Torsten Asmus/iStock via Getty Images

I recently wrote an article arguing that current economic conditions, including higher interest rates and wider interest rate spreads, point towards strong high yield corporate bond performance in 2023. Lots of funds focus on these securities and are likely to benefit from these trends. Of these, the SPDR Portfolio High Yield Bond ETF (NYSEARCA:SPHY) seems like a particularly strong choice, due to the fund’s above-average 6.2% dividend yield, above-average expected returns, and comparatively low 0.10% expense ratio. SPHY is set to benefit from current economic conditions, is one of the strongest funds in its peer group, and is a buy.

SPHY – Basics

- Investment Manager: State Street

- Underlying Index: ICE BofA US High Yield Index

- Expense Ratio: 0.10%

- Dividend Yield: 6.16%

SPHY – Overview

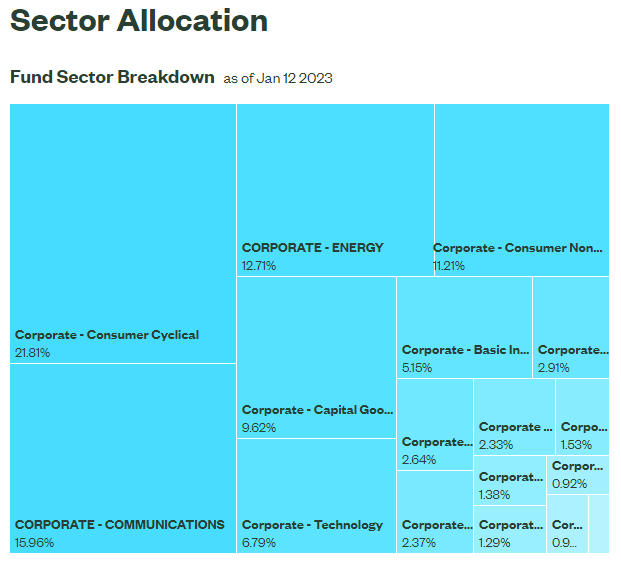

SPHY is a simple high-yield corporate bond index ETF. It tracks the ICE BofA US High Yield Index, an index of these same securities. As per fund management, the index includes publicly issued dollar-denominated bonds rated non-investment grade, at least 18 months to maturity at issuance, at least one year to maturity, a fixed coupon, and a minimum amount outstanding of $250M. Although not explicitly stated, it seems that issuer weights are capped at 1.0%. These are all reasonably standard terms / criteria, without any significant issues or downsides.

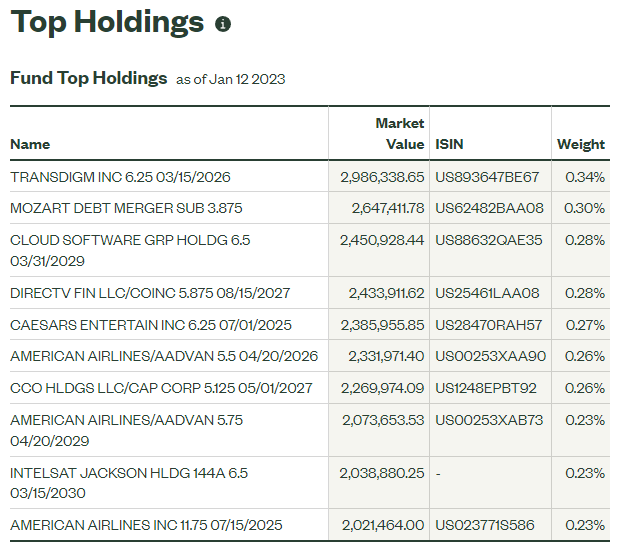

SPHY’s underlying index is incredibly broad, which results in an incredibly well-diversified fund, with almost 2,000 securities from all relevant industry segments. Concentration is quite low too, with the fund’s top ten holdings accounting for around 3.0% of its value.

SPHY

SPHY

Diversification reduces risk, volatility, and, most importantly, potential losses from the bankruptcy or default of any one specific issuer. As an example, if TransDigm (TDG), the issuer with the largest allocation in the fund, went bankrupt tomorrow, SPHY would only see losses of around 0.9% – 1.0%, quite low.

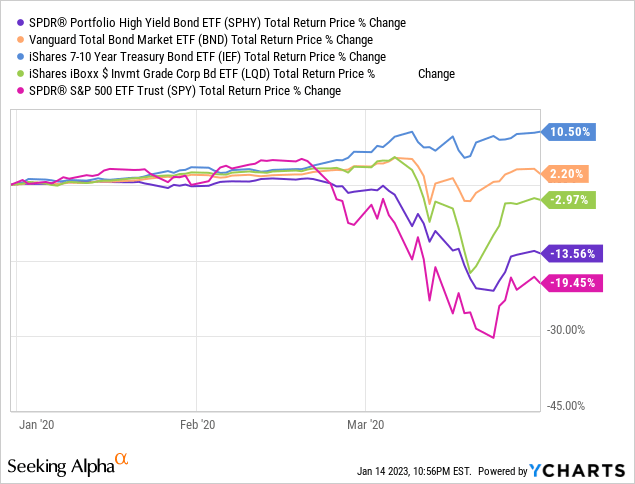

SPHY almost exclusively invests in non-investment grade bonds, issued by companies with weak financials and balance sheets. Said bonds are riskier than average, and more dependent on economic conditions for their repayment. Expect higher default rates during downturns and recessions, which should result in above-average capital losses for SPHY and its investors. This was the case during 1Q2020, the onset of the coronavirus pandemic, and the most recent recession. Bear in mind, equities are generally riskier than bonds, and that remains the case for SPHY.

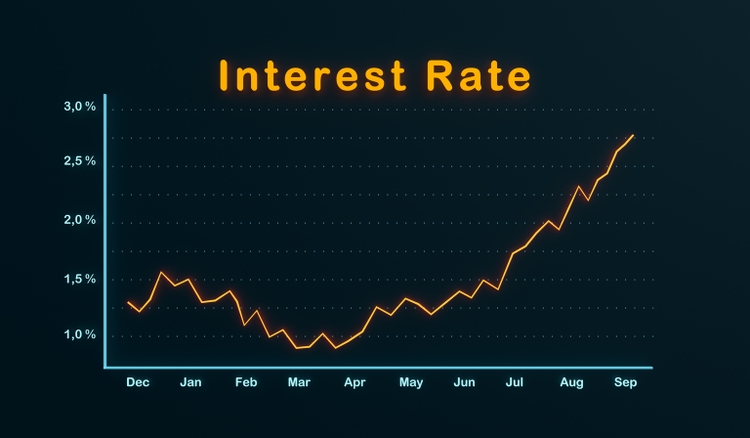

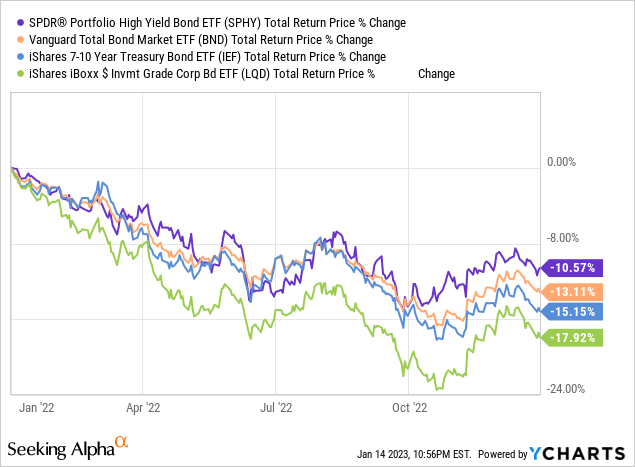

On a more positive note, SPHY’s holdings have below-average interest rate risk, with a maturity of 5.6 years, and a duration of 3.8 years. Bond index funds tend to have maturity and durations of +8.0 years, although metrics do vary fund by fund. SPHY’s comparatively low duration means the fund sees comparatively low losses when interest rates increase, while its low maturity allows the fund to quickly replace its portfolio to take advantage of rising rates. This should allow the fund to outperform during periods of rising interest rates, as was the case in 2022.

Besides the above, nothing stands out about the fund, its strategy, or holdings. With this in mind, let’s have a look at the fund’s investment thesis.

SPHY – Investment Thesis

SPHY’s investment thesis is quite simple, and rests on the fund’s strong 6.2% dividend yield, expected dividend growth, and moderate potential capital gains. Let’s have a closer look at each of these points.

Strong 6.2% Dividend Yield

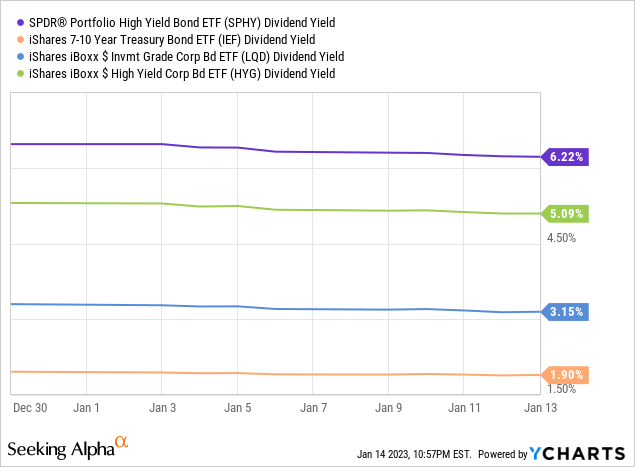

SPHY’s non-investment grade bonds are riskier than average, but also sport comparatively strong interest rates or yields. SPHY itself yields 6.2%, a reasonably strong amount, higher than the bond average, and higher than all relevant bond sub-asset classes.

Strong dividend yields are almost always a benefit for investors, and SPHY’s yield is no exception.

Strong Expected Dividend Growth

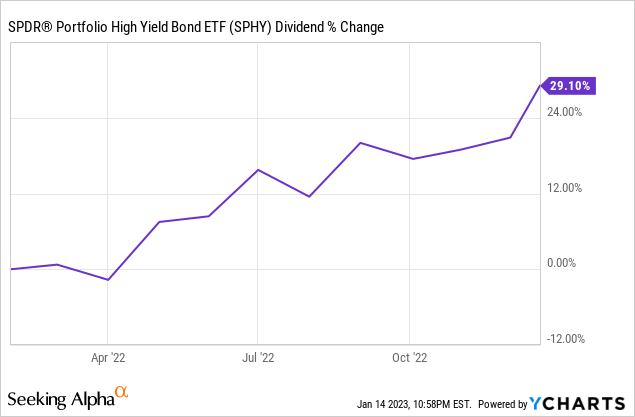

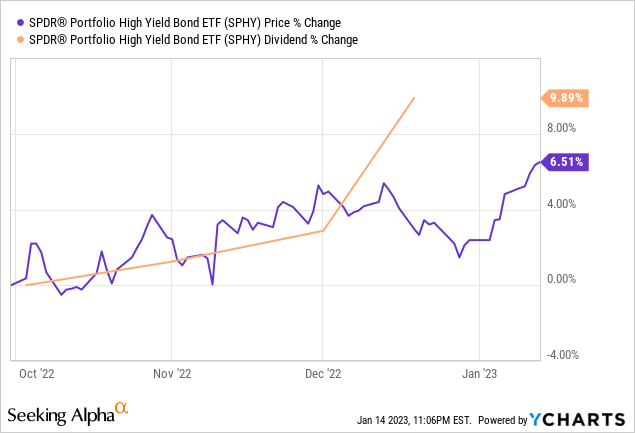

SPHY’s dividends have seen very healthy growth all year, courtesy of Federal Reserve interest rate hikes. Dividends grew over 29% in 2022, an incredibly strong rate of growth.

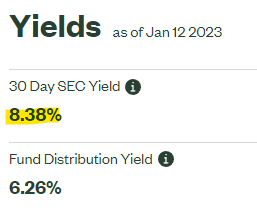

Importantly, dividends will very likely see further growth, as the impact from past interest rate hikes is felt across financial markets, and, possibly, due to future rate hikes. SPHY’s dividends should grow until the fund is yielding around 8.4%, equivalent to its SEC yield, a standardized measure of short-term generation of income. I have a longer, more in-depth explanation of said metric here.

SPHY

Strong realized and expected dividend growth is an important benefit for SPHY and its investors.

Moderate Potential Capital Gains

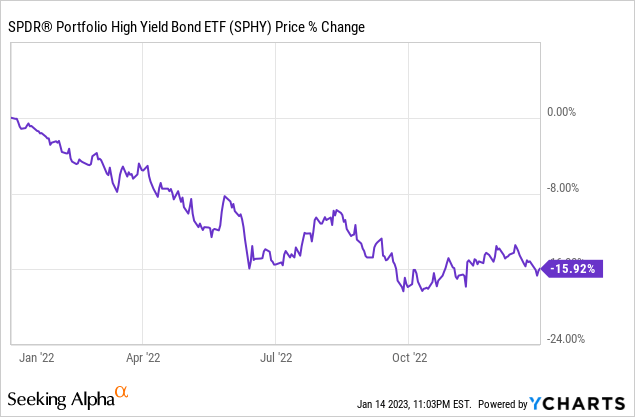

Skyrocketing inflation, higher interest rates, and bearish investor sentiment have led to a sustained bond selloff, with most bonds and bond funds seeing lower prices YTD. SPHY’s share price was down almost 16% in 2022, although prices have stabilized, even somewhat recovered, since October.

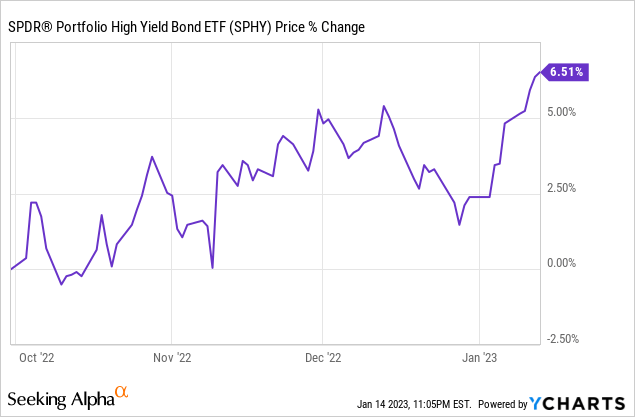

Importantly, only bond prices have gone down, investors are still owed their entire principal back, recent losses notwithstanding. As such, SPHY’s share price should recover from the losses seen above, barring an unprecedented increase in default rates. Prices should increase either as bonds mature, a lengthy years-long process, or as market sentiment improves, from inflation and / or interest rates normalizing. The process has already started, with SPHY’s share price recovering by upwards of 6% since October, when inflation started to normalize. Share prices could continue to increase in the coming months, contingent on inflation continuing to normalize, and on investor sentiment improving.

Although there is some tension between capital gains and dividend growth for most bond funds, rates can’t increase and decrease at the same time; if conditions are right, the fund could see both of these happening at the same time. Some dividend growth is likely to happen due to the impact from previous interest rate hikes. Some capital gains are possible if inflation continues to normalize. One more rate hike and softening inflation should result in positive capital gains and dividend growth for most bond funds, including SPHY. This has actually been the case for the past few months, but bond prices and ETF dividends are very volatile in the short-term, so results could have simply been due to volatility. Still, the situation does seem to be developing in an incredibly beneficial manner for investors.

SPHY – Peer Comparison

SPHY offers investors a strong, growing 6.2% dividend yield, and the potential for moderate capital gains. Although this is a reasonably good value proposition and investment thesis, it is a common one too. Most high-yield corporate bond ETFs have similar strategies and holdings compared to SPHY, and so share most of the same characteristics and investment theses. SPHY does offer investors three key advantages relative to most of its high-yield peers.

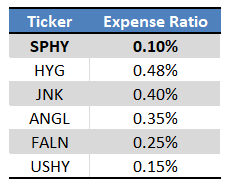

First, SPHY is the cheapest fund in its peer group, with a 0.10% expense ratio. Lower expenses directly increase (reduce by less) shareholder returns, an important benefit for investors. Lower expenses are also one of the only surefire ways of doing so. Other strategies, like leverage or active-management, might work. Lowering expenses always works, and is always a benefit for investors.

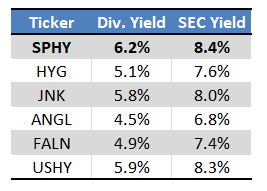

A quick table comparing SPHY’s expenses with some of its industry peers.

Seeking Alpha – Chart By Author

Second, SPHY is one of the highest-yielding ETFs in its peer group, for both dividend yields and SEC yields. The fund’s strong yield is at least partly the result of its low expenses. SPHY’s managers retain a small portion of the fund’s income, distributing most to investors as dividends. Other fund managers retain more, through higher fees, and so distribute less. SPHY’s higher yield is a significant benefit for the fund and its shareholders, and its key advantage relative to peers.

Fund Filings – Chart by Author

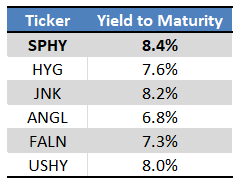

Third, is the fact that SPHY’s long-term expected returns, as measured by its yield to maturity, are also some of the highest in its peer groups. Expected returns are high because yields are high. Although this seems a bit redundant, I think differentiating between returns and yields is important. Right now, they both point in the same direction, but that might not always be true.

Fund Filings – Chart by Author

Conclusion – Buy

SPHY’s strong, growing 6.2% dividend yield and moderate potential capital gains make the fund a buy. SPHY’s comparatively low expense ratio, and comparatively strong dividend yield / expected returns make it one of the best high-yield corporate bond ETFs in the market today.

Be the first to comment