vzphotos

Introduction

As a dividend growth investor, I constantly seek investment opportunities in income-producing assets. Most of the time, I add to my existing positions whenever I find one of them to be very attractively valued. On other occasions, I start a new position to diversify my holdings further. The current volatility in the stock market allows me to increase the dividend income for less capital.

The healthcare sector is one of my favorite sectors. The reward for developing good products is mainly due to patents defending them from the competition. Moreover, the products support the longevity and life quality of people around the world. Therefore, the demand is high and remains high even during harsher times. In this article, I will look into Amgen (NASDAQ:AMGN).

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Amgen discovers, develops, manufactures, and delivers human therapeutics worldwide. It focuses on inflammation, oncology, hematology, bone health, cardiovascular disease, nephrology, and neuroscience. Amgen Inc. was incorporated in 1980 and is headquartered in Thousand Oaks, California.

Fundamentals

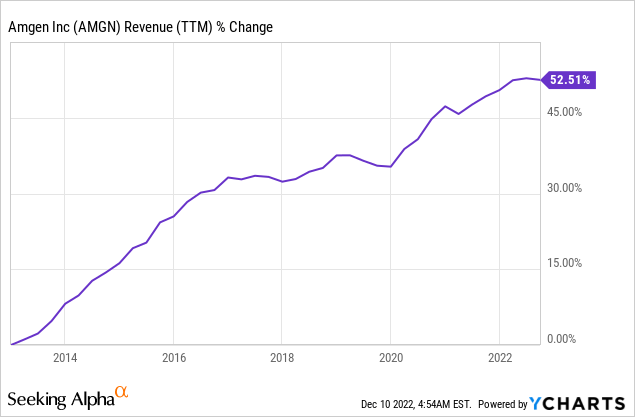

Sales of Amgen have increased by 52% over the last decade. It equates to ~4% annually. The company achieves its growth by combining organic R&D efforts with acquisitions of smaller companies that allow it to expand its reach significantly. In the future, as seen on Seeking Alpha, the analyst consensus expects Amgen to keep growing sales at an annual rate of ~3% in the medium term.

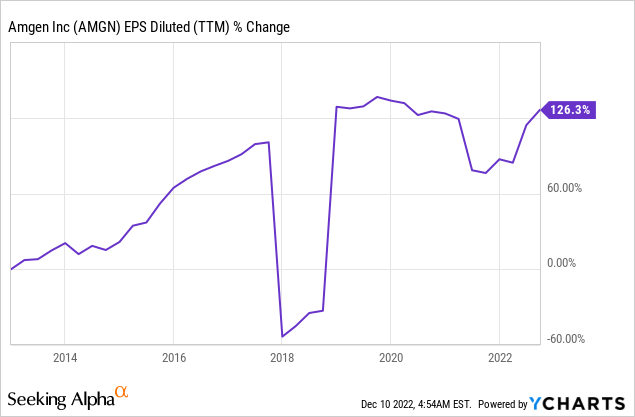

The EPS (earnings per share) has increased much faster over the same period. Over the last decade, the EPS increased by 126%. The increase in EPS is due to the combination of sales growth, aggressive buybacks, and slightly higher margins due to cost-cutting. In the future, as seen on Seeking Alpha, the analyst consensus expects Amgen to keep growing EPS at an annual rate of ~6% in the medium term.

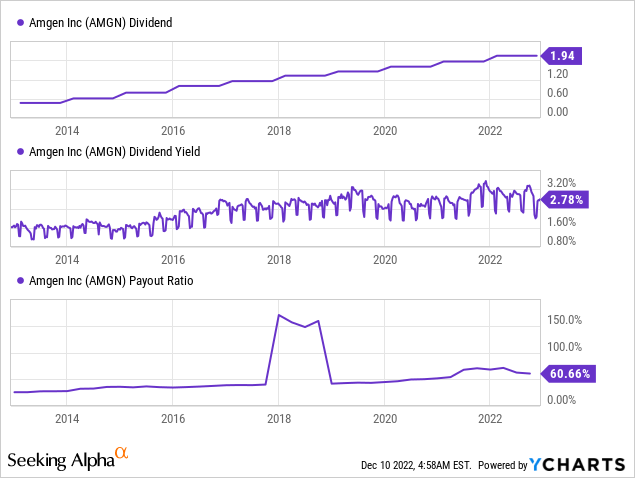

The dividend growth that Amgen offers is impressive. The dividend has grown by 30% annually since initiated a decade ago. Over the last five years, the dividend growth rate slowed to 12% annually. The dividend seems relatively safe, with a payout ratio of 60% when using GAAP EPS and 42% with non-GAAP EPS. The yield is attractive at 2.78%, and the company is likely to increase the dividend again in the coming days, as December is the month when it announces increases.

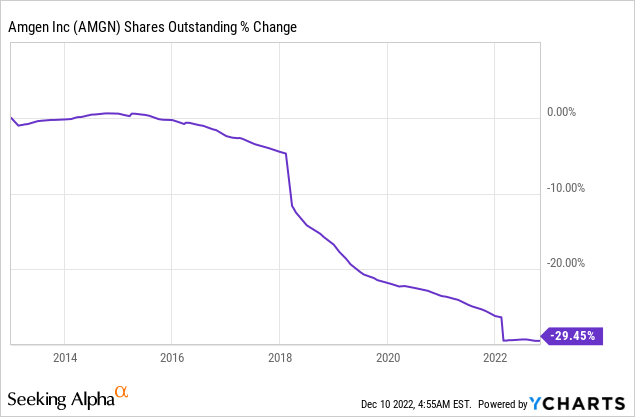

Share repurchase plans are another way to return capital to shareholders besides dividends. Buybacks support the EPS growth as they lower the number of outstanding shares and are most effective when trading for a low valuation. Over the last decade, Amgen has been aggressively buying back its shares. It has reduced their number by almost 30%. As long as the company invests enough in R&D and pays a growing dividend, investors will welcome buybacks.

Valuation

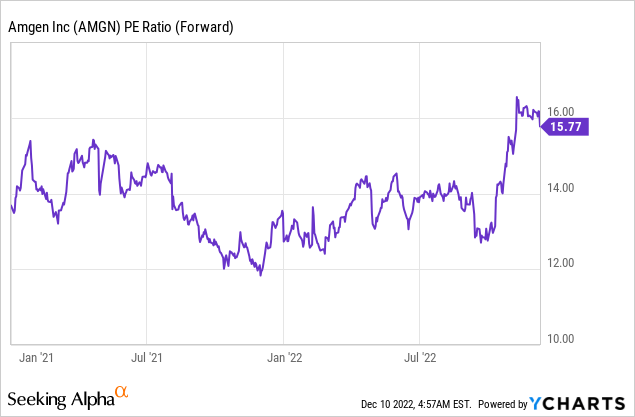

The P/E (price to earnings) ratio, when taking into account the forecasted EPS for 2022, is 15.8. The graph below shows that the valuation has increased over the last twelve months, with most of the increase in the weeks following the company’s quarterly report. The current valuation doesn’t seem too high for a quality company growing in a challenging business environment, yet it also doesn’t look too attractive.

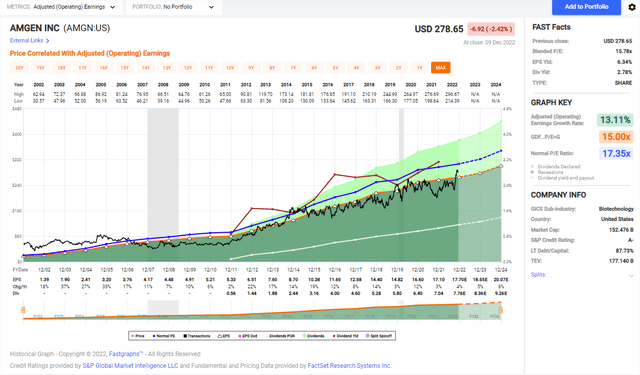

The graph below from FAST Graphs shows that the shares of Amgen are still trading below their historical valuation. Over the last two decades, the average P/E ratio was 17.35. The current P/E ratio of 15 is still below that. However, the forecasted growth rate of Amgen is also slower compared to the 13% annual growth rate we have seen in the last twenty years. Therefore, I believe the valuation is fair yet not too attractive.

FAST Graphs

To conclude, Amgen shows strong fundamentals across the board. Sales and EPS growth allows the company to reward shareholders with dividends and buybacks. The valuation seems fair at the moment despite slower growth. The company must show decent growth opportunities if it plans to maintain its historical growth rate.

Opportunities

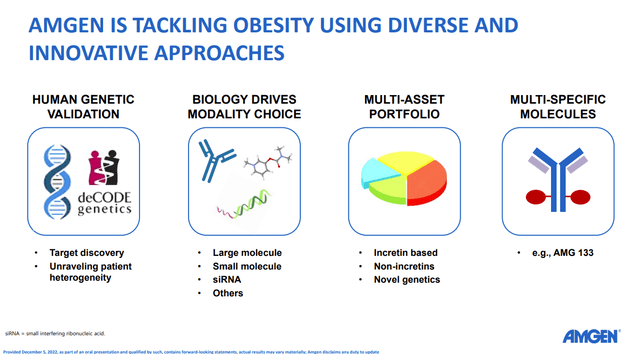

One of the key growth opportunities for Amgen is the continued development and introduction of new drugs and therapies. Amgen is constantly evolving, and there is a growing demand for treatments for various medical conditions. As a leading biopharmaceutical company, Amgen is well-positioned to take advantage of this demand and develop innovative new therapies that can help improve patients’ lives. One area where Amgen tries to shine is the fight against obesity. Obesity is a condition that leads to many severe illnesses, and tackling it may benefit society and Amgen.

Amgen

One area where Amgen could potentially see growth is in developing and marketing personalized medicines. These treatments are tailored to the specific genetic makeup of an individual patient, which can help improve the therapy’s effectiveness and safety. As the technology for personalized medicine continues to advance, Amgen could potentially develop new products and treatments that take advantage of this approach, which could open up new opportunities for the company and help it to differentiate itself from competitors.

Amgen

Amgen could also look to acquire smaller pharmaceutical companies or partnerships with other firms to expand its product portfolio and diversify its operations. This opportunity is prominent in the short term as volatility has pressured the share price of many promising biotech startups and companies. It could provide the company with access to new technologies and expertise and a broader range of products and therapies that can be offered to patients. These acquisitions and partnerships could also help Amgen to drive growth and improve its financial performance.

Risks

One of the primary risks for Amgen is the regulatory environment. The company must navigate complex and constantly evolving regulatory frameworks to bring its products to market. It can be a time-consuming and costly process. If Amgen fails to obtain necessary approvals or cannot meet regulatory requirements, it could harm the company’s operations and financial performance. The complexity is high as Amgen operates in many countries with different regulators trying to gain approval for very complex treatments.

Another risk for Amgen is the potential for product liability lawsuits. The nature of the pharmaceutical industry is prominent with Amgen. Its products are complex and innovative and treat many severe medical conditions. Any adverse reactions or side effects could result in legal action against the company. It could lead to significant financial damage and damage to Amgen’s reputation and brand. We see how even more prominent companies like Johnson & Johnson (JNJ) and 3M (MMM) have struggled with that risk.

In addition, Amgen faces competition from other pharmaceutical companies in developing new drugs and marketing and selling existing products. Amgen faces competition from giants like AbbVie (ABBV) and Merck (MRK), and many startups are trying to provide personalized treatments. This competition can put pressure on the company’s pricing and profitability. It also raises the stakes for every R&D that fails.

Conclusions

Amgen is an excellent biotechnology company with over forty years of innovation and drug manufacturing. Its long track record allowed it to grow significantly in sales and income. This $150B company is very shareholder friendly and has several growth prospects, including obesity treatments and M&A activity.

The valuation seems fair for a company with a track record and prospects. The risks are still relevant today but not specific to Amgen. Therefore, I believe that dividend growth investors should consider adding Amgen to their portfolios as it offers a decent yield that will probably increase over time. I think shares should be bought over time in this volatile era, and investors can capitalize on every dip.

Be the first to comment