mgstudyo/E+ via Getty Images

Apple Hospitality REIT, Inc. (NYSE:APLE) is the only hotel / lodging REIT, which I have been covering lately, and it is also the only REIT from this sector that is currently included in my portfolio.

The underlying thesis is based on a combination of high dividend yield, cheap multiple (relative to peers and its own history), improving financials and, importantly, strong balance sheet. From all of the thesis drivers, if I had to distinguish the most important one, it is definitely the capital structure angle, where it is critical to have very low leverage to minimize the risk of a sudden dividend cut. For hotel REITs it is especially important given the inherently unpredictable nature of the top-line, which as opposed to many other REIT sectors (e.g., office, industrial, retail, data centers) do not carry long-term lease agreements that provide the necessary cash flow visibility.

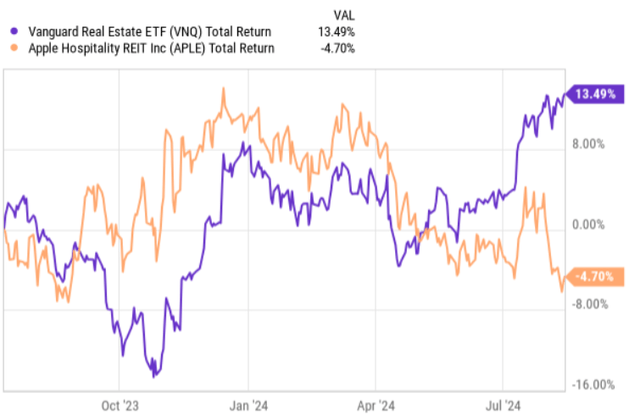

Yet, if we look at the total return performance since the publication of my initial thesis, we will notice it that APLE has meaningfully underperformed the broader REIT market. In the first couple of quarters after the piece was published, APLE exhibited great dynamics, trading in the alpha territory. However, really starting from April 2024, once the market began to price in elevated recessionary risks, all of the gains were gradually neutralized, even though the rest of the REIT market quite quickly rebounded and surged higher (due to the more positive interest rate outlook).

In my opinion, this could be explained by the following two factors:

- APLE’s sensitivity to the economic risks given the nature of hotel business.

- Relatively limited duration factor as the sales are not based on fixed long-term agreements, which, in turn, renders the interest rate cuts less effective on the underlying multiple.

Having said that, the fact that APLE has lagged behind the index implies that there is still an opportunity out there for capturing value (via price appreciation) on top of the juicy dividends, which currently yield ~ 7.3%.

Looking at the Q2, 2024 financials, the case becomes even more interesting.

Let me now elaborate on the recent quarterly earnings report and explain why I remain bullish here.

Thesis review

The key message that we could extract from the Q2, 2024 report is that APLE is a growing business, where the core metrics have been consistently improving across the board.

For instance, the comparable hotels sales landed at $387 million for Q2, 2024 and $718 million on a YTD basis, which translates to an increase of 3% and 2% relative to the same period of 2023. The main source of growth in the top-line was an uptick in comparable hotels RevPAR – i.e., an increase of 2.5%. The rest came from the slightly higher occupancy level, which grew by ~2%, thus providing a nice tailwind for the overall sales. The combination of higher RevPAR and higher occupancy level sends a clear message that APLE is able to raise the prices without sacrificing the demand.

Turning to the cost base, the comparable hotels expenses for the Q2, 2024 grew by ~3.5%, which slightly exceeds the aforementioned increase in the top-line level. Here, the key force pushing the cost base higher was the payroll component. Clearly, this is not a sustainable trajectory for APLE, where the costs are rising at a faster pace than the sales (even though in absolute terms this still leads to a positive cash flow effect). However, there are two important aspects that we should take into account:

- The cost increase dynamic has been decelerating, where in Q2, 2024 APLE managed to register a 100 basis point improvement compared to the rate of change statistic in Q1, 2024.

- The Management has taken some steps in reducing the reliance on contract labor, which in conjunction with the generally improving labor conditions (from the employer perspective) should reduce the pressure going forward.

The commentary by Liz Perkins – CFO – provides a nice color on this specific aspect:

We anticipate that near-term growth in payroll cost per-occupied room will be more in line with the modest increases we saw during the second quarter, with labor market stabilizing and overall inflation numbers coming down. Contract labor remained relatively stable during the quarter at 8.6% of total wages, and was down 230 basis points, or 17%, versus the same period in 2023. With lower turnover and less reliance on contract labor, we are better positioned to drive incremental property-level productivity. We will continue to work with our management companies to enhance the efficiency of our operations over time.

Now, if we move to the key metrics measuring the underlying cash generation – adjusted EBITDAre and MFFO -, we will observe a much better picture than what has been reflected above. Namely, the growth in adjusted EBITDAre and MFFO was 9% compared to Q1, 2023. The reason behind the divergence between the organic growth figures and the total cash generation growth results is purely related to APLE’s M&A activity, where since the pandemic, roughly $1 billion of has been directed towards the acquisition of new hotel properties. Granted, APLE has also divested a meaningful amount of properties ($294 million), but on a net basis, the portfolio has grown.

Based on the guidance by the Management and the fact that in Q2, 2024 there was a continued M&A activity by APLE, we could assume that going forward the process will remain unchanged (i.e., APLE being a net acquirer).

Here, it is critical to underscore that APLE carries the right balance sheet to accommodate growth. As of Q2, 2024, the net debt to TTM EBITDA stood at 3.4x, which is below the sector average and an indicative of a conservative leverage profile. Furthermore, the MFFO payout ratio of 48% (based on annualized Q2, 2024 MFFO and dividend levels) leaves a notable amount of internal cash generation at the books that automatically allows to facilitate M&A activity without aggressive reliance on the debt funding.

The bottom line

Q2, 2024 earnings results prove that Apple Hospitality REIT is a stable, well-capitalized and growing business. While the share price continues to be depressed by the market, the underlying fundamentals exhibit improving dynamics.

Given the FWD P/FFO multiple of 8.6x, dividend yield of ~7.3% and still growing cash flows that are underpinned by a fortress balance sheet, APLE is a clear buy.

Granted, the risk could come from the weakening economy, which theoretically could introduce serious headwinds for APLE given its exposure to the volatile hotel segment. Yet, in my opinion, the following factors are sufficient to offset this, making the case still a buy:

- Conservative MFFO payout ratio at ~48%, which provides ample margin of safety in terms of avoiding a dividend cut.

- One of the strongest balance sheets in the hotel REIT space.

- Positive organic growth statistics with a favorable outlook on the cost base front.

- Business strategy that is focused on the upper-end customer base, which is inherently less sensitive to the economic headwinds.

- Low multiple at FWD P/FFO of 8.6x, which de-risks the situation of multiple contraction due to an overvaluation.

As a result of this, I remain bullish on Apple Hospitality REIT.

Be the first to comment