BalkansCat/iStock Editorial via Getty Images

Introduction

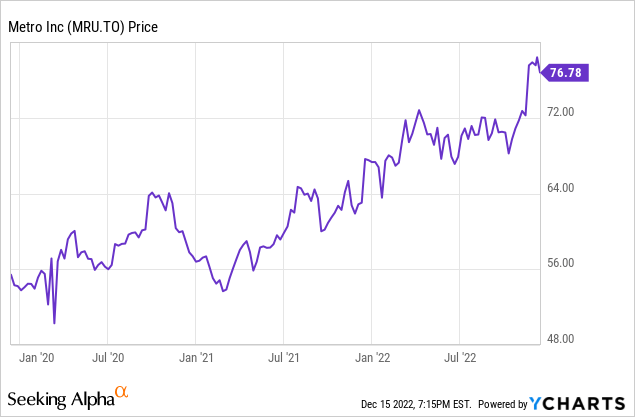

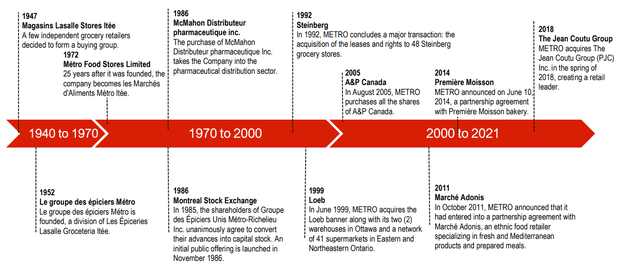

It has been almost seven years since I last discussed Metro (OTCPK:MTRAF) (TSX:MRU:CA) here in Seeking Alpha. Metro is a Canadian retailer operating grocery stores and pharmacies, and in the past few years I preferred the Loblaws group of companies (OTCPK:LBLCF) (L:CA) which pretty much has the same business model of operating a combination of grocery stores and pharmacies.

Metro’s FY 2022 was not as bad as feared

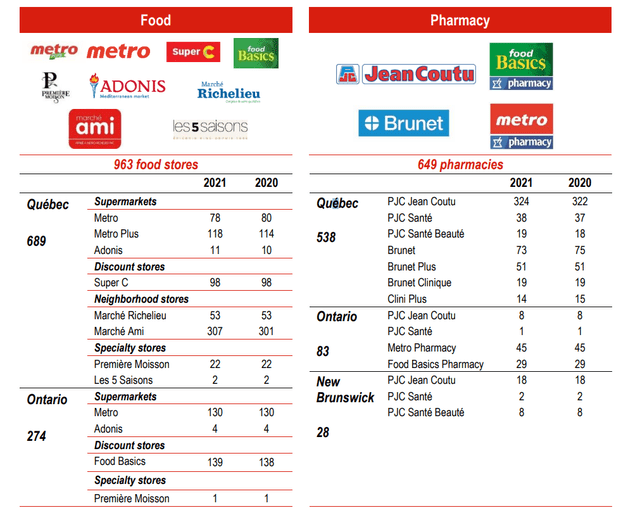

Metro is predominantly focusing on Eastern Canada as in excess of 70% of its grocery stores are located in Québec with the remainder located in the province of Ontario. As the company completed the acquisition of Jean Coutu in 2018, it added hundreds of pharmacies to its empire overnight.

The acquisition of Jean Coutu also allowed it to expand into a new region as it also acquired the 28 pharmacies in the province of New Brunswick. For now, Metro’s presence remains limited to just this handful of pharmacies and there are -as far as I know – no plans to expand the presence of the food stores to New Brunswick in the near future.

An inflationary period isn’t an easy time for a company that’s fully depending on selling things to a general public. Although you can always argue food is a basic necessity, a consumer can always opt for a cheaper solution and buy the lower margin no name brand versus buying brand name products. Additionally, there could be a general slowdown in the demand for certain non-essential products like chips or other “fun” items. On top of that, running about 1,000 grocery stores means Metro is running a massive goods-moving exercise and the energy costs weigh on the cost of transporting the goods from the distribution centers to the stores.

I wasn’t expecting much from Metro, but the company was able to put in a strong performance as its operating expenses as a percentage of the revenue remained relatively stable. This, in combination with a stable gross margin on the revenue, helped to protect Metro’s bottom line.

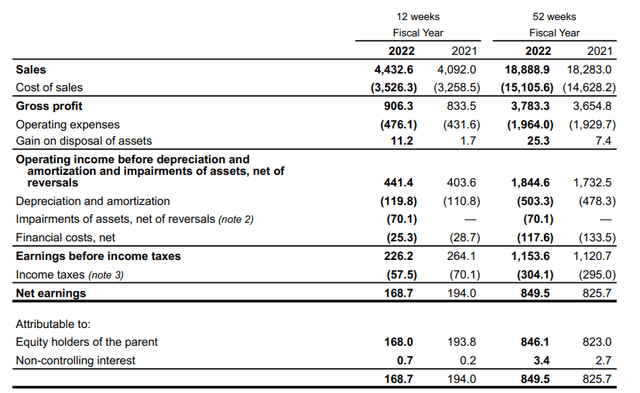

During the entire financial year, Metro’s reported revenue came in at C$18.9B with a clear acceleration in the fourth quarter as the revenue increased by almost 10%. The gross profit in FY 2022 came in at C$3.78B which is an increase of approximately 3.5% compared to the FY 2021 result and that’s even slightly higher than the 3.3% revenue increase on a YoY basis.

I’m positively surprised at how well Metro has been able to protect its margins as the pre-tax income in FY 2022 was approximately C$1.15B resulting in a net income of C$850M which translated into an EPS of C$3.53 per share. The Q4 net income was a bit lighter at just C$169M for an EPS of C$0.71 but this is entirely due to a C$70M impairment charge recorded during that quarter. Adjusted for this impairment charge (which was almost entirely related to the decision to withdraw the Jean Coutu branded stores from the Air Miles loyalty program), the pre-tax income would have jumped to C$296M and the reported net income would likely have been approximately C$220M for an EPS of C$0.93 (the reported non-GAAP EPS came in at C$0.92 and the difference could be explained by using the average share count versus the net share count). This means that both the Q4 as well as the FY 2022 results were “underreported” due to that impairment charge and adjusted for that non-cash charge, the underlying EPS in the financial year would have been C$3.75.

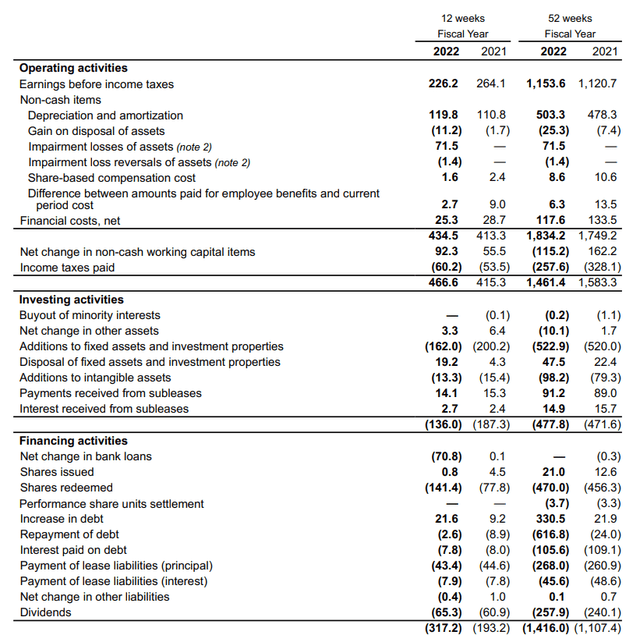

As the non-cash impairment charge weighed on the reported net income, I obviously also wanted to focus on the cash flow statement provided by the company.

Metro reported a net operating cash flow of C$1.46B but this included a C$115M investment in the working capital and excluded the C$151M in interest payments and C$268M in lease payments. Additionally, Metro only paid C$258M in taxes while it owed C$304M based on the income statement. There also was a C$106M incoming payment from subleases and interest on subleases.

Taking all these adjustments into consideration, the adjusted operating cash flow was C$1.26B. After deducting the C$523M in capex, the underlying free cash flow was C$740M or C$3.13 per share.

Surprisingly, that’s lower than the reported net income, but this is entirely related to Metro’s capex spending spree: While the total amount of depreciation recorded on the income statement was C$503M, Metro spent C$523M on capex and C$268M on lease payments for a total of C$790M, almost C$300M (or C$1.25 per share) higher than the depreciation.

Metro is investing pretty heavily in its supply chain updates and it expects its capex to increase to C$800M in the current financial year. While this will weigh on the reported free cash flow, Metro should be better off in the long run. The non-supply chain capex goes towards standard store refurbishment, the opening of new stores and equipping stores with self-checkouts and electronic shelf labels. According to the background provided on the FY 2022 conference call, the capex will remain at an elevated level in 2023 and 2024 before taper off in 2025.

Other than the capex guidance, Metro did not provide any more guidance on its expectations for FY 2023. I think the presentation of the Q1 results (which will discuss the calendar Q4) will be very important as I don’t think Metro will have been able to continue to protect its margins as well as in the preceding few quarters.

Investment thesis

Metro has a very solid business model and the only reason why the free cash flow result isn’t coming in higher is because Metro is spending about 60% more on capex than its depreciation charges. Over the next two years, this ratio will be even higher as Metro’s capex plus lease costs will likely be twice as high as its depreciation. While this will optically look like the company’s free cash flow comes under pressure, the earnings report should continue the upward trend. Expect this year’s reported EPS to be in line or slightly higher than the underlying C$3.75 from 2022 (I will finetune my expectations after seeing how Metro dealt with the first quarter of the current financial year) but from FY 2024 on I think we can aim for an EPS of C$4 per share.

That still doesn’t make Metro cheap as the stock is trading at about 18-19 times my earnings estimate for 2024, but the premium valuation is somewhat warranted as Metro has been able to protect its margins.

That being said, I’m not a buyer but Metro goes back on my watch list. Perhaps worth picking up on a weak day but I don’t think there’s any rush.

Be the first to comment