hanibaram/iStock via Getty Images

Applied Materials (NASDAQ:AMAT) reported earnings a good quarter in its earnings call on August 18, 2022, and importantly expects weakening demand from memory chip makers while providing upbeat guidance.

Adjusted earnings came in at $1.94 a share on sales of $6.52 billion. Wall Street had expected earnings of $1.78 a share on sales of $6.27 billion. The stock had initially climbed on the earnings release. AMAT stock had retreated 29% thus far in 2022.

There are two interesting comments coming out of AMAT management I thought amusing:

1. In the company’s press release, CEO Gary Dickerson wrote:

“We feel confident in our ability to navigate macroeconomic headwinds and remain very positive about the long-term strength of the semiconductor market and our outsized growth opportunities.”

Three days earlier on August 15, 2022, I wrote a Seeking Alpha article entitled “Applied Materials: Navigating 2 Successive Equipment Downturns.”

Coincidence? The second “coincidence” is that in my above referenced article I noted:

“AMAT announces F3Q earnings after market close on August 18, 2022. Be aware that since new AMAT management, the term pushout has not once been used in an earnings call. I alert readers to this, because pushouts of equipment are in the works in other semiconductor equipment companies, and this oversupply of consumer electronics products will hit AMAT harder than those companies announcing the previous month.”

As true to form, Dickerson in the earnings call stated:

“The changing macroeconomic environment is causing some customers to adjust the timing of their investments.”

CFO Brice Hill didn’t use the expression pushout in the earnings call stating:

“We believe some of our customers will moderate their capacity additions in areas that have been impacted by weak consumer spending.”

Applied Materials, Inc.’s CEO Gary Dickerson on Q3 2022 Results – Earnings Call Transcript

Even Jefferies Mark Lipacis prodded both executives using the term “push” but got the talk around when he asked:

“I think you used the expression adjusting the timing of the orders. So do you push there, are you able to, like, take the slot that you have allocated for them and push them back a quarter or two or do you — at some point, do you just say, listen, we can’t push this back anymore, you either got to take it or go to the end of the line.”

Ditto for analyst Timothy Arcuri of UBS who asked:

“Around some of the mixed signals around what’s happening this time around, and on one hand, customers are pushing out, but you also mentioned that you are getting long-term commitments from some other customers. I was wondering what that means, because it kind of sounds like you are confident that foundry/logic is going to hold up at this time even as memory pushes out and that’s not usually how it works.”

Again, a talk around. No indication of a “push” despite Lipacis and Arcuri indicating competitors are seeing them. That means one of three things:

- AMAT’s memory customers are smarter than competitors’ memory customers, but I noted in my above Seeking Alpha article that Micron (MU), Samsung Electronics (SSNLY), and SK Hynix (OTC:HXSCL), the Top 3 companies, are or will consider capex cuts, so that doesn’t work.

- AMAT just can’t use the term “push” because of the negative connotation and management, which has been losing market share to competitors since they took over, including moving $331 million from 2018 to 2019 to pump up share, are desperate to maintain an image of success.

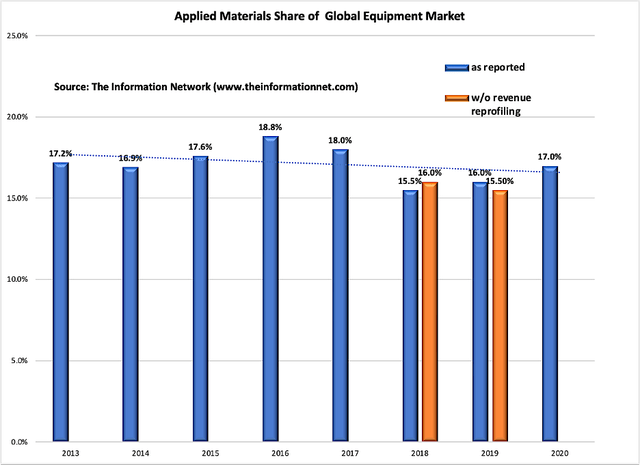

- AMAT is better than competitors, yet in numerous Seeking Alpha articles, I have pointed out time and time again AMAT is losing share to competitors, as shown in Chart 1, according to The Information Network’s report entitled: Applied Materials: Competing Analysis of Served Markets.

Chart 1

Key Financial Metric

Although AMAT’s shares increased after hours following its earnings call, as of close of the next day, shares retreated down 3.36%.

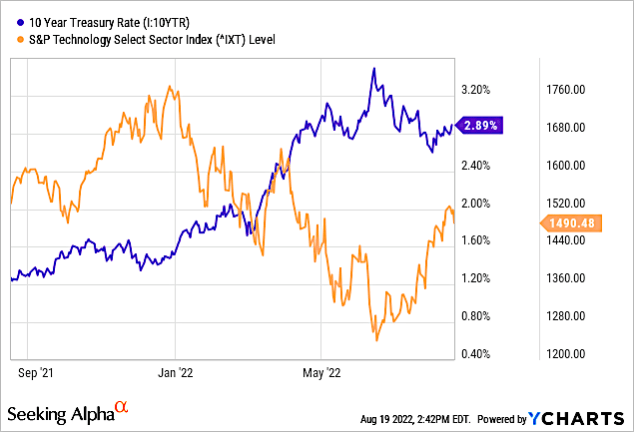

Why. Because the 10-year Treasury Rate increased, and there is a direct correlation between the 10-year and technology share performance. I have been discussing the 10-year in a series of several Seeking Alpha articles, such as my July 1, 2022, Seeking Alpha article entitled “Why Are Tech Stocks Selling Off And What Is The Outlook?” where I noted that during this period, the S&P Technology Select Sector Index (IXT) dropped about 30% until June 16, as seen in Chart 2.

YCharts

Chart 2

I had noted in my article:

“This correlation has been strong in 2022. Although analysts at Morningstar found minimal correlation between the 10-year treasury and technology stocks over a 15-year period, since January 2022 the rise in the 10-year due to inflation fears has significantly impacted technology stocks. Thus, as I stated above, if looking to buy the dip in tech stocks, you want to wait for the 10-year to top out.”

The 10-year has topped out on June 16, 2022, and we can see the IXT beginning to increase in this inverse relationship on June 16. Incidentally, the U.S. Fed raised interest rates on June 16 by 0.75%.

Nevertheless, as shown in Chart 1 above, the benchmark 10-year U.S. Treasury yield climbed to an almost one-month high near 3%.

AMAT’s Stock Performance

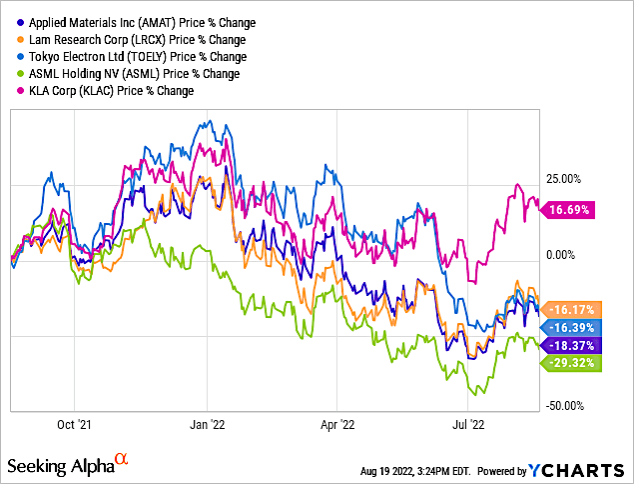

Chart 3 shows AMAT’s share performance. Despite its good performance, Technology Stocks are traded as a sector and not individually, due to lack of intimate knowledge of the industry by analysts and investors alike.

This is clear from Chart 3, which compares share price % change over a 1-year period for Applied Materials, and peers in the semiconductor process sector ASML (ASML), Lam Research (LRCX). Tokyo Electron (OTCPK:TOELY), and KLA (KLAC).

YCharts

Chart 3

Three of these companies, AMAT, LRCX, and TOELY are strong competitors of each other, particularly in etch and deposition process equipment. Yet these share prices over the past 1-year period have a difference of just 2%.

ASML had a dismal Q1 2022, but recovered in Q2 2022. This is reflected in its share performance in Q1 vs Q2 and it has recovered to just 11% lower than AMAT. KLAC is the clear winner among peers, growing 16.69% over the past year.

Investor Takeaway

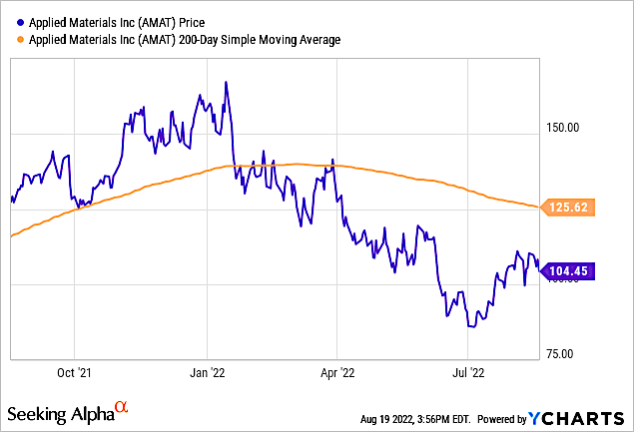

Chart 4 shows that AMAT has fallen below its 200-day moving average for the past 4-month period, but except for a few days, has been below since January 2022.

YCharts

Chart 4

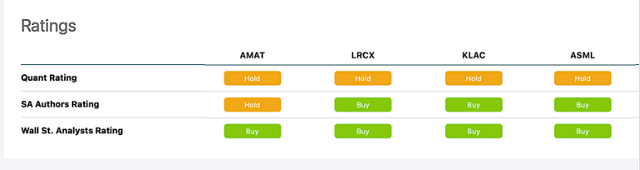

Chart 5 shows that AMAT is faring worse among Ratings compared to those of KLAC and ASML.

Chart 5

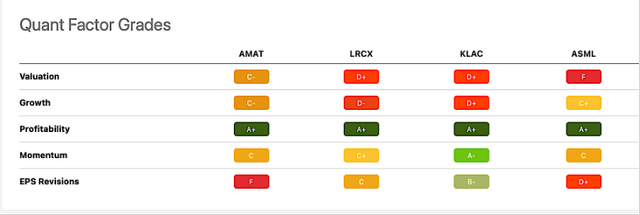

Chart 6 shows Quant Factor Grades. All show strong profitability, and various differences among peers on different Factor Grades. These Factor Grades are understandable given the common share performance of these companies, as shown above in Chart 3.

Chart 6

All companies in this analysis are competitors of each other, and yet share performance is comparable, with KLAC, my top stock pick, performing better. This common share performance is unusual, since these companies are competitors, and what is good for one should be bad for another. But that’s not the case, indicating investors/traders are trading these stocks as a sector instead of on the individual merits of the company.

But the overriding metric for consideration is the 10-Year Treasury. Macroeconomic factors, particularly inflation, show a strong correlation with share price. Even today, following a positive earnings call from AMAT, share prices closed -3.36% and compares to -5.24% for LRCX, -2.86% for ASML, and -2.67% for KLAC.

Be the first to comment