cofotoisme

Investment Thesis

Digital Turbine (NASDAQ:APPS) has seen its stock implode in the past year. Digital Turbine’s shares are now down 80% from previous highs.

Even if in hindsight the argument could have been made that Digital Turbine was overvalued, the same cannot be said now.

ironSource’s (IS) acquisition by Unity (U) sheds a light on just how cheap Digital Turbine has become.

As I compare and contrast Digital Turbine’s present valuation with Unity’s future valuation, we get a striking insight into how cheap Digital Turbine is.

Revenue Growth Rates Slow Down

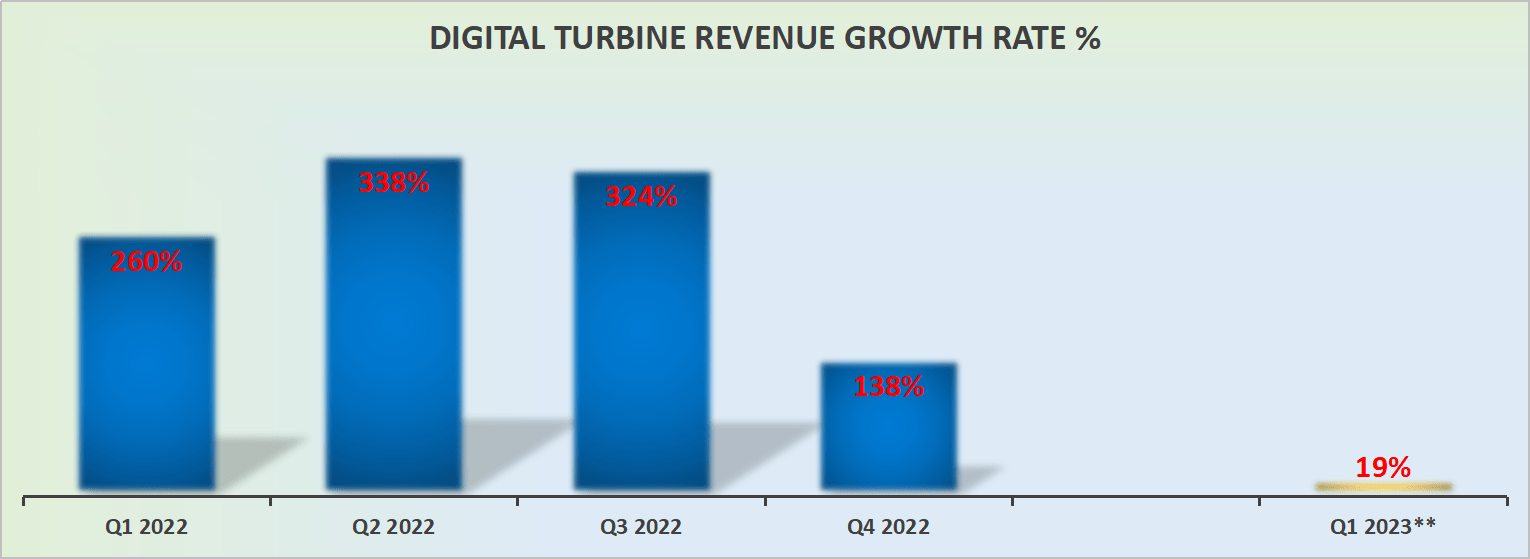

APPS revenue growth rates

Digital Turbine was a business with much promise. It came out of nowhere and saw its stock soar very high.

Along the way, it made a few large acquisitions that changed its revenue growth rate profile. But now, as it starts to lap that period of elevated growth, its organic revenue growth rates leave a lot to be desired.

But is it all doom and gloom? Perhaps not.

What to Make of ironSource’s Acquisition?

ironSource is a peer to Digital Turbine.

But what is particularly insightful about ironSource’s acquisition is that it’s being acquired at approximately 19x this year’s EBITDA.

Yes, the acquisition is being made for Unity’s stock, rather than in a cash deal. And to be fair, I believe that Unity’s stock is overvalued.

Nevertheless, this gives Digital Turbine’s investors some sort of handle on what is a fair valuation for App Economy companies.

Even though ironSource and Digital Turbine don’t fully overlap, there’s more that makes them similar than makes them different.

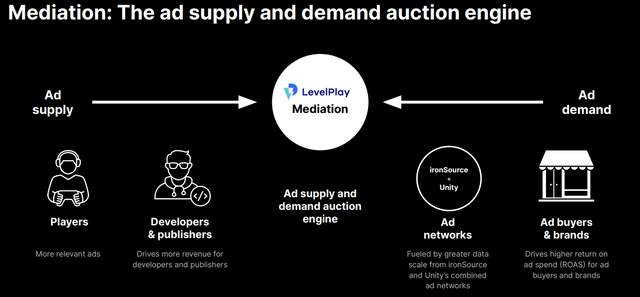

They are both app publishers. While ironSource is more tilted towards gaming, Digital Turbine is less exposed to gaming and much better positioned to monetize user acquisition and advertising.

And it’s in performance-based advertising where Unity believes that together with ironSource there is a rapidly growing large total addressable market that Unity wants to move its business towards.

Going forwards Unity and Digital Turbine will be increasingly competing as advertising brokerage firms that oversee both the supply and demand side of advertising. Being able to match ad buyers and brands to target end users (eyeballs).

Next, we’ll turn our focus to Digital Turbine’s valuation.

APPS Stock Valuation — Priced at 7x EBITDA

Digital Turbine has had multiple years of profitability. Indeed, anyone that follows ad tech companies knows that businesses in this sector are typically highly profitable.

On this note, Digital Turbine doesn’t disappoint. Digital Turbine’s Q1 2023 EBITDA line points to $50 million. What’s more, Digital Turbine’s EBITDA profile appears to be growing at a 30% CAGR.

This means that looking ahead to fiscal 2023, I estimate that Digital Turbine could reach $270 million of EBITDA.

For this estimate, keep in mind that Digital Turbine’s EBITDA is second-half weighted, as is the rest of the advertising industry, with the back end of the year being particularly strong.

That being said, as alluded to already, Digital Turbine has made several acquisitions making it difficult to ascertain what its true, sustainable, organic EBITDA growth rates could be.

In other words, there’s a possible scenario where this EBITDA growth rate could be downwards revised if the macro headwinds from inflationary forces and higher interest rates dampen Digital Turbine’s EBITDA growth rates for fiscal 2023.

However, if were to presume that management’s long-term guidance is even close to accurate, this could mean that Digital Turbine’s EBITDA could reach close to $1 billion of EBITDA by 2026 — according to Digital Turbine’s Investor Day.

Given that Unity Software together with ironSource is also guiding for $1 billion of EBITDA by 2024, this puts Unity priced 15x two years forward EBITDA. This gives investors a vague handle on how undervalued Digital Turbine is.

To illustrate, if my assumptions turn out to be in the right ballpark of $250 to $270 million of EBITDA in this fiscal year, this puts Digital Turbine priced at 7x this year’s EBITDA, compared with Unity which is priced at 15x two year’s forward EBITDA.

As another reference point, keep in mind that ironSource got acquired at 19x this year’s EBITDA. From this perspective, Digital Turbine’s valuation is strikingly cheap.

The Bottom Line

There’s a lot to like about Digital Turbine’s management team. Under CEO Bill Stone the business has successfully navigated what has been a very turbulent couple of years while always acutely focused on its bottom line profitability.

The one aspect where I have a question mark over is why Digital Turbine has changed its reported segments so often over the previous several quarters? I understand that it has made several large acquisitions, but even before that, this dynamic had been underway.

And now, on the back of its Q1 2023 earnings, Digital Turbine has changed its accounting from gross revenues to net revenues, with a goal of improving its gross margin profile.

I would like to believe that Digital Turbine’s consistent changing of its skin isn’t illustrative of anything nefarious. But it is odd and I’m certainly keeping alert on this front.

That consideration aside, there is a lot to like about Digital Turbine, most notably that its stock is now being valued at 7x this year’s EBITDA.

Be the first to comment