iridi/iStock via Getty Images

As many of my readers and followers know, I frequently write not so flattering articles in order to warn investors about dangerous REITs.

Some have even referred to me as the “REIT police” because I’ve been known to put a particular company in “time out” or even send them to jail, without passing Go.

These days were seeing a tremendous amount of fear in the market, highlighted by inflation, rising rates, and a war, just to name a few.

This volatility has sparked a selloff within many REIT property sectors, which has in turn boosted dividend yields and inspired temptation amongst the so-called high yield chasers.

We all know that Mr. Market has a pretty good barometer when it comes to dividend yields.

Whenever a stock’s yield becomes double digit, it becomes alluring in such a way that the prospective buyer becomes more fixated on the yield than the overall safety of the dividend itself.

In a Forbes article a few years ago I explained that “in the business of investing, as well as real life, the words ‘too good to be true’ means that ‘all the glitters is not gold.” Simply put, “if a stock seems to pay a dividend yield that is exceptionally high, investors should look harder at the sources of payment behind the dividend.”

So, 99 times out of 100, whenever a company pays a dividend beyond its earnings power it’s essentially eroding capital. So, when a stock is paying an extraordinarily high dividend yield combined with an unsustainable business model, there will most always be loss of principal.

Investors should always proceed with caution and focus more on dividend safety than dividend yield. As I explained in the Forbes piece,

“Be careful of chasing sucker yields as the raised nail always gets hammered.”

Since today is April Fool’s Day, I didn’t want anyone to be suckered or bamboozled into a so-called “sucker yield,” so I decided I would provide readers with three REITs to avoid at all costs.

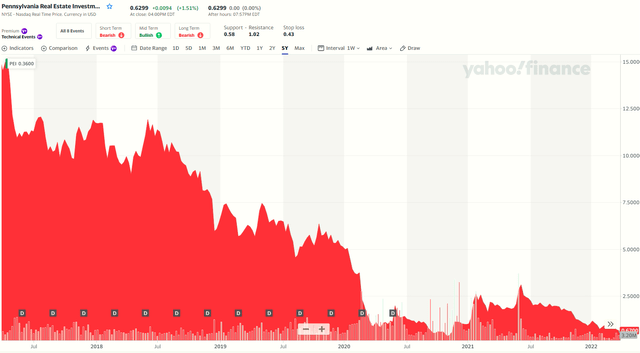

Believe me, I have a pretty good track record for spotting these dangerous picks, such as PREIT (PEI).

Yahoo Finance

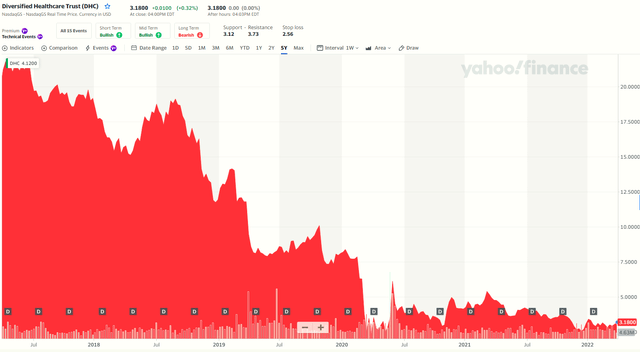

And also Diversified Healthcare Trust (DHC):

Yahoo Finance

I can provide other examples, such as CBL Properties and Washington Prime, but they have filed bankruptcy, so I can’t produce charts like those above. Needless to say, investors lost serious money by chasing yield.

So today I will provide you with a list of three sucker yield picks, and I can assure you that even though this is the April Fool’s edition, this is no joke. Please recognize that by avoiding these stinkers you could save yourself money and stress.

Global Net Lease: 10.2% Yield

Global Net Lease (GNL) is a net lease REIT that owns a portfolio of 235 properties in the U.S. and Canada and a 74 property Europe portfolio diversified across 138 tenants in 51 industries. Around 42% of the portfolio is comprised of office properties and another 54% is industrial/distribution (the remaining 4% is retail).

Keep in mind that office buildings are much more capital intensive than industrial properties, and that’s precisely the reason that REITs like Orion Office (ONL) has embarked on a more conservative payout blueprint, so that it can manage its capital expenditures without cutting the dividend.

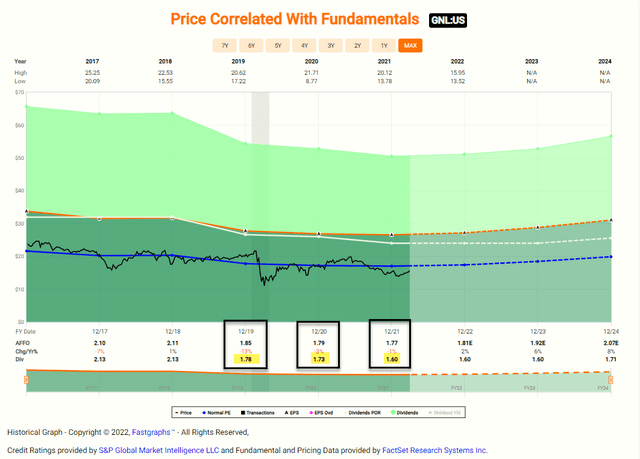

Alternatively, GNL has a much higher payout ratio, and of course that’s why the company was forces to cut the dividend in 2019, 2020, and 2021.

FAST Graphs

Of course, Mr. Market always has an eye for spotting sucker yields and these days he’s telling us that GNL us that this externally-managed REIT is dangerous. The shares are now yielding 10.2%, and although growth prospects are sound (analysts estimate +2% in 2022), the peers are in much better shape.

2022 Analyst Estimates (AFFO per Share)

The external management also give me fits because it makes no sense for the company to remain external when it has a market cap of $1 billion. I understand that smaller REITs can’t really afford to take on outsized G&A, but GNL seems to be fixated on its advisor, AR Global. Perhaps it’s because of the long-term contract that does not expire until June 2035.

GNL does not have the cost of capital to play in the sandbox with the others listed above. The equity multiple is 11.4%, almost 3x that of the others (listed above). This means it’s forced to either buy lower quality properties or invest in properties with shorter duration leases.

Thus, as Mr. Market has signaled, the payout ratio remains tight, especially for a REIT with 40%-plus invested in office buildings. There’s simply no margin of safety, or room for error.

Annaly Capital: 12.4% Yield

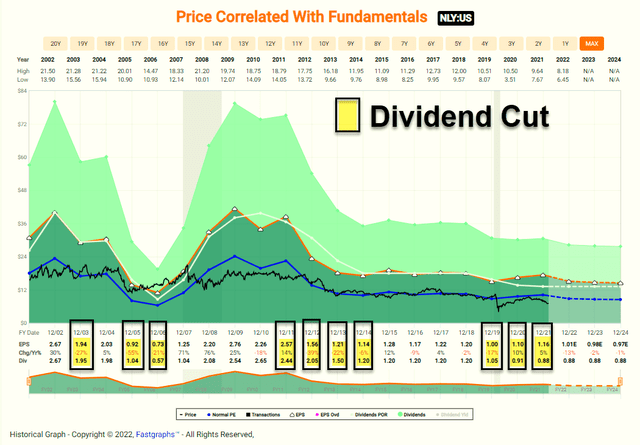

The next “sucker yield” REIT is Annaly Capital (NLY), a residential mREIT that I called out a few weeks ago in which highlighted this hi-flyer as a “chronic dividend cutter!”

FAST Graphs

I explained that “rising inflation and headwinds to net-interest margins, and the dividend is becoming riskier by the day. Shares have already fallen from $9.50 in June 2021 to $7.02 today, a decrease of over 25%.”

I have often warned investors that mortgage REITs are extremely sensitive to interest rate fluctuations and rarely perform well in rising-rate environments. That’s because most of the mortgages already on their books are fixed-rate assets. So they don’t benefit from any such changes.

Also, they have to pay higher interest rates to borrow money to fund their current operations and this results in shrinking profit margins, which in turn can easily impact the stock price, not to mention the dividend.

Many traders own the stock, hoping that can capture quick profits, by getting in and getting out. And, of course, the problem is that the mouth-watering 12.4% dividend yield makes it very hard to pass up.

This is where discipline comes in.

Investing in a REIT like NLY is gambling. I don’t care how you slice it and dice it. All I see is a declining earnings model that makes no sense to own, even if you’re a so-called “market timer.”

My best advice for you is to run, not walk!

Omega Healthcare Investors: 8.5% Yield

Omega Healthcare Investors (OHI) is my final “sucker yield” pick, but, as the title suggests, it’s also April Fool’s Day.

OK, to be clear, OHI is a high-yielding pick, as the current dividend yield is 8.5%.

However, just a few weeks ago shares were yield over 10%, so you can see that Mr. Market has become much less fearful of a dividend cut.

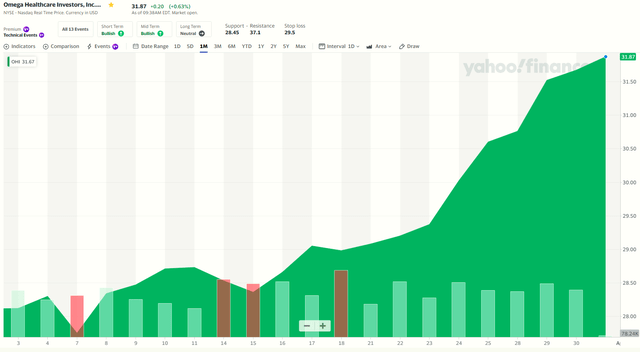

OHI Shares +13.5% in 30 Days

Yahoo Finance

OHI is a skilled nursing REIT and it seems that post-acute occupancy rates have rebounded, according to CMS national date +80 bps M/M through March 13th and +45 bps in February, as Omicron has faded.

The rebound in occupancy shows demand is there, but tenant liquidity still remains risky as government stimulus fades with wage pressure/worker availability exacerbating already challenging circumstances.

Now the reason I own OHI is because of its scale advantages, in which its 63 operators spread risk across 939 properties (over 95,000 beds). Over the last month OHI saw the second largest occupancy increase (+70 bps) while Sabra (SBRA) and LTC (LTC) lagged, -190 bps and 30 bps, respectively.

Although there are occupancy improvements in the sector, rent coverage has trended down (1.61 average SNF NNN EBITDAR Rent Coverage). The trailing 12-month operator EBITDARM and EBITDAR coverage for OHI’s core portfolio decreased to 1.52x and 1.18x, respectively, vs. 1.63x and 1.28x, respectively.

EBITDA coverage for Q3-21 for OHI’s core portfolio was 1.04x including federal stimulus and 0.92x excluding the $26 million of federal stimulus funds. This compares to Q2-21 of 1.2x and 0.99x with and without the $49 million in federal stimulus funds, respectively.

In terms of the so-called “sucker yield” description, in Q4-21 OHI’s adjusted FFO was $0.77 per share and Fad was $0.72 per share. OHI maintained its quarterly dividend of $0.67 per share and the payout ratio continues to have cushion at 87% of adjusted FFO and 93% of FAD.

The balance sheet is in good shape too, with no bond maturities until August 2023 and as of year-end 2021 the company had no outstanding borrowings on its revolving credit facility. Over 99% of the $5.3 billion in debt was fixed and the net funded debt to adjusted annualized EBITDA was 5.3x.

So, why I don’t consider OHI a so-called “sucker yield,” I suppose that Mr. Market will let us know if I’m a sucker or not (of course, I’m long the name).

In Closing

It’s articles like these that I love writing because I can help investors avoid painstaking losses. If I can help just one person avoid a sucker yield, I feel as though my work is worthwhile. I thought I would end this one with a few quotes,

“It’s extremely rare to hear of anyone winning at it (market timing) over a period of years. Indeed, I’ve never heard of such a genius.” Jack Brennan, Vanguard CEO

“Forget about timing the market, it doesn’t work. You’ll lose money. Invest for the long haul and then sit back and wait — the market always goes up in the long-run.” Paul Farrell, CBS Marketwatch

“Buy and hold is a very dull strategy. It lacks pizzazz and doesn’t inspire much admiration at cocktail parties. It has only one little advantage: It works, very profitably and very consistently.” Frank Armstrong

“When you buy a sucker yield stock you are essentially gambling that you will get your principal back in equal installments with no interest earned. If you get it back in 10 years, consider yourself lucky.” Brad Thomas

Be the first to comment