Lobro78

At this week’s Apple (NASDAQ:AAPL) Event, the company showcased its main product, iPhone 14, and two of its wearables, Apple Watch 8 and AirPods (3rd generation). The presentation was vintage Apple with a sweeping montage of its products and Tim Cook headlining the event.

To entice Apple fans to upgrade their phone and watch, the company added features such as crash detection and all-day battery life. The newest feature not previously seen in any smartphone is Apple’s Emergency SOS via Satellite capability that enables iPhone users to call for help if they are in a remote area not covered by a 5G signal.

With the Apple Watch, the company introduced three new versions, Apple Watch 8, SE and Ultra based on the person’s level of activity whether they are a regular exerciser, weekend warrior or a hard core adventurist.

These new features may only seem to add incremental value to the devices, but they should certainly be enough to get Apple fans to buy them. The consistent development of these small yet dynamic additions to the capabilities of Apple’s devices may be the reason that the company has taken the lead in the number of active smartphones in the U.S. over Android devices.

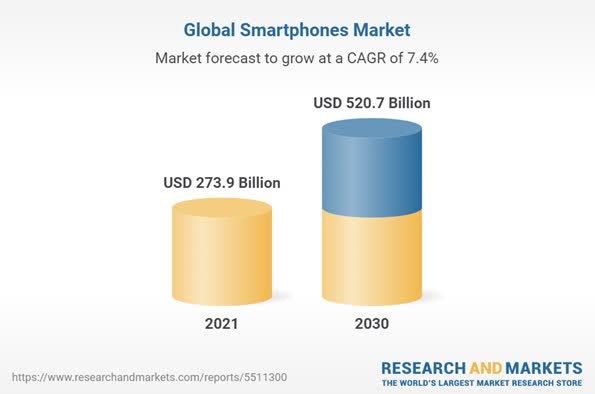

Still, the growth in smartphone sales worldwide is expected to be over 7% annually to $520 billion by 2030 from $273 billion in 2021 with over 1.6 billion smartphones sold in the past year. As a result, there is no reason to believe that Apple’s smartphone sales will not continue to grow as they add more features and capabilities year in and year out.

Research and Markets

Services

Where I see more consistent growth for the company is in its services division. The services division includes its advertising services and digital content with subscription services such as Apple TV+ and Apple Music. This division has consistently grown by 27% each year over the last four years, and is now 19% of its total sales and the second largest revenue source.

As Apple sells more devices (iPhones, iPads, Macs and Apple TVs), it should generate more content and drive its services revenues even higher.

Diversifying away from China

Yet, as much as Apple continues to innovate and grow, it is also continuing to find ways to protect its lead not just in innovation but also in manufacturing. Over the past year since the Covid pandemic, Apple has looked into diversifying its manufacturing from China into other low cost manufacturing countries such as Vietnam and India.

With more than 90% of Apple’s iPhones, iPad and MacBook laptops made in China, it is fully aware of its dependency on one country’s infrastructure for its manufacturing. A fact that became very real during the pandemic when the Chinese government shut down several cities and severely affected Apple’s supply chain.

By looking at increasing production in India, it is also building its sales force in the second most populated country in the world. This is something that the company has had experience in when it opened its products to the Chinese market in 2008. Today, China accounts for 19% of the company’s sales worldwide.

In diversifying its manufacturing from China to other low cost countries, Apple will be able to maintain its operating margins if not improve upon them due to currency conversions to the new countries. This is one of the ways to ensure that Apple stays one step ahead of its competition over the long term.

Analysis

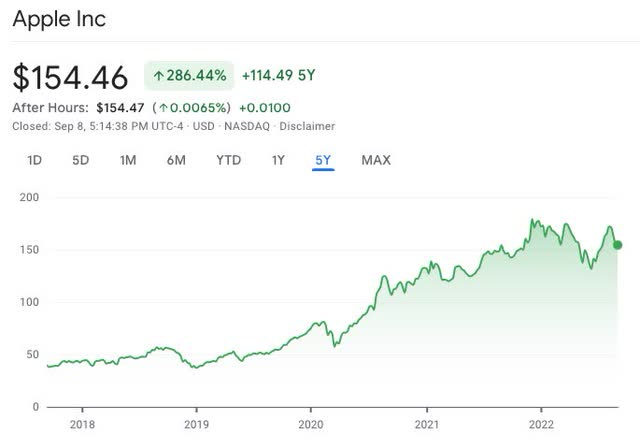

Buy Rating: I have a Buy rating for Apple’s stock with a five-year target price of $250 per share.

In my analysis of Apple’s stock, I believe the company can grow their sales by 11% over the next 5 years. From a net margin basis, I expect the company to continue to generate 23% net margins, which is very achievable especially as its services revenues increase as a percentage of its total sales. I anticipate that the stock’s price-to-earnings ratio (P/E) will continue to trade at a premium relative to the market, but may expand slightly over the next several years.

Below is a table contrasting the company’s current metrics and stock price to the 5-year estimate:

| Apple |

Current* (as of 9/8/22) |

5-Year Estimate |

|

Revenue (in millions) |

$365,817 |

$555,336 |

|

Net Margin (%) |

25.88% |

23% |

|

Net Income (in millions) |

$94,680 |

$127,727 |

|

# Outstanding Shares |

16,877,000,000 |

15,811,000,000 |

|

Net Income per Share |

$5.61 |

$8.08 |

|

Price/Earnings (PE) Ratio |

27.5 |

31 |

|

Stock Price |

$154.46 |

$250 |

Source of company metrics: Morningstar, Apple *Current metrics based on fiscal year end 2021

To better understand how to read the table above, read my previous article Meta: Attractive Valuation.

Back Testing the Methodology

Having used this methodology of estimating a future stock price over the past 20 years, it is useful once in a while to back test and see the results as it was used five years ago. Below is a back testing of Apple’s stock back in 2016.

| Apple |

Original (12/31/16) |

5-Year Estimate (12/31/21) |

5-Years Later (12/31/21) |

|

Revenue (in millions) |

$215,639 |

$374,274 |

$365,817 |

|

Net Margin (%) |

21.19% |

22.8% |

25.88% |

|

Net Income (in millions) |

$45,687 |

$85,335 |

$94,680 |

|

# Outstanding Shares |

5,500,281,000 |

5,500,000,000 |

4,219,000,000 (pre-split 4:1) |

|

Net Income per Share |

$8.31 |

$15.52 |

$22.44 (pre-split 4:1) |

|

Price/Earnings (P/E) Ratio |

13.9 |

13.7 |

27.5 |

|

Stock Price (pre-split) |

$115.84 |

$213.03 |

$617.84 (pre-split 4:1) |

|

Stock Price (post-split 4:1) |

$28.96 |

$53.26 |

$154.46 |

Source of company metrics: Morningstar & Apple Investor Relations

As you can see, Apple’s revenues were less than what I estimated five years ago, but its net income was much higher as a result of a higher net margin. Converting its 2021 year end earnings per share of $5.61, the actual pre-split earnings of $22.44 per share is greater than the $15.52 EPS I estimated. Lastly, the post-split stock price of $53.26 per share is less than the actual stock price today of $154.46.

So with my estimates, Apple exceeded all metrics except revenues. All told, the methodology worked five years ago, and I am confident that it will continue to work to help investors identify their potential return.

Be the first to comment