Craig Barritt

Note:

I have covered Amyris previously, so investors should view this as an update to my earlier articles on the company.

Earlier this month, specialty renewable products developer Amyris, Inc. (NASDAQ:AMRS) reported another set of weak quarterly results. The company missed consensus expectations by a mile while SG&A expenses continued to balloon.

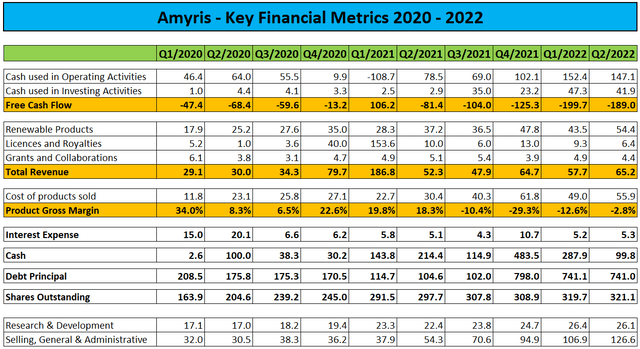

Company SEC-Filings

Revenues in the core consumer business surged 108% year-over-year, but this was actually materially below the company’s full-year projection of “well over 150%” growth. As a result, sales momentum will have to pick up substantially in H2 to avoid another top line disappointment.

Even worse, Amyris used a whopping $189.0 million in cash in Q2. At the current burn rate, Amyris would run out of funds by the end of this month despite generating $670 million in net proceeds from a convertible debt offering just nine months ago.

As a result, the company needs to raise additional capital as soon as possible.

On the conference call, CEO John Melo pointed to “term sheets for up to $250 million of term loan financing” which he expects to close before the end of this quarter.

In addition, the company expects to receive $350 million in cash until the end of this year from further marketing rights sales.

Lastly, Amyris is working on bringing $150 million in earn-out payments forward.

Melo also asserted that the company has “complete access” to key shareholder financing, if necessary.

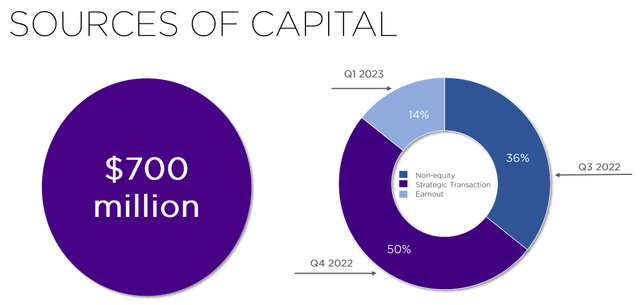

According to CFO Han Kieftenbeld, the company has visibility on $700 million in new funds:

Finally, regarding capital funding. As John mentioned, we have visibility on $700 million, of which we expect to secure $200 million in non-equity financing in Q3, $350 million from a strategic transaction expected by end of Q4 and the remainder from earn-out no later than the early part of 2023.

Company Presentation

As a result, year-end cash is expected to be between $300 million and $400 million.

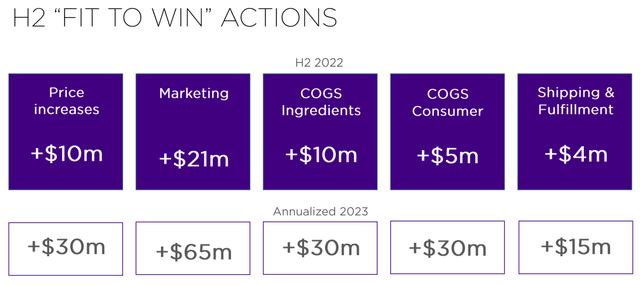

The company also revealed a new “Fit to Win” initiative which is expected to result in $50 million of Adjusted EBITDA improvement in H2 and $175 million of full year Adjusted EBITDA improvements next year.

Company Presentation

As usual, given management’s very long history of over-promising and under-delivering, investors would be well-served to take these projections with a huge grain of salt.

For my part, I am particularly concerned about potentially onerous term loan conditions as the company has violated debt covenants a number of times in the past already.

Quite frankly, I wouldn’t be surprised to see the interest rate approaching or even exceeding double digits and the facility being governed by certain EBITDA-related covenants. Investors should also prepare for a material minimum liquidity requirement.

Assuming $650 million in total funds being raised in H2 and Amyris finishing the year with $350 million in cash, cash usage for the second half of the year would calculate to approximately $400 million, roughly in line with H1 and likely considerably higher than expected by market participants at this point.

While renewed risk appetite among investors resulted in shares rallying to their highest levels since the ugly Q1 report, Roth Capital analyst Craig Irwin actually downgraded Amyris from “Buy” to “Neutral” with a price target of $2 based on repetitive revenue disappointments and balance sheet concerns. In addition, Irwin pointed to potentially overly optimistic valuation expectations for the proposed marketing rights sale.

Bottom Line

At least in my opinion, it takes a lot of faith in management’s projections and ability to secure large amounts of additional capital at favorable terms to justify an investment in Amyris at this point.

Unfortunately, management’s track record is among the worst I have ever come across in more than twenty years of full-time investing/trading and aggressive conference call projections by CEO John Melo like “We (..) are executing on a clear path to a $1 billion revenue business that delivers 20% or better operating margin by the end of 2023” are thwarting renewed promises of managing investor expectations more adequately going forward.

Moreover, the proposed term loan facility will likely expose the company to renewed risks of debt covenant violations.

Just three months ago, a very similar set of quarterly results caused a more than 30% sell-off in the shares but vastly improved sentiment has resulted in renewed risk appetite among market participants in recent weeks.

But for shares to sustain recent gains, Amyris must not only raise material amounts of capital in the very near term but finally start to deliver on management’s promises.

At this point, I reiterate my grave concerns regarding management’s ability to execute on its stated targets but do not expect the company’s elevated liquidity requirements to result in a near-term bankruptcy as Amyris still has a number of levers to pull.

That said, I do not expect the company to come anywhere close to its stated targets for 2023 and 2024. Quite frankly, I wouldn’t be surprised to see the company being required to raise additional capital in the second half of next year again.

Be the first to comment