by-studio/iStock via Getty Images

Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) is a leader in RNAi therapeutics. RNA interference, or RNAi, as its name implies, is one way to stop the body from producing a wrong, harmful protein by interfering with the genetic process that produces proteins.

Just to put things in context, and to do this in the most non-technical language possible, there are two basic ways to genetic modification. One is by adding something that then produces a good protein, and second is by removing something that would have produced a bad protein. Sometimes this process is reversed – so you add something (like a stop codon, a code that tells the process to stop working) to block the production of a bad protein, and sometimes you may remove something to produce a good protein. RNAi is classified into the second category; it removes something to stop the production of a bad protein.

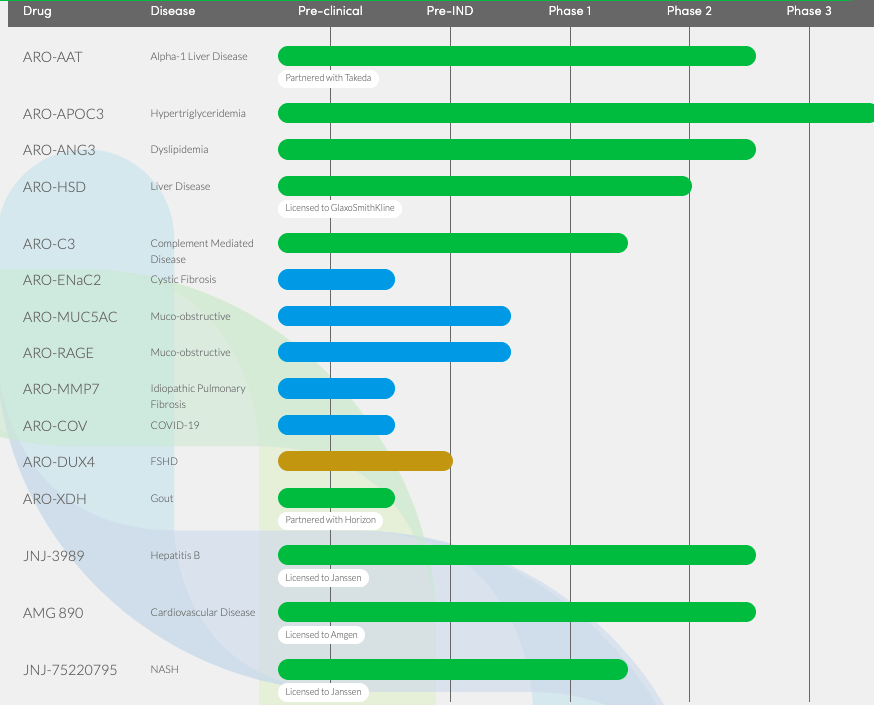

Arrowhead has a vast pipeline based on the RNAi platform, and it is slowly bringing its therapies to regulators. The entire pipeline is here:

ARWR Pipeline (ARWR website)

Late stage candidates are ARO-AAT for Alpha-1 liver disease or A1AD, ARO-APOC3 for hypertriglyceridemia, and ARO-ANG3 for dyslipidemia. Two other assets, licensed to Janssen and Amgen respectively, are in phase 2.

ARO-AAT for Alpha-1 liver disease or A1AD

I discussed ARO-AAT a year ago. At that time, it had just concluded a phase 1 trial in healthy volunteers, whose reduction in serum AAT indicated the drug’s efficacy. In 2019, they had also begun an adaptive phase 2 trial called SEQUOIA, which will topline in mid-2023 under a fast track status. Data from a small cohort of patients, 4 in number, was available at that time. Data showed that treatment with ARO-AAT resulted in consistent reductions of the disease-causing Z- AAT protein and improvements in clinically relevant biomarkers of liver disease.

An update from an interim 48-week liver biopsy results from the AROAAT2002 study, an open-label Phase 2 clinical study of ARO-AAT, was available in April 2021. It showed the following:

After 48 weeks of treatment with investigational ARO-AAT in cohort 2 (n=5) of the AROAAT2002 study, the following results were observed:

-

Four of the five patients achieved a 1 or greater stage improvement in Metavir fibrosis stage, with no worsening of fibrosis in the fifth patient

-

All five patients demonstrated reductions in histological globule assessment scores

-

Total intra-hepatic Z-AAT decreased by 77-97%

Interesting to note what Javier San Martin, M.D., chief medical officer at Arrowhead, said: “…The results from 24 and 48 weeks of treatment also indicate that when production of the Z-AAT protein is inhibited, the liver has the ability to clear the accumulated mutant protein and begin the fibrosis regression process earlier and more efficiently than we anticipated, even in patients with severe liver disease…”

Improved and additional data from the same trial was presented at AASLD in November. However, more importantly, just yesterday, phase 2 data from an open label study of the same asset was presented in the New England Journal of Medicine. Key points were:

-

Fibrosis regression observed in 58% (7 of 12) of patients receiving 200 mg fazirsiran

-

Median reduction of 83% of Z-AAT accumulation in the liver

-

Reduction of 69% in histologic globule burden

-

Substantial and sustained improvements in clinically relevant biomarkers of liver health

In this context, here’s what the principal investigator said:

“There is currently no specific treatment for liver disease associated with AATD. The results from the AROAAT-2002 study provide multiple lines of evidence that preexisting liver damage in these patients may be meaningfully improved following treatment with fazirsiran,” said Pavel Strnad, M.D., Professor at University Hospital RWTH Aachen and principal investigator of the AROAAT-2002 study who presented the data at EASL. “Specifically, the improvements in histological globule burden, reduction in histological signs of portal inflammation, normalization of elevated liver enzymes, and improvement in liver fibrosis are all encouraging indicators that fazirsiran may rapidly ameliorate liver injury. It also speaks to the exciting innovation going on in the field, that an siRNA therapeutic specifically targeted into the liver has the potential to address a previously untreatable liver disease”

Data from the larger SEQUOIA trial is still awaited.

ARO-APOC3 for hypertriglyceridemia

ARO-APOC3 is dosing in a 60-patient Phase 3 PALISADE study, to evaluate the efficacy and safety of ARO-APOC3 in adults with familial chylomicronemia syndrome (FCS). This is a placebo-controlled study with subcutaneous dosing. The primary objective of the study is to evaluate the change from baseline in triglycerides between each ARO-APOC3 dose and pooled placebo at month 10. The study will take about 1 year to complete. FCS is a rare genetic disorder that prevents the body from breaking down fats consumed through the diet, or triglycerides.

Earlier, in November, this asset produced data that showed that in patients with sHTG, ARO-APOC3 was well tolerated, and consistently decreased APOC3, TG, and non-HDL-C, and increased HDL-C, independent of underlying genetic cause of HTG.

ARO-ANG3 for dyslipidemia

This asset has a phase 2 trial ongoing in 180 patients with mixed dyslipidemia. This trial will topline in mid 2023 – enrollment is completed. A second small study in Homozygous Familial Hypercholesterolemia (HOFH) is being run in Canada.

Way back in 2020, this asset produced positive data in healthy volunteers.

Financials

ARWR has a market cap of $3.6bn, down almost 50% from where it was last year. Cash balance is $603mn. Revenue for the March quarter was $151.8 million, mainly from GSK, Takeda and Horizon. Total operating expenses for the quarter were $110.3 million, which includes $76mn in R&D expenses and $35mn in G&A. At that rate, the company has a cash runway of 5-6 quarters, without taking into account any further revenue, which may occur chiefly from collaborations.

Horizon Pharma (HZNP) made a $700mn licensing deal, $40mn upfront, while GSK (GSK) inked a $1bn deal, $120mn upfront.

Bottom Line

Last year, ARWR was uninvestable. At $7+bn market cap, with a yet-unproven platform, multiple assets none of which had been proven in a large trial, or had been commercialized – ARWR was risky in 2021.

In 2022, ARWR shed half its valuation while moving up the regulatory ladder twice the distance it was last year. By a rough calculation, that makes it four times more investable- relatively speaking – than it was last year. But does it make it investable in absolute terms?

I don’t think so.

First, these are unprecedented times, and nobody knows where we go from here. Second, ARWR has so many assets we can afford to let one of them cross the regulatory mark before we consider investing; that is to say, let one of them prove the platform is good, then we can invest in the platform. Third, ARWR is difficult to fathom; there are too many assets, too much going on, and too little focus on data from a late stage trial of a lead asset.

Given all of the above, I have chosen to stick to the sidelines.

Be the first to comment