Sean Gallup/Getty Images News

Alphabet (NASDAQ:GOOGL) reported second quarter earnings which comfortably eased doubts regarding the mega-tech company’s ability to grow amidst difficult macro conditions. The stock has historically found itself trading at a cross between Apple (AAPL) and Meta Platforms (META) as the market can’t make up its mind whether to award it a premium for its monopolistic position or a discount like META. There are striking similarities between GOOGL and AAPL of the past, as I expect the ongoing share repurchase program to only get more aggressive. GOOGL stock continues to represent one of the best risk-reward opportunities in the market today is a core holding of the Best of Breed Growth Stocks portfolio.

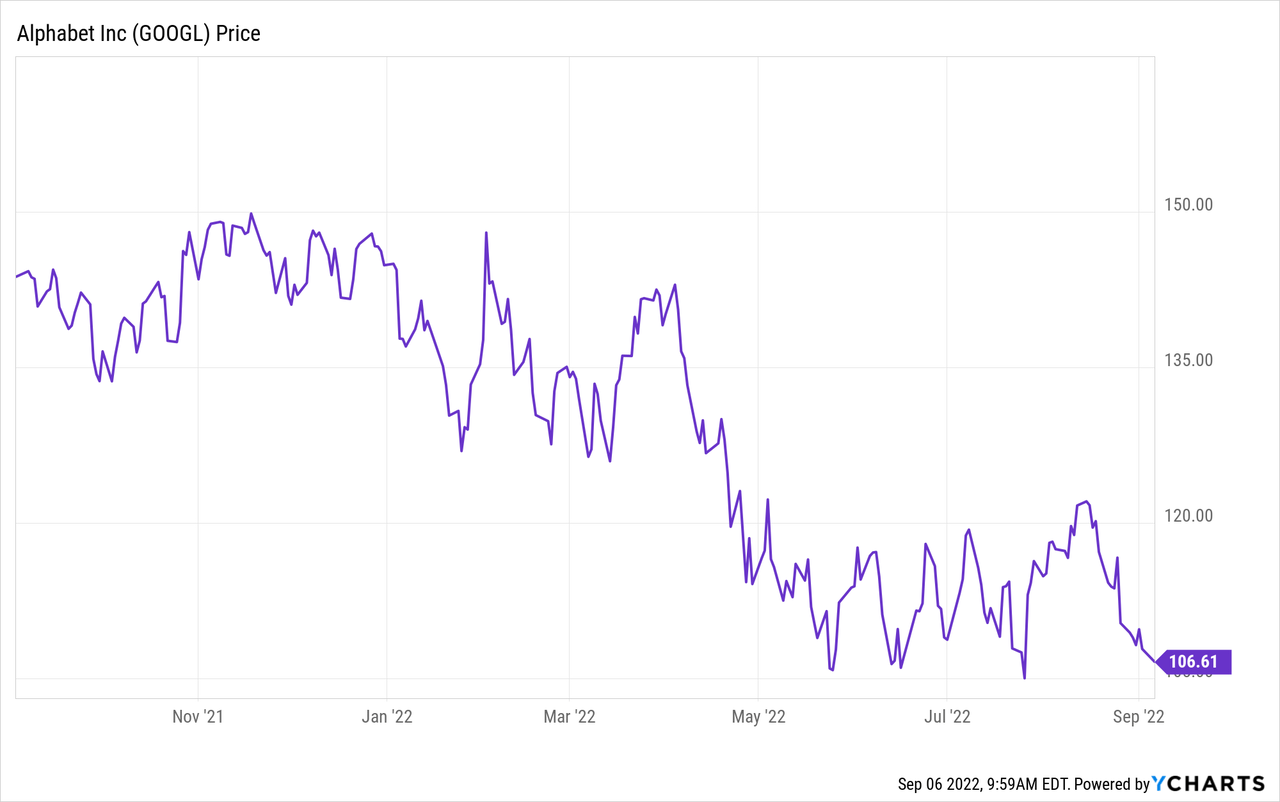

GOOGL Stock Price

While GOOGL did perk up after reporting earnings, the stock still remains substantially below recent highs.

What’s more, GOOGL stock traded at compelling valuations even prior to the fall – making this recent decline one of the more obvious opportunities.

GOOGL Stock Key Metrics

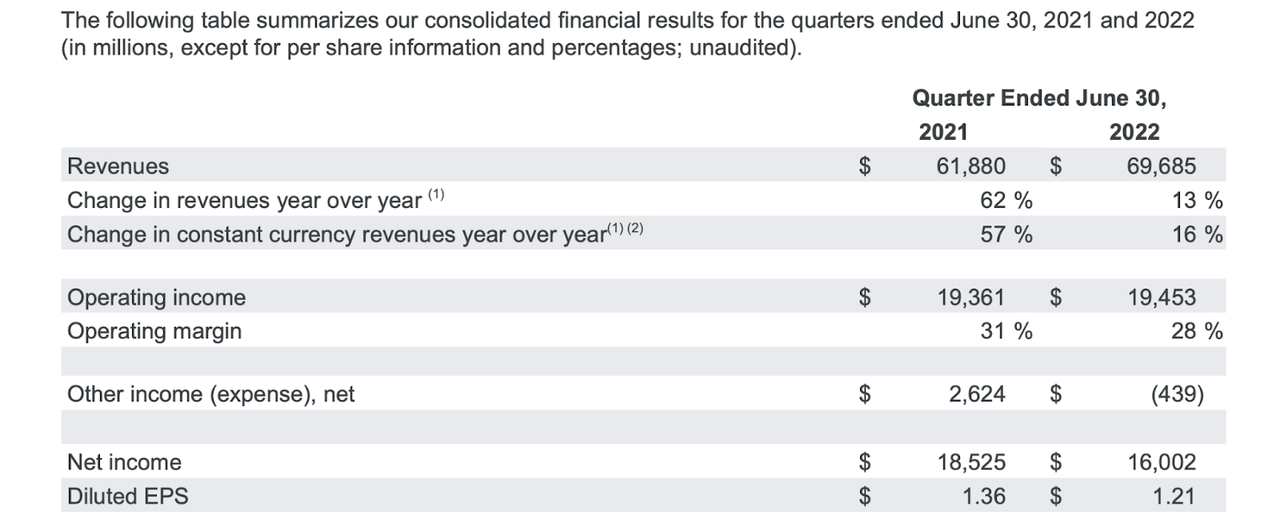

GOOGL reported 13% revenue growth (16% adjusted for constant currency), a dramatic slowdown from last year but last year’s results were boosted by easy comparables. Headline numbers may otherwise report a decline in earnings per share.

2022 Q2 Press Release

But that would be the wrong takeaway, as due to GAAP accounting rules, GOOGL is required to account for fluctuations in its investments every quarter, even though those are non-cash line items. After adjusting for unrealized gains and losses on investment securities, earnings per share grew 12% from $1.15 to $1.29.

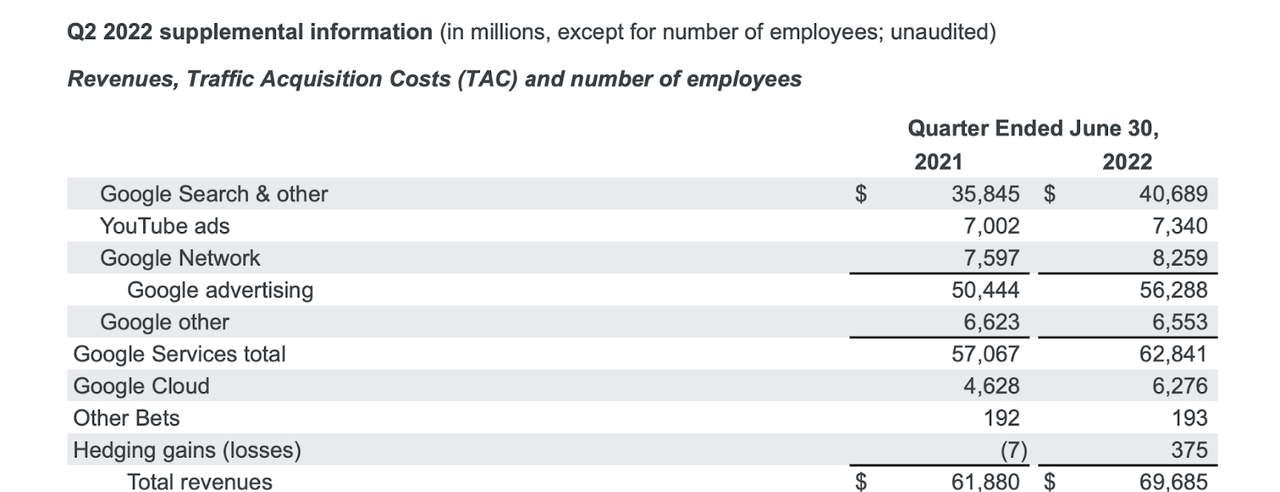

We can see below that GOOGL saw healthy growth across all of its segments, with the strongest growth seen in Google Cloud. I note that YouTube only grew by 4.8%, but based on what I’ve seen from advertising competitors, that is an impressive result amidst a difficult environment.

2022 Q2 Press Release

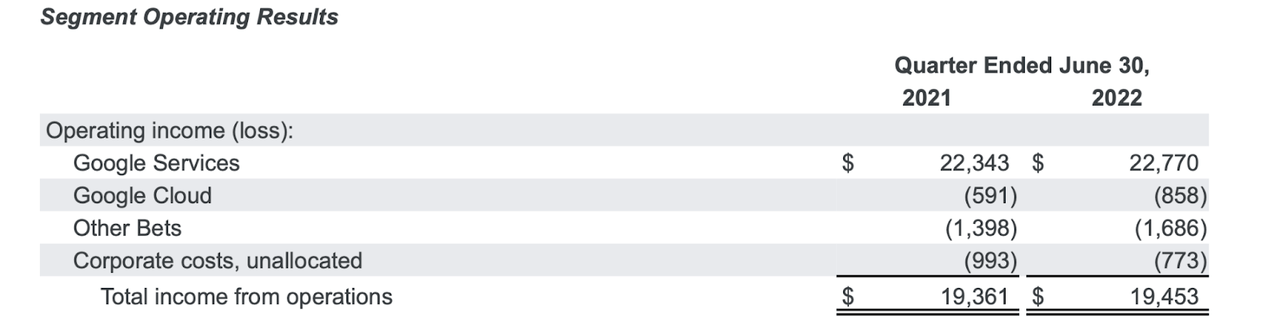

Due to heavy investment in growth, GOOGL did not show material growth in operating income. In fact, Google Cloud, in spite of growing revenues by 35.6%, saw its operating loss increase.

2022 Q2 Press Release

Like many top-notch tech companies, one should not judge the long term profit potential based on near term trends. GOOGL has historically invested very aggressively in future growth – that investment involves adding headcount, which increases operating expenses and decreases operating income. Wall Street can oftentimes be nearsighted in penalizing companies for reducing profit margins, but in reality they should be rewarding the long term vision (assuming the company has a good track record, which GOOGL does). I have seen some commentators show their disdain for the lack of profits at Google Cloud – I continue to expect that division to report at least 30% net margins over the long term.

GOOGL ended the quarter with $125 billion of cash and equivalents versus $14.7 billion of debt. The company spent $15.2 billion of cash on share repurchases, surpassing the $12.6 billion in free cash flow (as well as the $12.8 billion spent in the same quarter last year). The commitment to an aggressive share repurchase program is very welcome amidst the declining stock prices. It also draws memories of AAPL in 2015 when it began winding down its net cash position and executing its share repurchase program in earnest. While the net cash position is not nearly significant now as it was then, I view share repurchases as being the primary driver of the rich multiples that AAPL has enjoyed in recent years – GOOGL may experience a similar boost as it simply continues buying back stock.

Is GOOGL Stock A Buy, Sell, or Hold?

At recent prices, GOOGL is trading for around 20x trailing earnings (adjusted for unrealized gains and losses on investment securities). That is already a compelling valuation for a company still growing its top-line at a double-digit pace. But due to the heavy investments in growth, earnings are highly understated. Let’s start by calculating what GOOGL is worth excluding certain losses. We should do this because otherwise those businesses are being assigned a negative valuation. Excluding losses from “Other Bets” and Google Cloud, GOOGL would have earned $91.5 billion in operating income over the trailing twelve months, or about $76.7 billion in net income after taxes. That represents $5.76 in earnings per share. GOOGL is trading at just 18.4x that number. But those earnings only reflect the value at core Google (basically search and YouTube). While we have removed the negative valuations assigned to Google Cloud and Other Bets, we have not yet added any positive value to those segments. I can see Google Cloud earning 30% net margins over the long term (judging where Amazon Web Services is operating, this assumption is arguably too conservative). Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), Google Cloud might be worth 13.5x sales, or $339 billion, or $25.50 per share. Other Bets houses the company’s moonshot investments including the self-driving unit Waymo. There should be positive value there ($50 billion seems more than reasonable) but to be conservative we can avoid assigning value. The company has $110 billion of net cash, or $8.30 per share. We should account for this because the company is aggressively repurchasing shares and I could see the company eventually sustaining net leverage over the long term. Assuming core Google is worth 20x earnings, then a sum of the parts valuation implies $33.80 per share upside from everything else, or 40% upside. But I see fair value for core Google standing more around 25x to 30x earnings, representing at least $144 per share. That would imply potential upside of 67% – and the company continues to grow at a double-digit clip in the meantime. If GOOGL can achieve the AAPL-like multiples of the past several years, then there would be even more upside to that target. The monopolistic position represents both the opportunity and the risk. It is possible that regulators eventually break up the company. While I see any such event as a catalyst for multiple expansion (the company is clearly being penalized as a conglomerate), that eventual event may serve as a potential overhang on the stock price. The ongoing share repurchase program will help take advantage of the persistent undervaluation, but impatient investors might not appreciate that detail. I rate GOOGL a strong buy as one of the best risk-reward opportunities in the market today.

Be the first to comment