to acquire media businesses in the hopes to bundle their existing telecommunication products with media services. For AT&T, this involved acquiring both DirecTV and TimeWarner. Unfortunately, like much of the industry, this newfound media segment has been largely unsuccessful. These two acquisitions and management’s subsequent investments into their new business segments created massive amounts of debt and bottlenecked top-line revenue growth.

Thankfully, in the last two years, rationality has prevailed and AT&T has spun-off both DirecTV and TimeWarner. Using the cash from its spin-offs and diverting funds back into its legacy business, AT&T has the opportunity to grow margins through reduced operating expenses, pay down its debt, protect its dividend, and return top-line revenue growth and investor confidence.

Company Profile & Firm Evolution

As most are aware, AT&T is a global communications conglomerate that provides telecommunications, media, and technological services. It is an entrenched market leader in the core communications industry providing service to more than 434 million U.S. customers, including 250+ million in their 5G networks. Moreover, it is the world’s largest telecommunication company by revenue and the largest provider of US mobile telephone service by sub-count.

Statista

However, as previously mentioned, AT&T has expanded past telecommunication and into the media business. This started in 2015 with the acquisition of DirecTV for $48.5 billion ($67 billion with debt) motivated by hopes of bundling the national pay-TV company with its wireless service. The next year, AT&T announced its intention to purchase TimeWarner for $85.4 billion. This vertical integration was disputed by the US Justice Department which claimed the combined company would use Time Warner’s networks to hinder its rivals from distributing those networks and slow the industry’s transition to new video distribution models. Eventually, the court ruled in favor of AT&T, and the transaction was completed in 2018 for a new total of $108 billion.

Consequently, management proceeded full steam ahead in transforming its new business segment. Launching HBO Max, and rebranding TimeWarner as Warner Media, AT&T invested heavily in their attempt at diversification and a Direct-to-Consumer Distribution (D2C) business model. However, as mounting debt started to limit its ability to compete with larger streaming giants like Disney and lackluster growth in their WarnerMedia began to materialize, AT&T accepted the failure of its M&A strategy. In the last two years, AT&T reversed its M&A through the completion of two spinoffs. First, they spun off video properties of DirecTV, AT&T TV, and U-verse into a new company it would co-manage with private equity firm TPG Capital. Then in early 2022, they successfully spun off their WarnerMedia segment which was then merged with discovery to form Warner Bros Discovery.

With these things in mind, let’s take a look at how AT&T’s business model and financials break down before and after the spinoffs.

Financial Overview

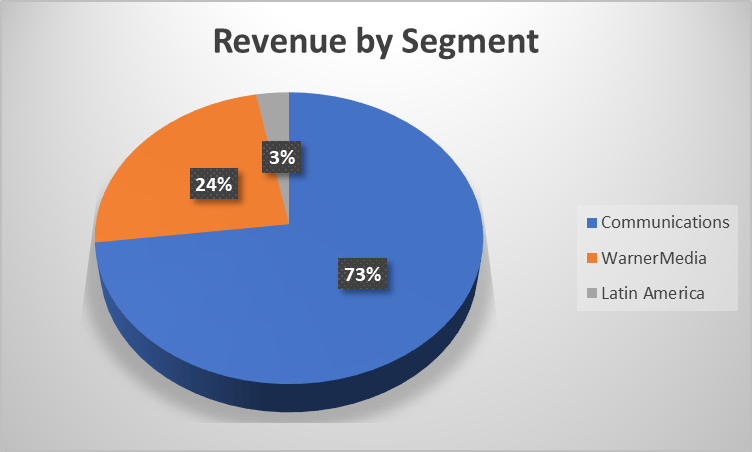

Prior to the spinoff, AT&T had three total revenue streams: Communications, WarnerMedia, and Latin America. As shown by the graph below, the vast majority of total revenue is driven by the Communications and WarnerMedia segments (73% and 24%, respectively).

2021 10-K

The communications segment consists of three subsegments: mobility, business wireless, and consumer wireless. Mobility includes nationwide wireless services and equipment; business wirelines includes advanced ethernet-based fiber services, IP Voice, and Managed professional services & traditional voice and data services; and Consumer Wireless includes broadband services (fiber connections) & legacy telephone voice communication services. The WarnerMedia segment develops, produces, and distributes feature films, television, gaming and other content globally. WarnerMedia was distributed through basic networks, Direct-to-Consumer (DTC) or theatrical, TV content and games licensing. It also included Xandr advertising and Otter Media Holdings (Otter Media).

During these years, company financials were unpredictable. While gross and EBITDA margins remained relatively flat, top-line revenue had large swings from moderate growth to moderate contraction. All the while, total debt soared from $165 billion (EoY 2017) to $208 billion (EoY 2021). However, after the completion of the spin-offs, both revenue segments and company financials have changed dramatically. Communications revenue now represents the vast majority of total revenue (97%) and by using money from the spinoff, total debt has fallen to $160 billion whilst the company has been able to make new pledges to pay back its creditors.

On the revenue side, its recently released Q3 earnings report and revised FY guidance have demonstrated the success of its new business model. Revenues for the third quarter totaled $30.0 billion versus $31.3 billion in the year-ago quarter, down 4.1% reflecting the impact of the U.S. Video separation in July 2021. Excluding the impact of U.S. Video, operating revenues for standalone AT&T were up 3.1%, from $29.1 billion in the year-ago quarter. Confident in the demonstrated strength of their legacy business model, management is now projecting low single digit, revenue growth and mid-single-digit EBITDA and EPS growth, a far cry from the mediocre performance ups and downs in revenue and constant margins of the last few years.

Yahoo Finance

The market reacted very positively to this news, rising 18.8% this October. This is a clear demonstration of the possibility of share price increases as AT&T continues to prove its ability to reach projections and slim down debt.

Investment Thesis

With all this in mind, AT&T is a good buy due to a variety of factors, most associated with the strength of its communications segment and its spinoff. As previously mentioned, AT&T has now created a streamlined business model focused on its communications portfolio, a segment in which it possesses three critical competitive advantages over peers.

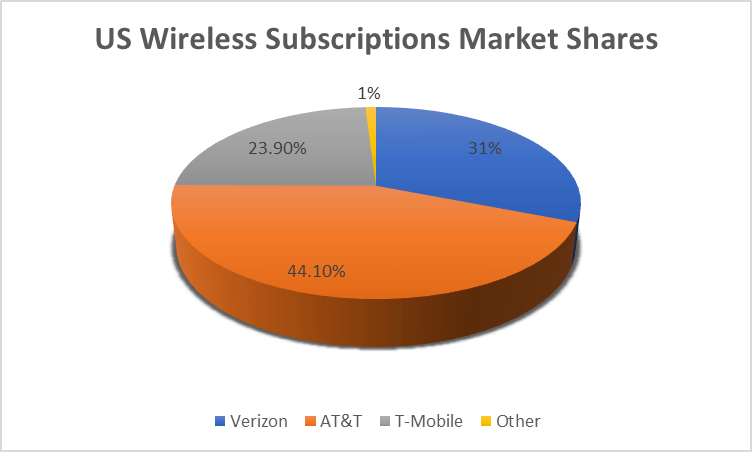

For one, they possess an entrenched position and scale. AT&T has an industry-leading market share, with a 44.1% share of US wireless subscriptions. This provides a significant moat, considering the money that is required for new entrants to develop proprietary networks. These advantages are only made more evident by their early involvement with the development of 5G. Its robust wireless network with its investment in 5G technology and expansion in its fiber capabilities is demonstrated in two critical factors of RBOC’s: Wireless sub-growth and EPS growth/EBITDA margin expansion (Analyst Consensus: 3% y/y eps growth for next 3-5 years). Through this part of 2022, AT&T has created 1.6 million phone additions vs 24k loss for Verizon and is expected to grow margins ~3% each year, higher than its peers.

Another advantage is its lowest industry churn. Their Q3 earnings report showed a postpaid churn of 1.01% vs 1.10% for Verizon. Additionally, they reported postpaid phone-only churn of .84%, vs .88% for Verizon and T-Mobile. Historically, AT&T has led in this department and retained customers better than anyone else in the communications space. With an increase in focus and investment in this space, it is very likely to see that churn increase.

Lastly, they possess leading fiber capabilities. Their fiber network is in 21 different states and reaches an industry-leading 18.5mm eligible customers. The only competitor that has more than half of AT&T’s eligible customers is Verizon with 15mm eligible; no one else has even half. However, even Verizon fails to offer competitive maximum speeds (5Gpbs vs 940 Mbps). This also means for plans of similar speeds, AT&T is the more competitively priced option.

In addition to their competitive advantages, AT&T is a strong defensive play in times of economic uncertainty. It is located in a cemented and necessary industry that can continue to turn profits despite recessionary or inflationary environments. This is only amplified by the healthiness and strength of the wireless telecommunication industry. It continues to grow subscribers and usage with global smartphone users growing at 2.3% CAGR through 2030 whilst holding off new competitors with its high barriers to entry and low threat of new entrants. Additionally, AT&T provides strong cash flow benefits to investors with an impressive dividend yield of 5.99%. This means that even if AT&T share price remains relatively flat, investors are guaranteed at least a near 6% of cold, hard cash.

Valuation

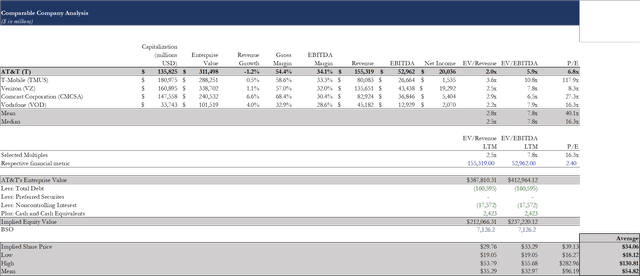

Taking a deep dive into AT&T, it is clear that is trading at a discount on a relative basis and intrinsic value basis. On the relative valuation side, AT&T has four very similar comparable companies: Verizon, T-Mobile, Comcast, and Vodafone. Verizon and T-Mobile (recently merged with Sprint) are both telecommunication giants which compete heavily against AT&T in domestic markets whereas Vodafone provides comparable products in European markets. On the other hand, Comcast competes with AT&T in the home services and fiber industry.

As demonstrated below, I used the LTM multiples for EV/Revenue, EV/EBIDTA, and P/E to perform the relative valuation. After calculating the median multiples for the four, I applied the multiple to the respective financial metric to determine the implied enterprise value and implied share price using each method. Averaging these prices, AT&T has an implied share price of $34.06.

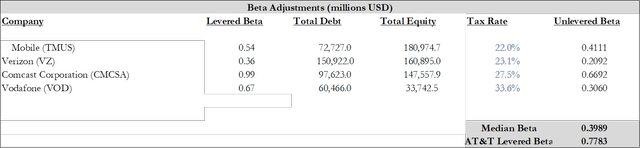

On the intrinsic valuation side, I started by calculating AT&T’s levered beta (0.7783) through unlevering its comps betas to find the median and relevering the median unlevered beta.

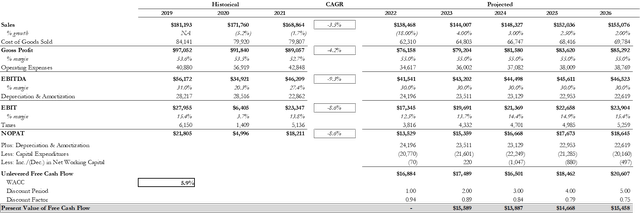

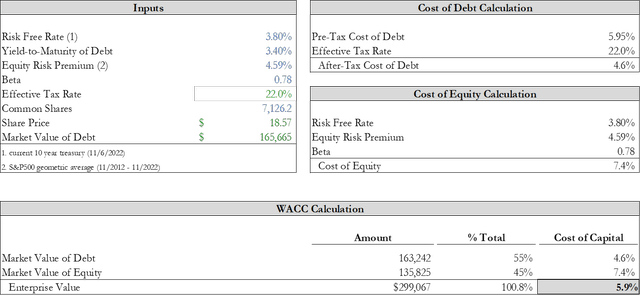

Then, I utilized AT&T’s levered beta, the current 10-year treasury yield, and an equity risk premium of 4.59% amongst other financial metrics to arrive at a WACC of 5.9%.

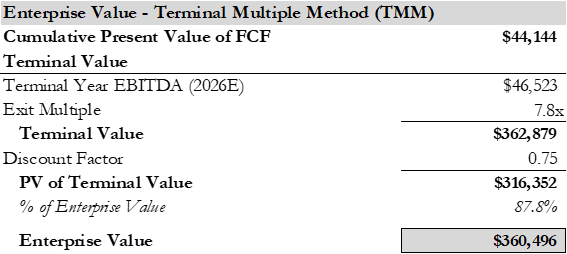

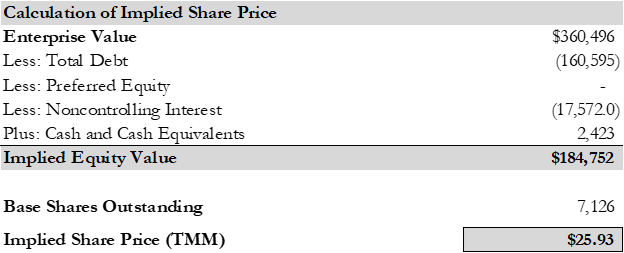

Using historical data, and this year 10-Q’s, I project an 18% decrease in top-line revenue for the year. Following that, revenue growth will be at 4% y/y until scaling down to 2%. EBITDA will reach a consistent 30% margin as a percentage of revenue and D&A will drop to close to around 14% of top-line revenue (note: EBIDTA margins are conservative estimates due to concerns with 5G expansion costs noted in the risks section of this article). With all this in mind, we reach a terminal year EBITDA of $46.253 billion and a present value of free cash flow of $44.144 billion. Using the median EV/EBITDA multiple from the comparable companies, we arrive at an enterprise value of $360,496 and an implied share price of $25.93.

DCF Terminal Multiple Method Share Price-TMM

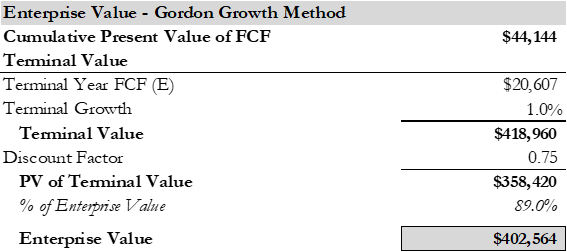

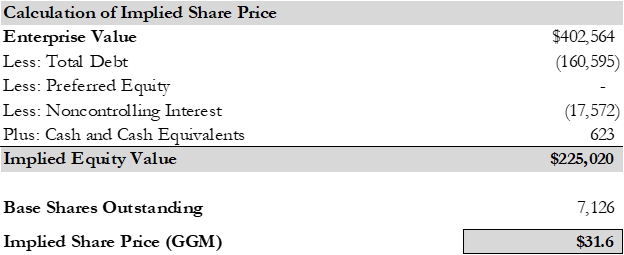

Now we calculate the share price using the perpetuity growth method. I assume a 1% terminal growth rate due to the low beta and historical revenue growth of the company. With our terminal year FCF of $20,607, it yields an enterprise value of $402,564 and an implied share price of $31.60.

Gordon Growth Method Share Price-GGM

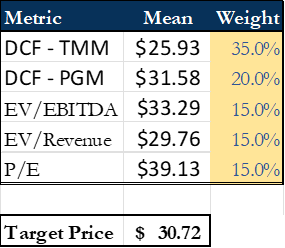

Lastly, to come to a final target price, a weighted average metric will be used. Due to the similarity of AT&T and the companies used in its relative valuation, the terminal multiple method and financial ratios were weighted more heavily. As demonstrated below, this yields a target price of $30.72, a 62.28% upside from its current market price of 18.93 (11-16 market close).

Weighted Average

Risk Factors

Despite the clear possibility of upside, shareholders should be aware of there are three main risks.

For one, there could be market share concerns due to the highly competitive nature of the industry. Competitors like T-Mobile and Verizon are aggressive at trying to capture market share and the growing demand for high-speed data services puts pressure on pricing and margins. However, there are multiple mitigants that reduce this risk. For one, AT&T’s industry-leading churn demonstrates the stickiness of its offerings, making it difficult for competitors to steal away market share. Secondly, AT&T’s streamlined focus and record levels of investment into 5G and fiber make them more competitive than ever before.

Another risk that AT&T faces is a more macro one. With current economic uncertainty, consumers may cut back on consumption spending by delaying hardware purchases or switching to telecommunication resellers like Boost Mobile. In this environment, AT&T would struggle to reach management goals of top-line revenue growth that are critical to returning shareholder confidence. This risk is mitigated by two factors: the rising necessity of the telecommunications industry and the spin-off. In our highly digitalized and communicative society, mobile communications have become a less elastic industry as consumers simply cannot afford to be without cellular or internet services. Additionally, following the spinoff, AT&T is positioned to have even more reduced revenue risk by ridding themselves of a highly unnecessary industry: media & subscription services.

Finally, AT&T faces the risk of future spectrum acquisitions. The costs associated with spectrum have continued to rise over time and if they continue it could eat into its bottom line. Spectrum costs are critical to the 5G rollout and could pose a barrier to expansion. Despite this, the company already has a substantial market portfolio with C-Band spectrum, limiting the impact of rising spectrum costs. Also, spectrum costs affect the industry as a whole and are not specific to AT&T; therefore, it is an overall risk for the telecommunications industry as a whole and will not disproportionately affect AT&T.

Conclusion

In times of economic downturn, it is important to turn to proven players in mature industries. AT&T fits that description well while offering opportunities for capital appreciation on top of its significant 5.99% dividend that provides beneficial cash flow to shareholders. It is trading at a cheap price on a historical, relative, and intrinsic basis due to a loss in market confidence from a failed attempt to change its business model. With a reorganized business and key advantages over competitors, AT&T is a buy.

Be the first to comment