AndreyPopov

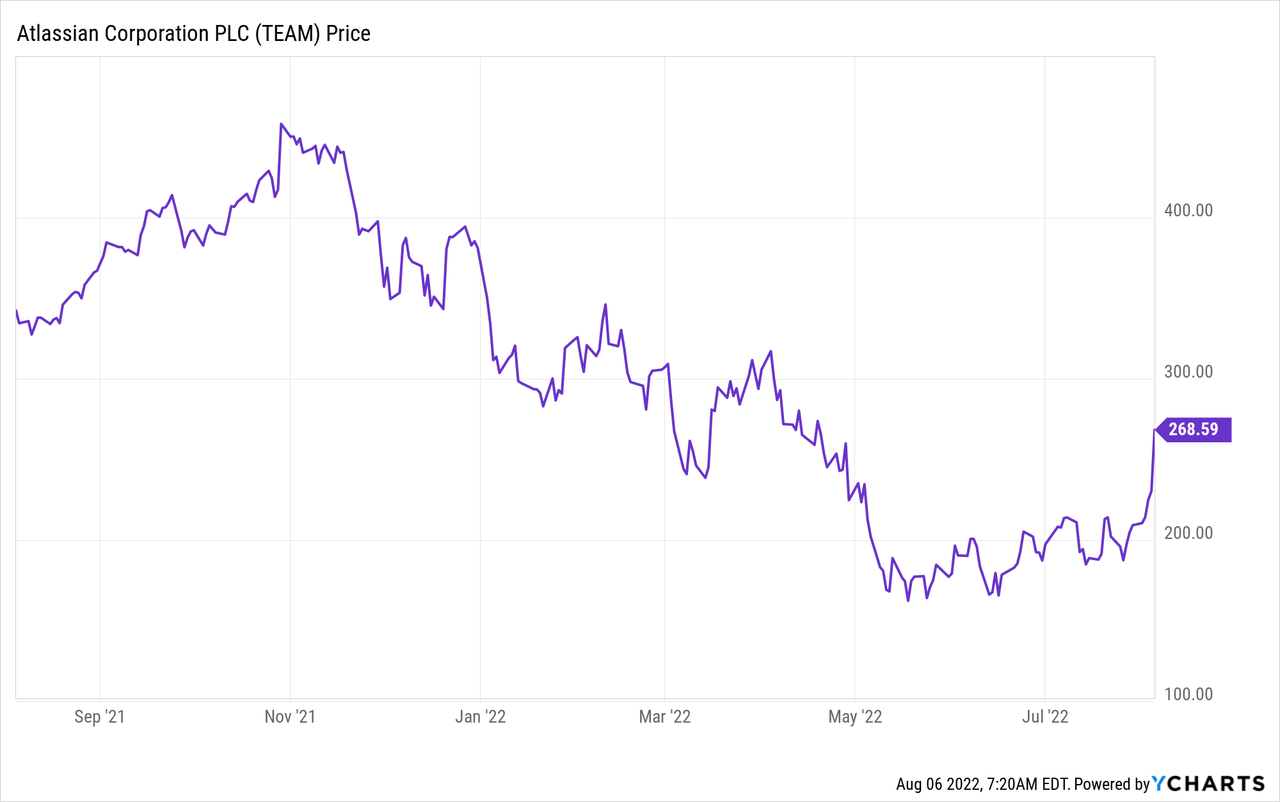

Atlassian (NASDAQ:TEAM) is a leading software company which helps others to manage the build of their own software. Its management believes customers are unlikely to stop using their platform even during recession, and so far their financial results back up this claim. Atlassian beat top line estimates for revenue growth in the quarter, and its platform has continued to invest strongly into R&D in order to stay at the cutting edge. The stock price popped by a monster 17% in 24 hours and is up 29.6% in the past 5 days. In this post, i’m going to break down the company’s business model, its recent earnings report and calculate the valuation, let’s dive in.

Business Model

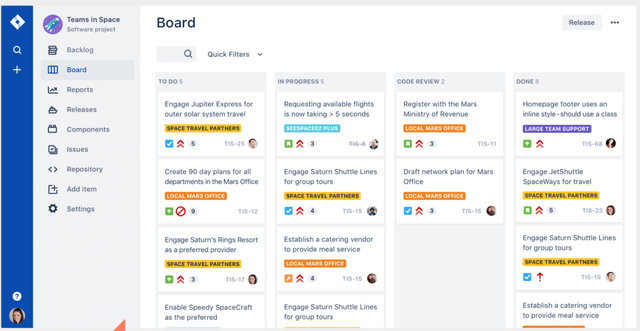

Founded in Australia in 2002, Atlassian created a software platform which pioneered the “Agile” development methodology. This allows teams to set requirements, design, test and then rapidly iterate to improve product features. Atlassian’s flagship Jira platform and Jira boards are a product management platform, which is used to manage this process. According to the 2021 State of Agile Report, Jira is the number one tool recommended by agile teams.

Atlassian Jira (Website Screenshot)

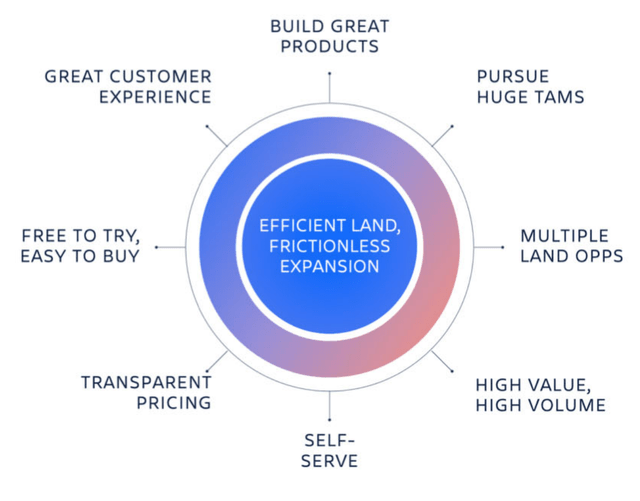

Atlassian has an efficient and “Low friction” go to market strategy which believes “software should be bought, not sold”. Thus the company’s Product Marketing Strategy, uses “Product Led” tactics to allow customers to try and start using product today, without any need to discuss with Sales reps. Atlassian can then expand accounts and benefit from upsells as customers use more features and become more embedded with the product.

Atlassian Go to Market (Atlassian )

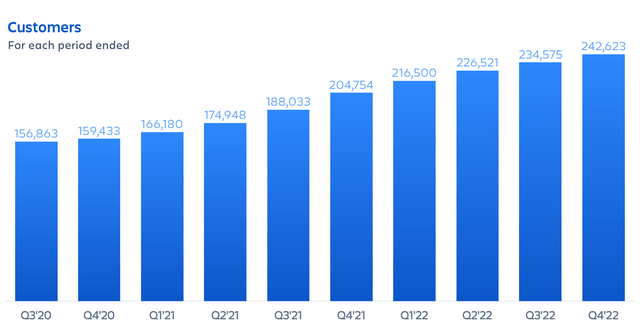

The company’s strategy has been working well so far, and they have expanded their customer base to 242,623 customers, up a rapid 18.6% year over year.

Atlassian Customers (Investor report)

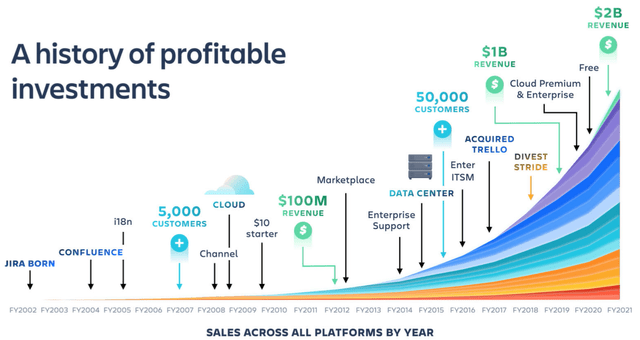

Atlassian has expanded it’s offering to provide software tools across three major markets; Agile/DevOps, IT service Management and Work Management, its mission is to “Unleash the potential of every Team”. To accomplish this the company has expanded its own team increasing headcount to 8,813 employees, up 2,300 over the year. In addition, Atlassian has been executing a “Growth by Acquisition” strategy very similar to Salesforce. In 2017, the company acquired workplace collaboration tool Trello. While more recently Atlassian has acquired Chartio now Atlassian analytics. This enables customers to bring all of their “Siloed” big data together into one place (Data Lake) and then query this data using “Visual SQL” which doesn’t require any code and thus is much more user-friendly, than many other Datalake providers.

Atlassian Investments (Investor Day Presentation)

Growing Financials

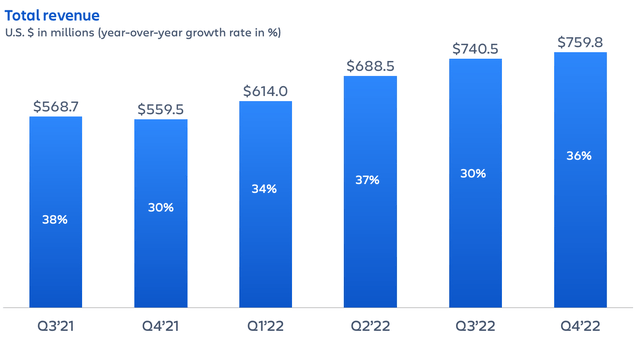

Atlassian reported strong financials for the quarter ending June 30th 2022. Revenue popped to $759.8 million, up a blistering 36% year over year and beating analyst estimates by $35.6 million. Gross Profit also showed strong growth, jumping to $627 million, up ~35% year over year.

Atlassian Revenue (Earnings Report)

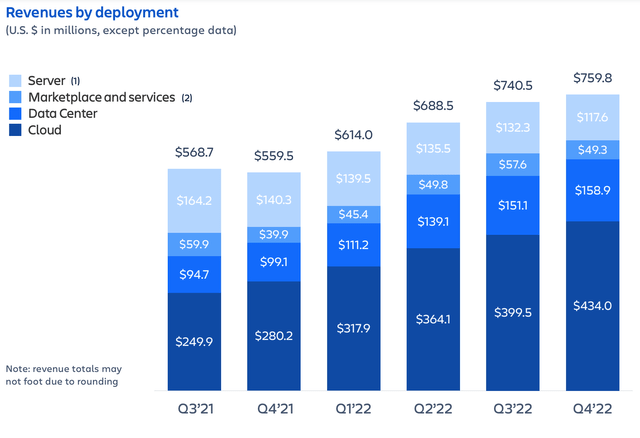

This revenue growth was driven primarily by Cloud ($434 Million) and Data Center Segments ($158 Million) which increased by a blistering 55% and 60% respectively. Data Center revenue growth was driven by “event-driven demand” as many customers purchased before the price increases which occurred into in Q3’22. In addition, Atlassian has plans to reduce “loyalty discounts” at the start of Q1’23 and thus this also promoted customers to upgrade packages sooner. Server revenue has been decreasing over the past few years, as the company discontinued sales of new Server licenses in Q3’21, but will continue to offer maintenance and support to Server customers until February 2024. Thus, overtime, the majority of its Server customers are expected to migrate to its Cloud based or Data Center offerings.

Revenues by Deployment (Q4 Earnings report)

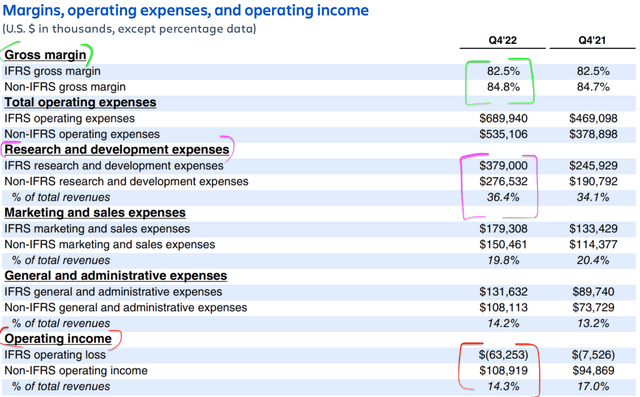

As a software company, Atlassian has a super high gross margins of 82.5% and thus generated $626.7 million in Gross Profit during Q422. However, the company is operating at a loss of -$63.3 million on an IFRS basis. This may make some traditional value investors fearful of the stock, but I think it’s makes sense to dive deeper. As you can see from the financial statement below, Atlassian invested 36.4% of its revenue ($379 million) into Research and Development. According to management, this is more than many of its competitors and a key strategy of its product marketing approach. By creating an exceptional product and allowing teams to start using it for free, they will use it, find value and tell friends. As a former product manager, I actually discovered Jira via this same method, as a software engineer informed me it would be great to use. Management could easily reduce this expense and thus be more “profitable” on a traditional basis, but this would also not be as tax efficient of a strategy.

The good news is Atlassian generated strong Free Cash Flow of $194.7 million in the fourth quarter of 2022. This equates to a Free cash flow margin of 26%, which is strong. The company has a solid balance sheet with $1.5 billion in cash. In addition to $1.3 billion in total debt which is manageable given the majority is long term debt and the company has positive free cash flow, with a low Capex business model.

Mixed Guidance

Moving forward, Atlassian is forecasting rapid Cloud Revenue growth of 50% per year for the next 2 years, driven by Cloud migrations and the digital transformation of businesses. Data Center revenue is expected to maintain a “high growth rate” in Q1’23, before “moderating” over the remaining three quarters of FY23.

Regarding the macroeconomic environment moving forward, management stated in their letter to shareholders.

We are not insulated from broader macroeconomic impacts. We are seeing a modest decrease in the conversion rates of Free instances upgrading to paid plans, but nothing we are seeing right now is changing our outlook.

The good news for Atlassian is over 90% of its revenue has been derived from existing customers, and they are expecting this trend to continue moving forward. A customer who is product managing a software project will be unlikely to halt the entire product or switch providers for such short term headwinds. However, as the company mentioned, new upgrades to paid plans may be delayed.

Advanced Valuation

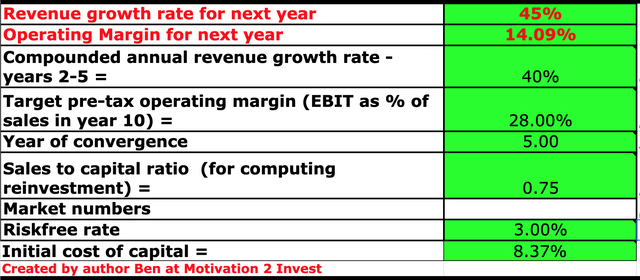

In order to value Atlassian, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted an optimistic 45% revenue growth for next year, driven by strong Cloud growth guidance. In addition, I’ve forecasted 40% revenue growth for the next 2 to 5 years.

Valuation Model (created by author Ben at Motivation 2 Invest)

I have optimistically forecasted the company’s operating margin to increase to 28% over the next 5 years as its R&D and Marketing spend starts to generate a return. Keep in mind, this includes an adjustment for R&D expenses, which I have capitalized to increase the accuracy of the valuation.

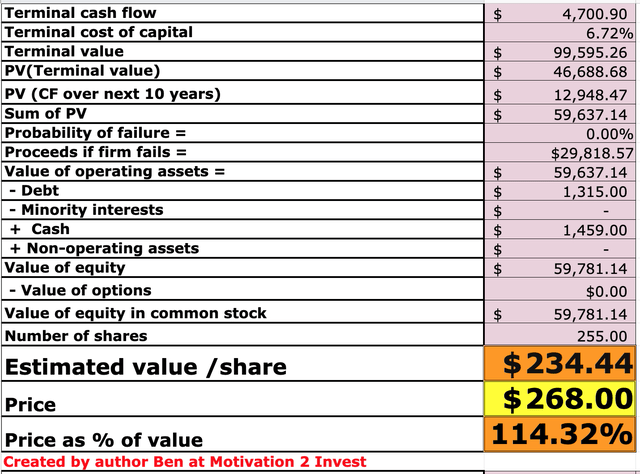

Atlassian Stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $234 per share, the stock is trading at $268 per share and thus is ~14% overvalued at the time of writing.

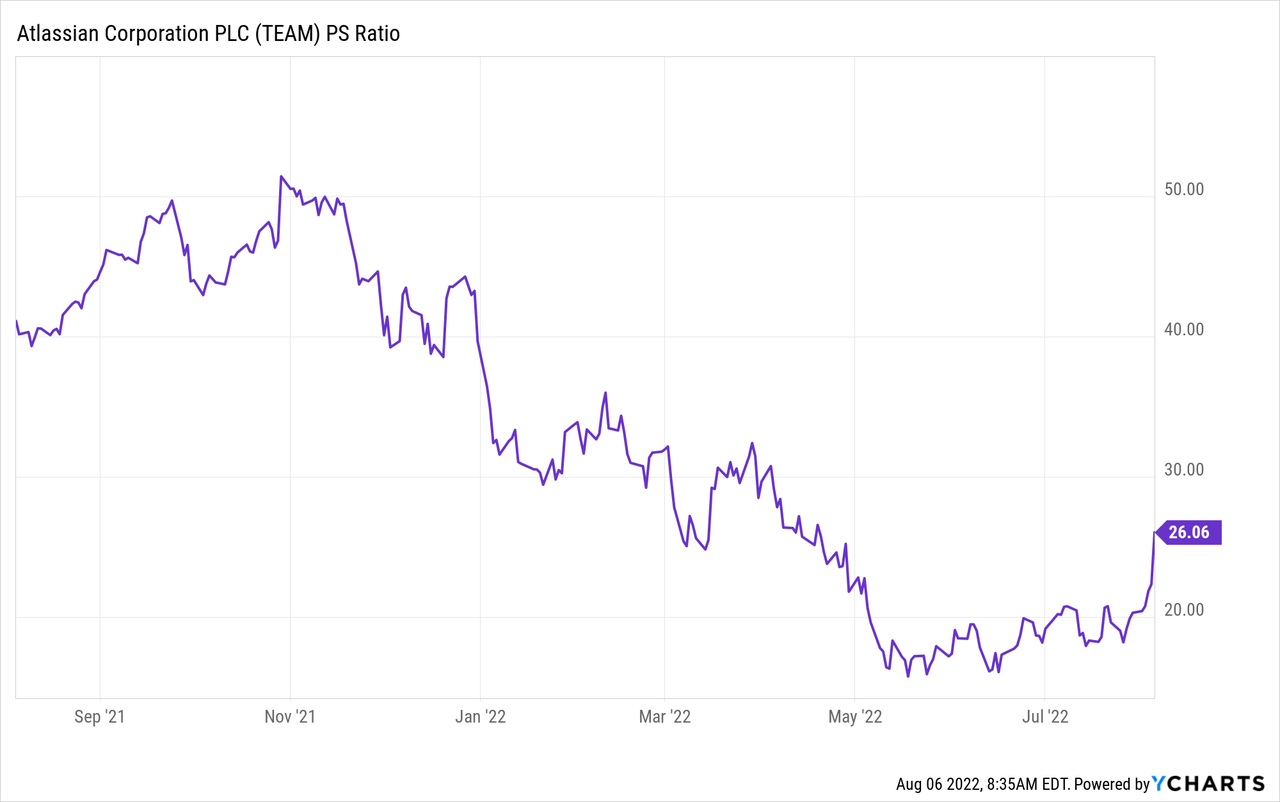

As an extra data point, Atlassian trades at a Price to Sales Ratio = 24.27, which is approximately 5% cheaper than its 5-year average.

Risks

High Valuation and Recession

Atlassian trades at a high intrinsic valuation, and the stock price has popped by ~46% in the past couple of weeks alone. As a contrarian investor, I prefer to buy when others are selling and sell when others are buying. Atlassian is a tremendous company, but the market exuberance may be optimistic given the macroeconomic situation and the forecasted Recession.

Final Thoughts

Atlassian is a tremendous company, which has surpassed analyst expectations and continued to perform strong in the prior quarter, despite macroeconomic challenges. However, the current valuation is just a little too spicy for me right now and given the competition for SaaS platforms which includes; Asana, ServiceNow, Monday.com etc., I deem the stock to be a “Hold”. In addition, one must think about the opportunity cost of buying Atlassian vs. other “cheaper” stocks on the market (feel free to follow and read my other posts).

Be the first to comment